Is Raiffeisen Bank Still a Bargain After Gaining 53% in 2025?

Reviewed by Simply Wall St

Deciding what to do with Raiffeisen Bank International’s stock right now? You are not alone. After a rollercoaster in recent years, this banking heavyweight is once again drawing interest, thanks to some eye-catching numbers. In the last year alone, the stock has delivered a powerful 71.3% gain. Even more impressively, it has achieved a 180.4% return over three years and 182.6% over five. While the past month has seen a modest dip of 3.6%, there has been a bounce-back over the last week, up 2.6%. Year to date, Raiffeisen is still firmly in the green with a 53.3% climb.

What is behind these moves? Recent shifts in the banking landscape and broader European market sentiment seem to be driving a recalibration of risk and growth potential for players like Raiffeisen. Investors are weighing potential regulatory headwinds and the outlook for interest rates alongside ongoing discussions about Eastern European exposure. These factors have only added to the intrigue around Raiffeisen’s current price relative to its future prospects.

Of course, headline performance numbers are just part of the story. To get a clearer sense of Raiffeisen’s investment appeal, it is key to dig into how the stock is really valued today. Based on six major valuation checks, Raiffeisen receives a value score of 2, suggesting it is undervalued in a couple of important ways but not across the board. Up next, we will break down those valuation approaches and what they mean for your decision making. Make sure to read on as we will also discuss a smarter way to think about valuation by the end of this article.

Raiffeisen Bank International scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Raiffeisen Bank International Excess Returns Analysis

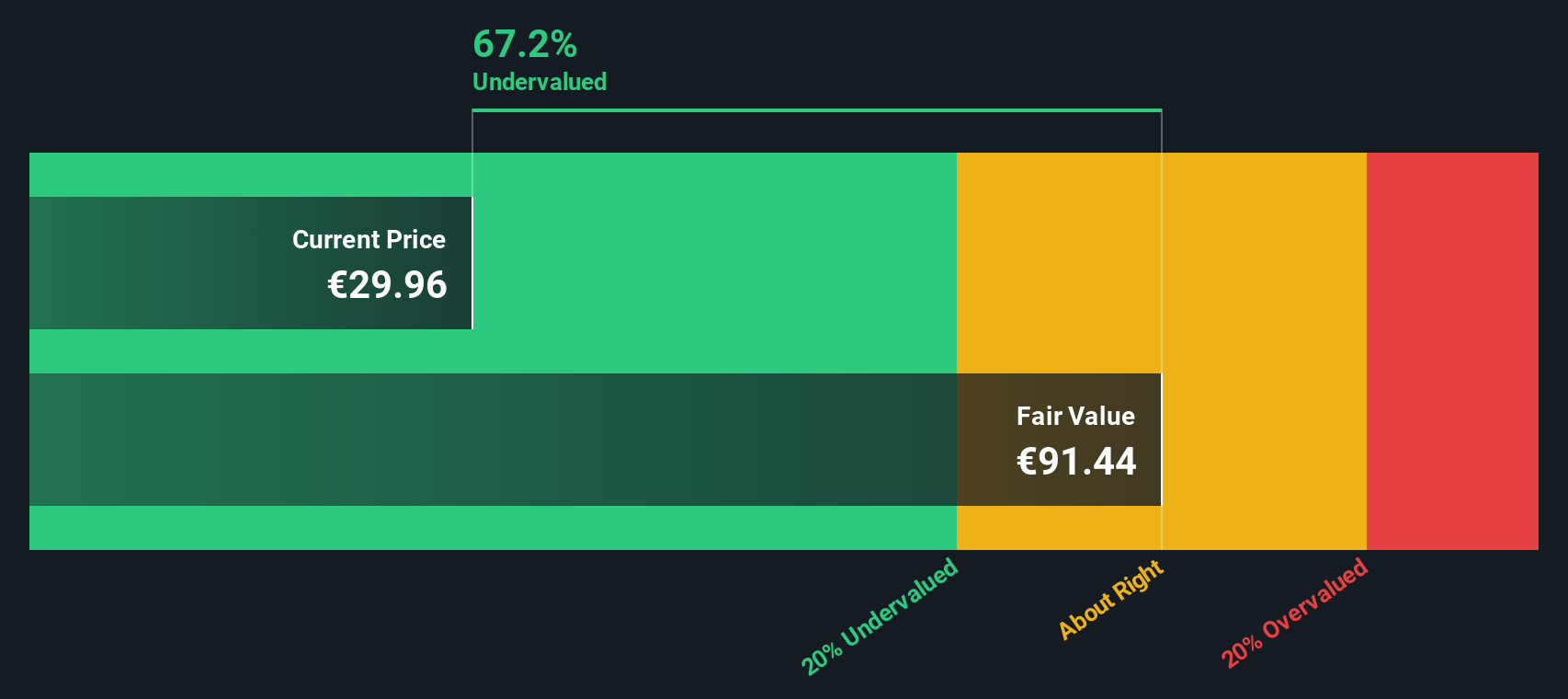

The Excess Returns model offers a straightforward framework for estimating a company’s intrinsic value by focusing on what matters most in banking: the ability to consistently generate excess returns above the cost of equity. In plain terms, this approach takes the value of equity held per share, considers sustainable earnings power, and compares that with the expected cost of capital to determine if the bank is positioned to create real value over time.

For Raiffeisen Bank International, the Excess Returns model uses these core inputs:

- Book Value: €60.65 per share

- Stable EPS: €5.89 per share (Source: Weighted future Return on Equity estimates from 9 analysts.)

- Cost of Equity: €4.66 per share

- Excess Return: €1.24 per share

- Average Return on Equity: 8.88%

- Stable Book Value: €66.37 per share (Source: Weighted future Book Value estimates from 4 analysts.)

This model estimates Raiffeisen’s intrinsic value at €90.20 per share. The current share price implies a 67.5% discount, which suggests the stock appears significantly undervalued under this analysis.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Raiffeisen Bank International.

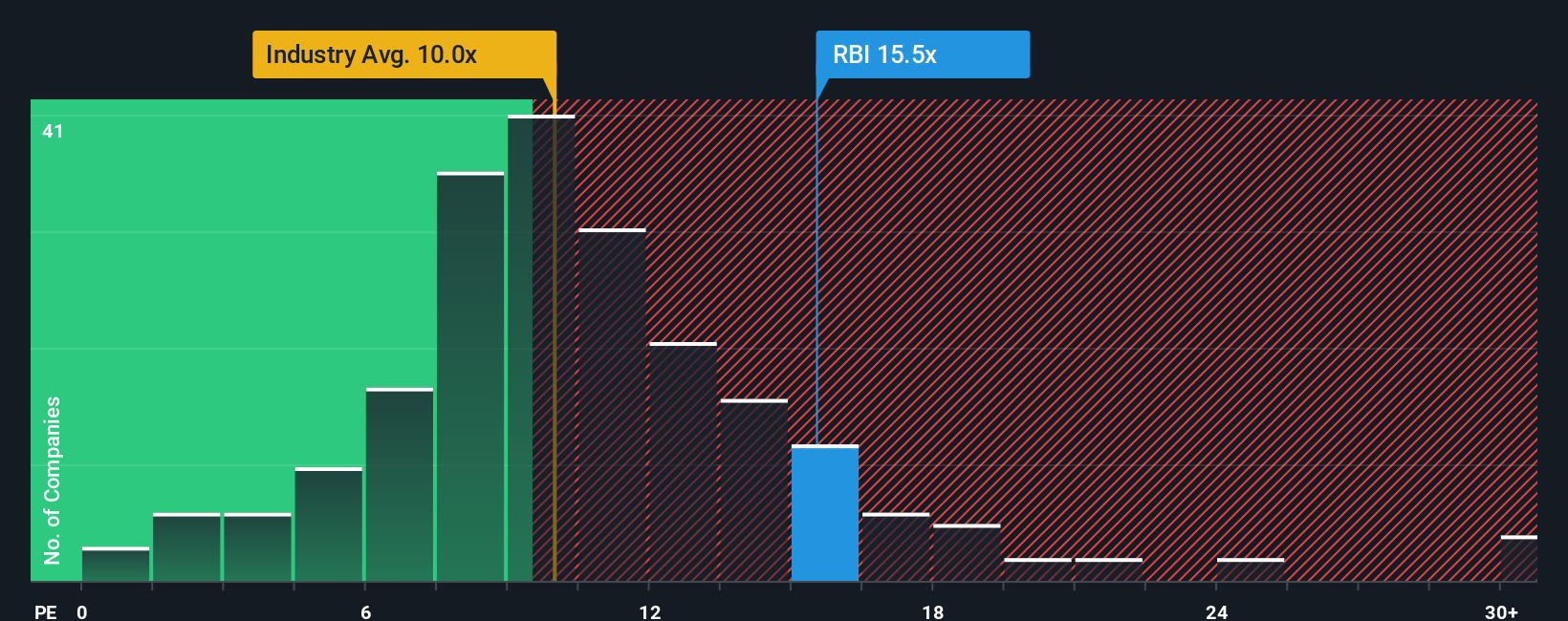

Approach 2: Raiffeisen Bank International Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely trusted metric for valuing profitable companies like Raiffeisen Bank International because it shows how much investors are paying for each euro of earnings. For banks in particular, where earnings quality tends to be consistent and transparent, the PE ratio provides a solid benchmark to assess value.

However, it is important to remember that a “normal” or fair PE ratio depends on factors such as how quickly a company is expected to grow its earnings and the risks it faces. Higher expected growth or lower risk usually supports a higher PE, while earnings volatility or greater regulatory headwinds tend to justify a lower PE.

Currently, Raiffeisen trades at a PE ratio of 15.46x. When compared to the industry average PE of 10.41x and the peer average of 12.74x, Raiffeisen’s shares look more expensive than many of its competitors. This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio for Raiffeisen is 13.35x, reflecting an analysis that goes deeper than a simple industry or peer comparison. It takes into account the bank’s earnings growth outlook, profit margins, market risks, and even its size in the context of the broader banking sector. This makes it a tailored benchmark.

Given that Raiffeisen’s actual PE ratio is only slightly above the Fair Ratio, the stock’s valuation appears to be in line with what is justified by its fundamentals and future prospects.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Raiffeisen Bank International Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story or perspective about a company, a view of where it is headed, why, and how this shows up in the numbers, like its fair value and future growth estimates. Narratives bridge a company’s unique story to financial forecasts, turning your views on future revenue, earnings, and margins into a fair value specific to your outlook.

On Simply Wall St’s Community page, Narratives are available for every investor to use and update. They are easy tools that make investing more personal and informed by letting you compare the fair value that results from your Narrative to today’s price, helping you decide if Raiffeisen is a buy, hold, or sell for your situation. What’s powerful is that Narratives are dynamic. As new news, earnings, or data comes in, your Narrative updates automatically so your story stays up to date.

For example, some investors currently estimate Raiffeisen’s fair value as low as €22.00, reflecting caution over shrinking revenues or risk in core markets, while others see as much as €31.00, highlighting strength in digitalization and capital expansion. Narratives help you anchor decisions to your own convictions, not just the market consensus.

Do you think there's more to the story for Raiffeisen Bank International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:RBI

Raiffeisen Bank International

Offers banking services to corporate, private, and institutional customers.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives