- Italy

- /

- Personal Products

- /

- BIT:PHN

Insiders Back These 3 European Growth Stocks

Reviewed by Simply Wall St

As the European markets show tentative optimism amid potential trade deals with the U.S. and a steady interest rate environment from the European Central Bank, investors are keeping a close watch on growth stocks that demonstrate resilience and potential for expansion. In this context, companies with high insider ownership often attract attention as they suggest confidence from those who know the business best, aligning management interests with shareholder value in navigating uncertain economic landscapes.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| Pharma Mar (BME:PHM) | 11.8% | 48.6% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 129.3% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.3% | 65% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.7% | 94.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 62.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Here's a peek at a few of the choices from the screener.

Pharmanutra (BIT:PHN)

Simply Wall St Growth Rating: ★★★★☆☆

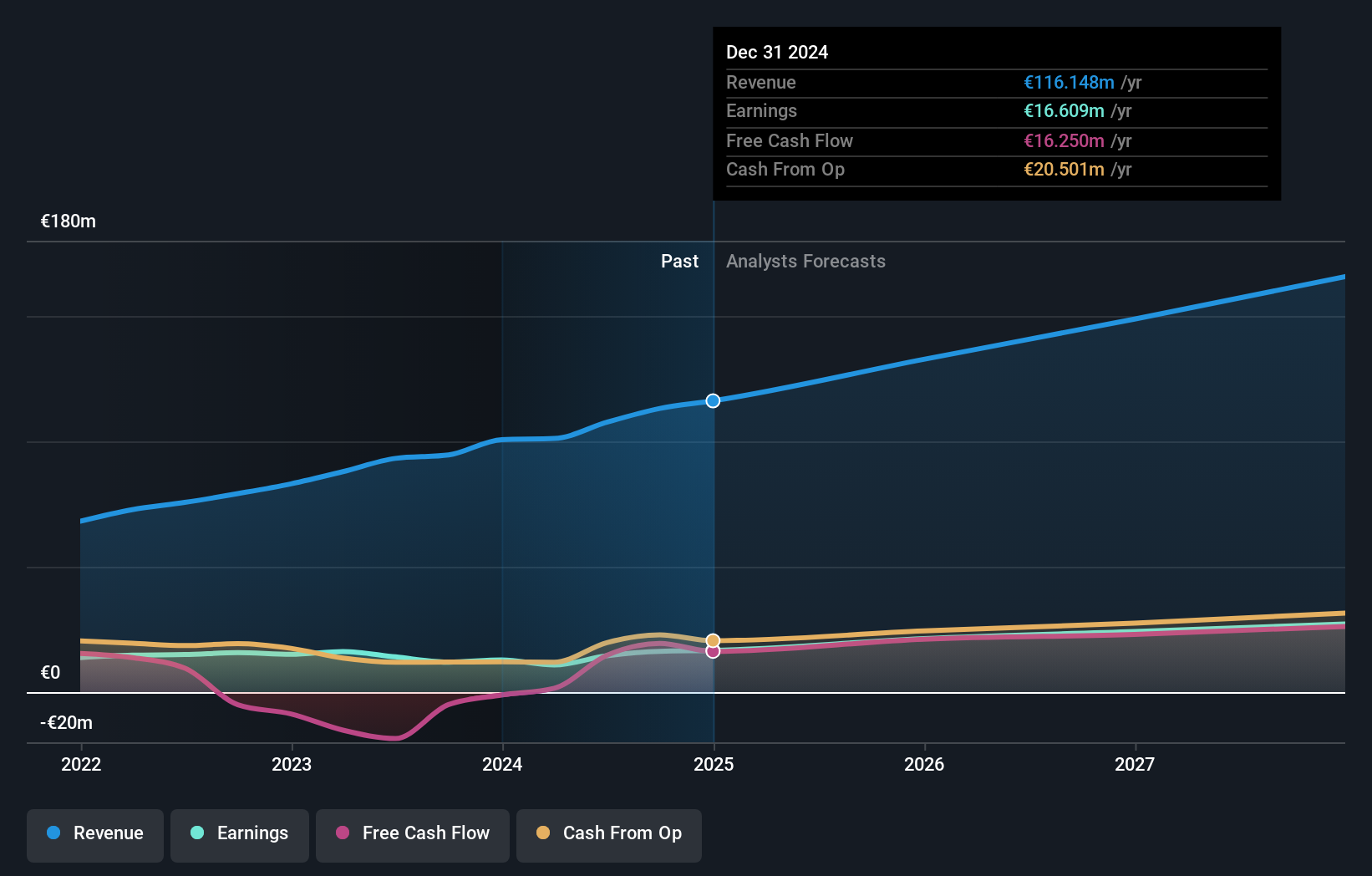

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that focuses on researching, designing, developing, and marketing nutritional supplements and medical devices across Italy, Europe, the Middle East, South America, the Far East, and internationally with a market cap of €441.27 million.

Operations: The company's revenue segments consist of €5.92 million from Akern, €70.24 million from Italy, and €39.34 million from foreign markets.

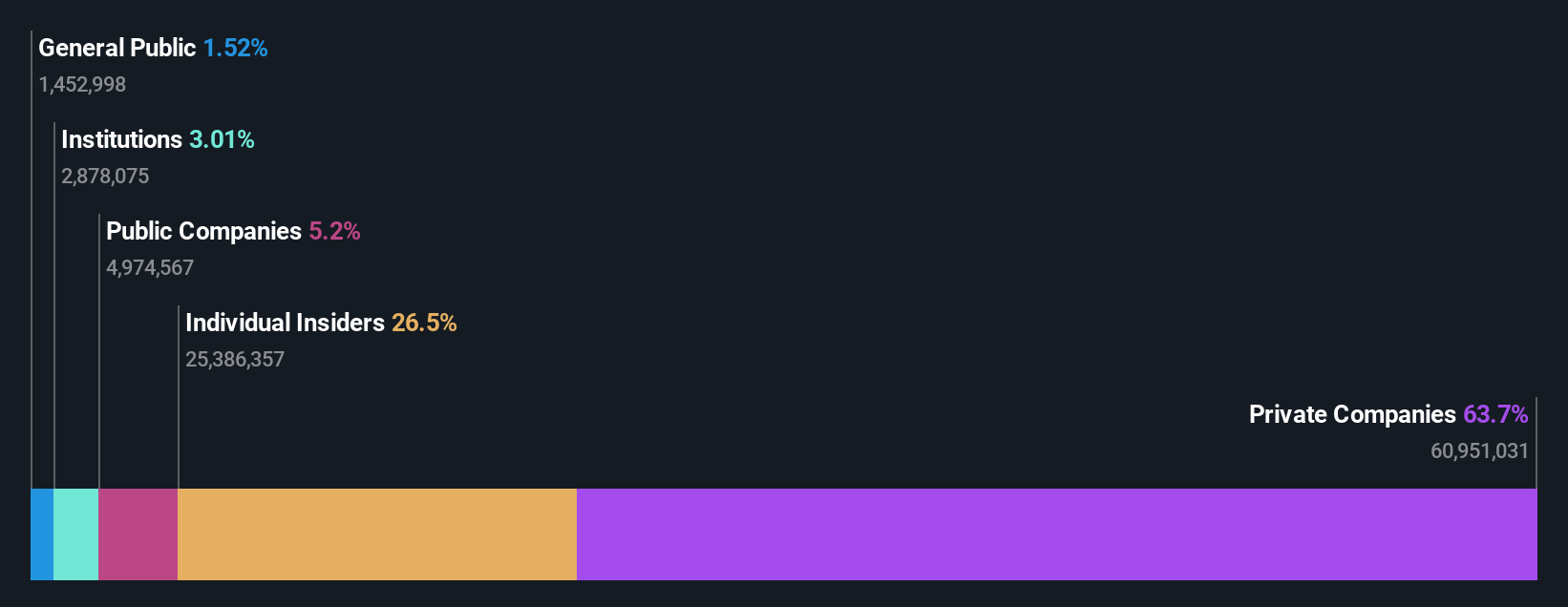

Insider Ownership: 10.8%

Earnings Growth Forecast: 15.7% p.a.

Pharmanutra's earnings are forecast to grow at 15.7% annually, outpacing the Italian market's 8.2%. Revenue growth is expected at 11.7% per year, also surpassing the market rate of 4.6%. Recent profit growth was strong at 29.4%, and a high return on equity of 27.2% is anticipated in three years. Despite no recent insider trading activity, substantial insider ownership aligns management interests with shareholders, supporting its position as a growth-focused company in Europe.

- Delve into the full analysis future growth report here for a deeper understanding of Pharmanutra.

- Our valuation report here indicates Pharmanutra may be overvalued.

Andfjord Salmon Group (OB:ANDF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Andfjord Salmon Group AS is involved in land-based farming of Atlantic salmon in Norway, with a market capitalization of NOK2.97 billion.

Operations: The company's revenue segments are not explicitly detailed in the provided text.

Insider Ownership: 24.1%

Earnings Growth Forecast: 61.5% p.a.

Andfjord Salmon Group is poised for significant growth, with revenue expected to increase by 57.3% annually, outpacing the Norwegian market. Despite a recent net loss of NOK 18.03 million in Q1 2025, the company is projected to achieve profitability within three years. The completion of key infrastructure at its Kvalnes facility will boost production capacity by approximately 20%. Substantial insider ownership aligns management interests with shareholders, although past shareholder dilution remains a concern.

- Click to explore a detailed breakdown of our findings in Andfjord Salmon Group's earnings growth report.

- The analysis detailed in our Andfjord Salmon Group valuation report hints at an inflated share price compared to its estimated value.

Semperit Holding (WBAG:SEM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Semperit Aktiengesellschaft Holding is a global company that develops, produces, and sells rubber products for the medical and industrial sectors, with a market cap of €271.16 million.

Operations: The company's revenue is derived from its Semperit Engineered Applications segment, contributing €361.97 million, and its Semperit Industrial Applications segment, which accounts for €290.48 million.

Insider Ownership: 10.1%

Earnings Growth Forecast: 86.7% p.a.

Semperit Holding is forecast to achieve profitability within three years, with earnings expected to grow 86.65% annually. Despite a recent net loss of €7.2 million in Q1 2025 and volatile share prices, the stock trades at 12.4% below its estimated fair value and analysts project a 27.2% price increase. However, return on equity remains low at an anticipated 4.9%, and dividends are not well covered by earnings, though insider ownership aligns management interests with shareholders'.

- Take a closer look at Semperit Holding's potential here in our earnings growth report.

- Our valuation report unveils the possibility Semperit Holding's shares may be trading at a discount.

Taking Advantage

- Click through to start exploring the rest of the 210 Fast Growing European Companies With High Insider Ownership now.

- Contemplating Other Strategies? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PHN

Pharmanutra

A pharmaceutical and nutraceutical company, researches, designs, develops, and markets nutritional supplements and medical devices in Italy, Europe, the Middle East, South America, Far East, and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026