- United Arab Emirates

- /

- Consumer Services

- /

- DFM:TAALEEM

Undiscovered Gems None And 2 Promising Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate through a period of mixed performance, with major indices like the S&P 500 and Nasdaq hitting record highs while the Russell 2000 experiences a decline, investors are keenly observing how these dynamics impact small-cap stocks. In this environment, identifying promising small-cap companies can be crucial for portfolio enhancement, as these stocks often offer unique growth opportunities that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Forth Smart Service | 60.55% | -7.89% | -14.33% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Value Rating: ★★★★★★

Overview: Taaleem Holdings PJSC is engaged in providing and investing in education services within the United Arab Emirates, with a market capitalization of AED4.04 billion.

Operations: Taaleem generates revenue primarily from school operations, amounting to AED947.58 million. The company's market capitalization stands at AED4.04 billion.

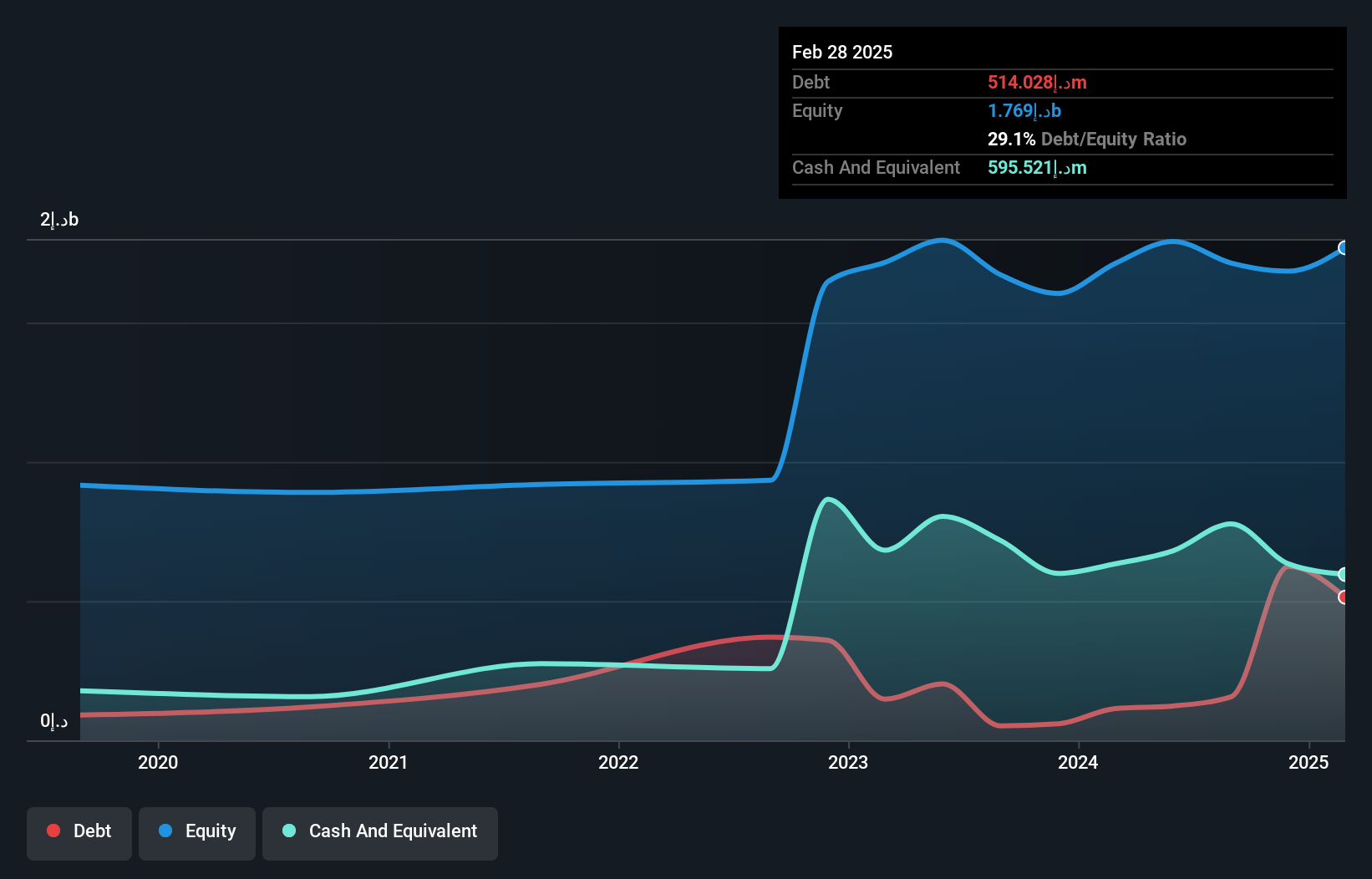

Taaleem Holdings, a promising player in the education sector, has shown robust financial health with its debt-to-equity ratio improving from 9.9% to 9.1% over five years and holding more cash than total debt. The company reported AED 946.88 million in sales for the year ending August 2024, up from AED 820.14 million previously, alongside net income growth to AED 138 million from AED 117.34 million. Earnings per share increased slightly to AED 0.14, reflecting high-quality earnings and a positive free cash flow trend of US$116 million as of May 2024 despite higher capital expenditures impacting performance recently.

- Navigate through the intricacies of Taaleem Holdings PJSC with our comprehensive health report here.

Explore historical data to track Taaleem Holdings PJSC's performance over time in our Past section.

YesAsia Holdings (SEHK:2209)

Simply Wall St Value Rating: ★★★★★★

Overview: YesAsia Holdings Limited is an investment holding company involved in the procurement, sale, and trading of Asian fashion and lifestyle, beauty, cosmetics, accessories, and entertainment products with a market cap of HK$2.01 billion.

Operations: YesAsia Holdings generates revenue primarily from Fashion & Lifestyle and Beauty Products, contributing HK$270.65 million, while Entertainment Products add HK$2.56 million.

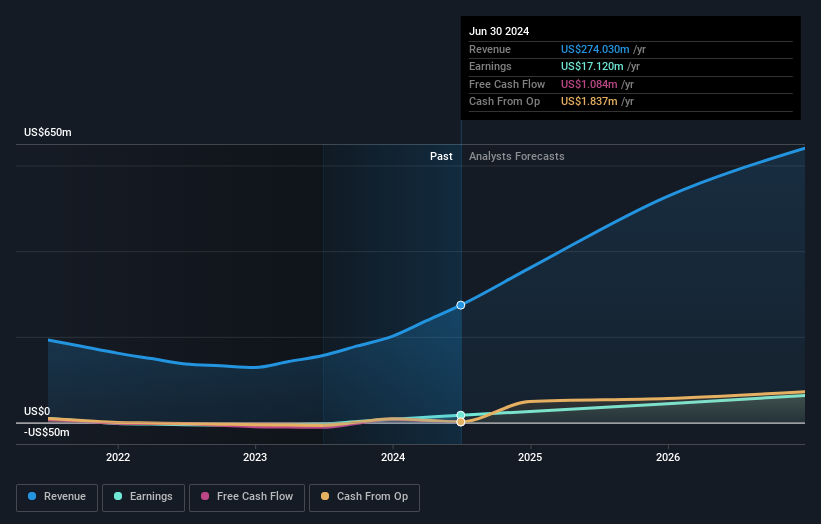

YesAsia Holdings, a niche player in the specialty retail sector, has recently turned profitable, setting it apart from an industry that saw a 26.6% contraction. With no debt on its books now compared to a 2.9 debt-to-equity ratio five years ago, financial stability seems solid. The company reported levered free cash flow of US$1.08M at the end of this year, rebounding from negative figures over previous quarters. Despite some shareholder dilution last year and notable insider selling recently, YesAsia's forecasted earnings growth of nearly 49% per annum paints an optimistic picture for potential investors looking for emerging opportunities in retail markets.

- Delve into the full analysis health report here for a deeper understanding of YesAsia Holdings.

Review our historical performance report to gain insights into YesAsia Holdings''s past performance.

Aichi Steel (TSE:5482)

Simply Wall St Value Rating: ★★★★★★

Overview: Aichi Steel Corporation engages in the manufacturing and sale of steel, forged products, and electro-magnetic products in Japan, with a market capitalization of ¥98.56 billion.

Operations: Aichi Steel's primary revenue streams are derived from its Steel Company segment, contributing ¥145.19 billion, and the Forge Company segment with ¥122.92 billion. The Stainless Company adds ¥42.16 billion to the revenue mix, while the Smart Company contributes ¥19.42 billion.

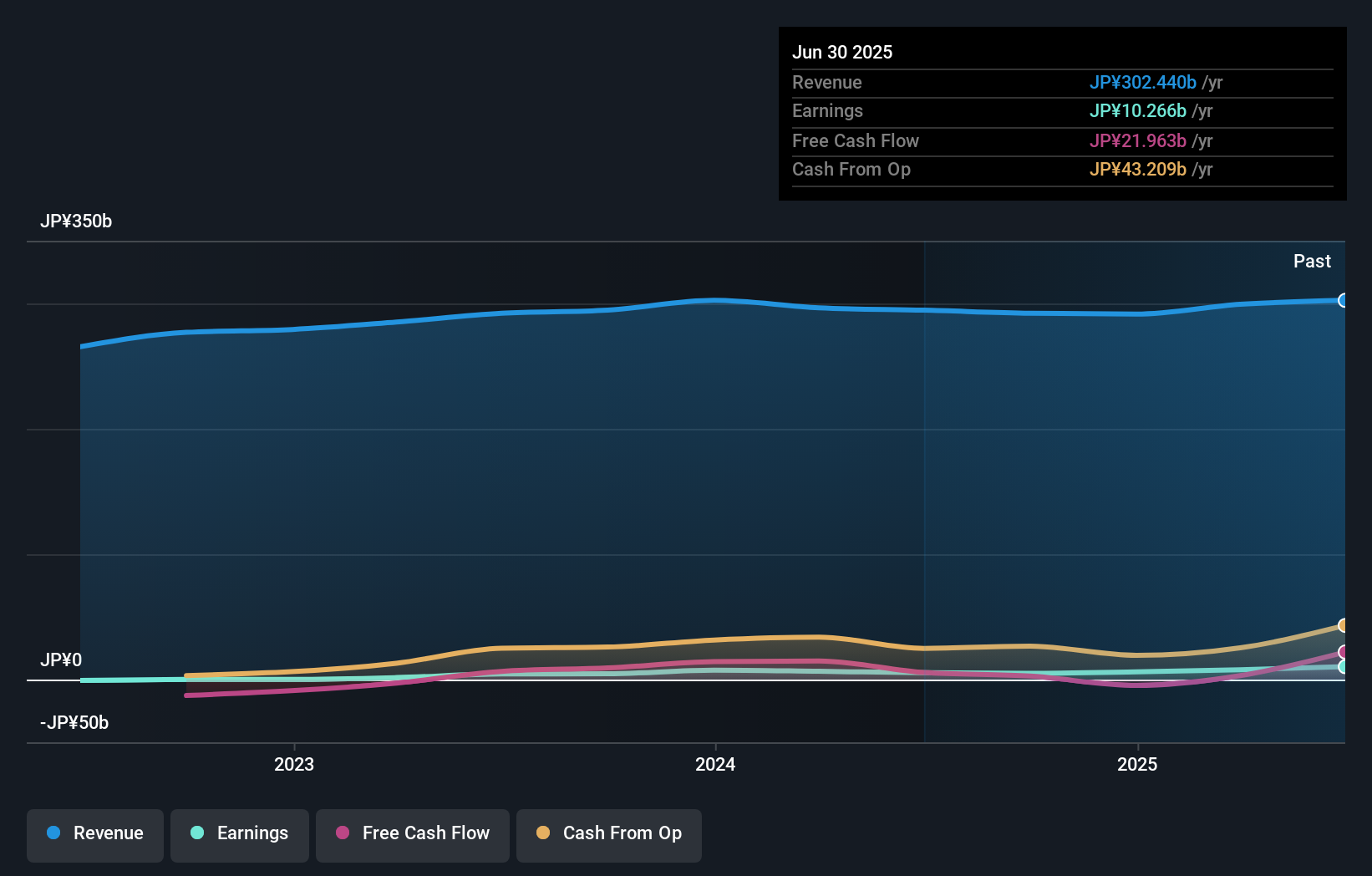

Aichi Steel, a nimble player in the steel industry, is trading at 24.1% below its estimated fair value. The company has demonstrated resilience with an 8.2% earnings growth over the past year, outpacing the struggling Metals and Mining sector's -13.1%. Despite facing a ¥2.4 billion one-off loss impacting recent results, it maintains a satisfactory net debt to equity ratio of 13.5%. Aichi's interest payments are well covered by EBIT at 20.9x coverage, indicating robust financial health amidst challenges like a consistent annual earnings decline of 7% over five years and strategic dividend increases reflecting shareholder confidence in future prospects.

- Dive into the specifics of Aichi Steel here with our thorough health report.

Gain insights into Aichi Steel's historical performance by reviewing our past performance report.

Next Steps

- Investigate our full lineup of 4644 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Taaleem Holdings PJSC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Taaleem Holdings PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:TAALEEM

Taaleem Holdings PJSC

Provides and invests in education services in the United Arab Emirates.

Proven track record with adequate balance sheet.