- United Arab Emirates

- /

- Logistics

- /

- DFM:ARMX

Aramex PJSC (DFM:ARMX) earnings and shareholder returns have been trending downwards for the last three years, but the stock rallies 11% this past week

Aramex PJSC (DFM:ARMX) shareholders should be happy to see the share price up 11% in the last week. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 49% in the last three years, significantly under-performing the market.

On a more encouraging note the company has added د.إ307m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for Aramex PJSC

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

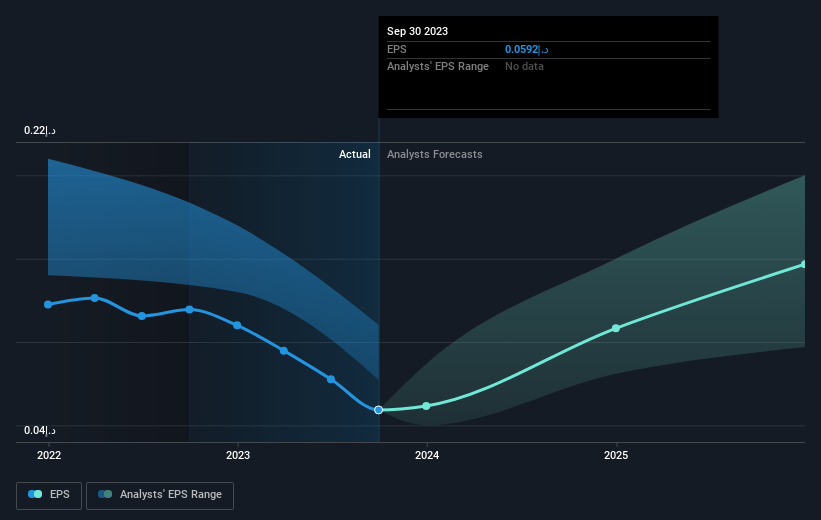

During the three years that the share price fell, Aramex PJSC's earnings per share (EPS) dropped by 35% each year. This fall in the EPS is worse than the 20% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Aramex PJSC's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Aramex PJSC, it has a TSR of -44% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Aramex PJSC had a tough year, with a total loss of 37% (including dividends), against a market gain of about 2.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with Aramex PJSC .

Of course Aramex PJSC may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Emirian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:ARMX

Aramex PJSC

Engages in the investment of freight, express, logistics, and supply chain management businesses in the United Arab Emirates, the Middle East, North Africa, Turkey, East and South Africa, Europe, North America, North and South Asia, and Oceania.

Proven track record and fair value.