- United Arab Emirates

- /

- Pharma

- /

- ADX:JULPHAR

Gulf Pharmaceutical Industries P.S.C And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets continue to show mixed results, with major U.S. indexes like the S&P 500 and Nasdaq Composite reaching record highs while others such as the Russell 2000 decline, investors are increasingly looking at diverse investment opportunities. Penny stocks, despite their somewhat outdated name, remain a compelling area for those interested in smaller or newer companies that may offer surprising value. By focusing on stocks with solid financial foundations and potential for growth, investors can explore opportunities that might provide both stability and upside in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.51B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$144.95M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.21B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.105 | £793.09M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$44.6B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.825 | £182.42M | ★★★★★★ |

Click here to see the full list of 5,707 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Gulf Pharmaceutical Industries P.S.C (ADX:JULPHAR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gulf Pharmaceutical Industries P.S.C., along with its subsidiaries, operates in the manufacturing and sale of medicines, drugs, and various pharmaceutical, medical, and cosmetic compounds across the United Arab Emirates, other GCC countries, and internationally; it has a market cap of approximately AED1.50 billion.

Operations: The company's revenue segments include Planet with AED1.14 billion and Manufacturing with AED834.10 million.

Market Cap: AED1.5B

Gulf Pharmaceutical Industries P.S.C. has shown a reduction in net losses, with a recent Q3 net loss of AED 5.9 million compared to AED 39.3 million the previous year, indicating some financial improvement despite ongoing unprofitability. The company reported sales of AED 417.1 million for the third quarter, up from AED 366 million year-on-year, reflecting revenue growth amidst challenges such as high debt levels with a net debt to equity ratio of over 96%. Its cash runway remains robust for more than three years due to positive free cash flow, though its share price remains highly volatile.

- Get an in-depth perspective on Gulf Pharmaceutical Industries P.S.C's performance by reading our balance sheet health report here.

- Explore historical data to track Gulf Pharmaceutical Industries P.S.C's performance over time in our past results report.

Pacific Textiles Holdings (SEHK:1382)

Simply Wall St Financial Health Rating: ★★★★★☆

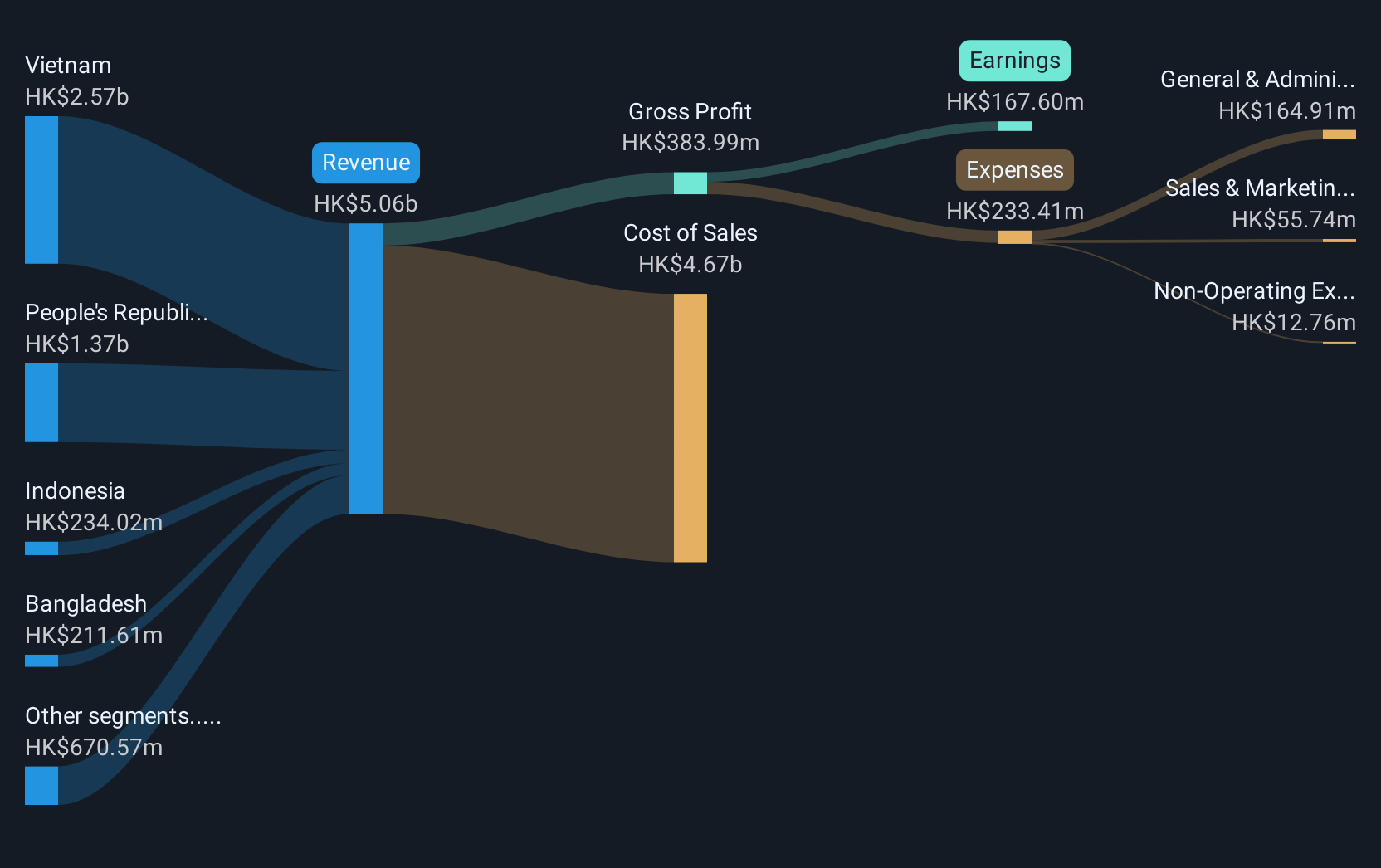

Overview: Pacific Textiles Holdings Limited is engaged in the manufacturing and trading of textile products across various regions including China, Vietnam, Bangladesh, and internationally, with a market cap of HK$2.07 billion.

Operations: The company's revenue from the manufacturing and trading of textile products amounts to HK$5.04 billion.

Market Cap: HK$2.07B

Pacific Textiles Holdings Limited has recently initiated a share buyback program, potentially enhancing its net asset value and earnings per share. Despite facing operational disruptions due to Typhoon Yagi, which temporarily halted production at its Vietnam plant, the company swiftly reallocated orders to minimize impact. Financially, it reported HK$2.67 billion in sales for the half-year ending September 2024, with a net income of HK$106.86 million. Short-term assets exceed liabilities by HK$500 million, though debt levels have risen over five years. The dividend yield is high but not well covered by earnings or free cash flow.

- Take a closer look at Pacific Textiles Holdings' potential here in our financial health report.

- Assess Pacific Textiles Holdings' future earnings estimates with our detailed growth reports.

JW (Cayman) Therapeutics (SEHK:2126)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: JW (Cayman) Therapeutics Co. Ltd is a clinical stage cell therapy company focused on the research, development, manufacturing, and marketing of anti-tumor drugs in the People’s Republic of China, with a market cap of HK$534.04 million.

Operations: The company's revenue is derived from its pharmaceuticals segment, totaling CN¥172.93 million.

Market Cap: HK$534.04M

JW (Cayman) Therapeutics, with a market cap of HK$534.04 million, is currently unprofitable but has managed to reduce losses over the past five years by 10.1% annually. The company’s revenue from its pharmaceuticals segment stands at CN¥172.93 million, and it trades at a significant discount to its estimated fair value compared to peers and industry standards. Its financial position appears stable with short-term assets covering both short- and long-term liabilities, while having more cash than debt. Recent changes include Deloitte replacing PwC as the auditor effective October 31, 2024.

- Navigate through the intricacies of JW (Cayman) Therapeutics with our comprehensive balance sheet health report here.

- Evaluate JW (Cayman) Therapeutics' prospects by accessing our earnings growth report.

Next Steps

- Take a closer look at our Penny Stocks list of 5,707 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:JULPHAR

Gulf Pharmaceutical Industries P.S.C

Manufactures and sells medicines, drugs, and other pharmaceutical, medical, cosmetic compounds in the United Arab Emirates, other GCC countries, and internationally.

Good value with adequate balance sheet.