Shareholders Will Probably Hold Off On Increasing BAWAG Group AG's (VIE:BG) CEO Compensation For The Time Being

Despite positive share price growth of 6.3% for BAWAG Group AG (VIE:BG) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 29 March 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for BAWAG Group

Comparing BAWAG Group AG's CEO Compensation With the industry

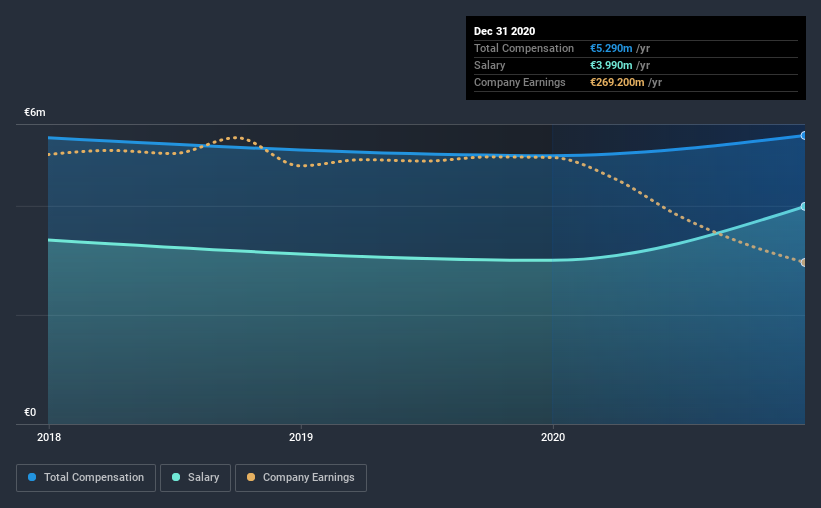

According to our data, BAWAG Group AG has a market capitalization of €3.9b, and paid its CEO total annual compensation worth €5.3m over the year to December 2020. That's just a smallish increase of 7.5% on last year. In particular, the salary of €3.99m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from €1.7b to €5.4b, we found that the median CEO total compensation was €882k. Accordingly, our analysis reveals that BAWAG Group AG pays Anas Abuzaakouk north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €4.0m | €3.0m | 75% |

| Other | €1.3m | €1.9m | 25% |

| Total Compensation | €5.3m | €4.9m | 100% |

On an industry level, roughly 74% of total compensation represents salary and 26% is other remuneration. Our data reveals that BAWAG Group allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

BAWAG Group AG's Growth

Over the last three years, BAWAG Group AG has shrunk its earnings per share by 12% per year. In the last year, its revenue is down 20%.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has BAWAG Group AG Been A Good Investment?

BAWAG Group AG has not done too badly by shareholders, with a total return of 6.3%, over three years. It would be nice to see that metric improve in the future. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

To Conclude...

Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

Whatever your view on compensation, you might want to check if insiders are buying or selling BAWAG Group shares (free trial).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade BAWAG Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade BAWAG Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BAWAG Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WBAG:BG

Excellent balance sheet with proven track record.