- United Arab Emirates

- /

- Real Estate

- /

- DFM:UPP

Union Properties And 2 Additional Middle Eastern Penny Stocks To Watch

Reviewed by Simply Wall St

The Middle Eastern stock markets have been navigating a mixed landscape, with concerns over U.S. tariff policies and potential economic slowdowns influencing investor sentiment. Amidst these broader market dynamics, penny stocks continue to capture attention for their unique investment opportunities. Although the term "penny stocks" might seem outdated, these lower-priced shares often represent smaller or newer companies that can offer significant growth potential when backed by strong financial health.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.08 | SAR1.63B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR4.15 | SAR498M | ✅ 2 ⚠️ 3 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪3.077 | ₪213.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.956 | ₪2.97B | ✅ 1 ⚠️ 2 View Analysis > |

| Tarya Israel (TASE:TRA) | ₪0.59 | ₪175.15M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.173 | ₪161.55M | ✅ 2 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.556 | AED2.37B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.746 | AED446.46M | ✅ 2 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.01 | AED2.02B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.45 | AED10.42B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 97 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Union Properties (DFM:UPP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Union Properties (ticker: DFM:UPP) is a company that invests in and develops properties, with a market cap of AED2.37 billion.

Operations: The company's revenue is derived from three main segments: Contracting (AED25.61 million), Real Estate (AED47.31 million), and Goods and Services (AED455.83 million).

Market Cap: AED2.37B

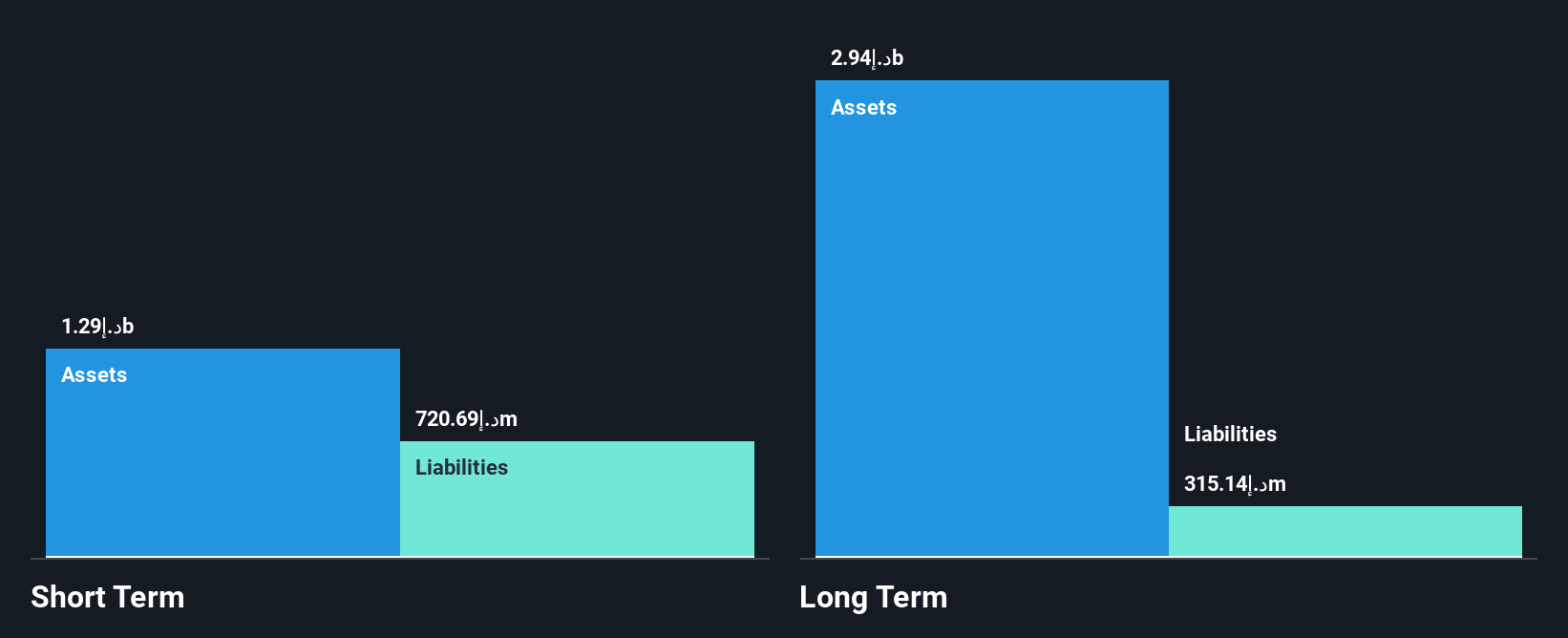

Union Properties has faced challenges with negative earnings growth and a volatile share price, yet it remains a potentially interesting option among penny stocks. The company's debt to equity ratio has improved significantly over the past five years, now standing at 18.8%, although its debt is not well covered by operating cash flow. Despite reporting sales of AED528.75 million for 2024, net income dropped to AED275.64 million due to large one-off gains impacting results. Union Properties' short-term assets comfortably cover both short and long-term liabilities, suggesting manageable financial health amidst ongoing restructuring efforts to address accumulated losses.

- Click here and access our complete financial health analysis report to understand the dynamics of Union Properties.

- Examine Union Properties' earnings growth report to understand how analysts expect it to perform.

Sinpas Gayrimenkul Yatirim Ortakligi (IBSE:SNGYO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sinpas Gayrimenkul Yatirim Ortakligi, originally established as Sinpas Insaat in 2006 and transformed into a Real Estate Investment Partnership in 2007, operates in the real estate sector with a market capitalization of TRY12.84 billion.

Operations: The company generates revenue primarily from its Residential Real Estate Developments segment, amounting to TRY13.44 billion.

Market Cap: TRY12.84B

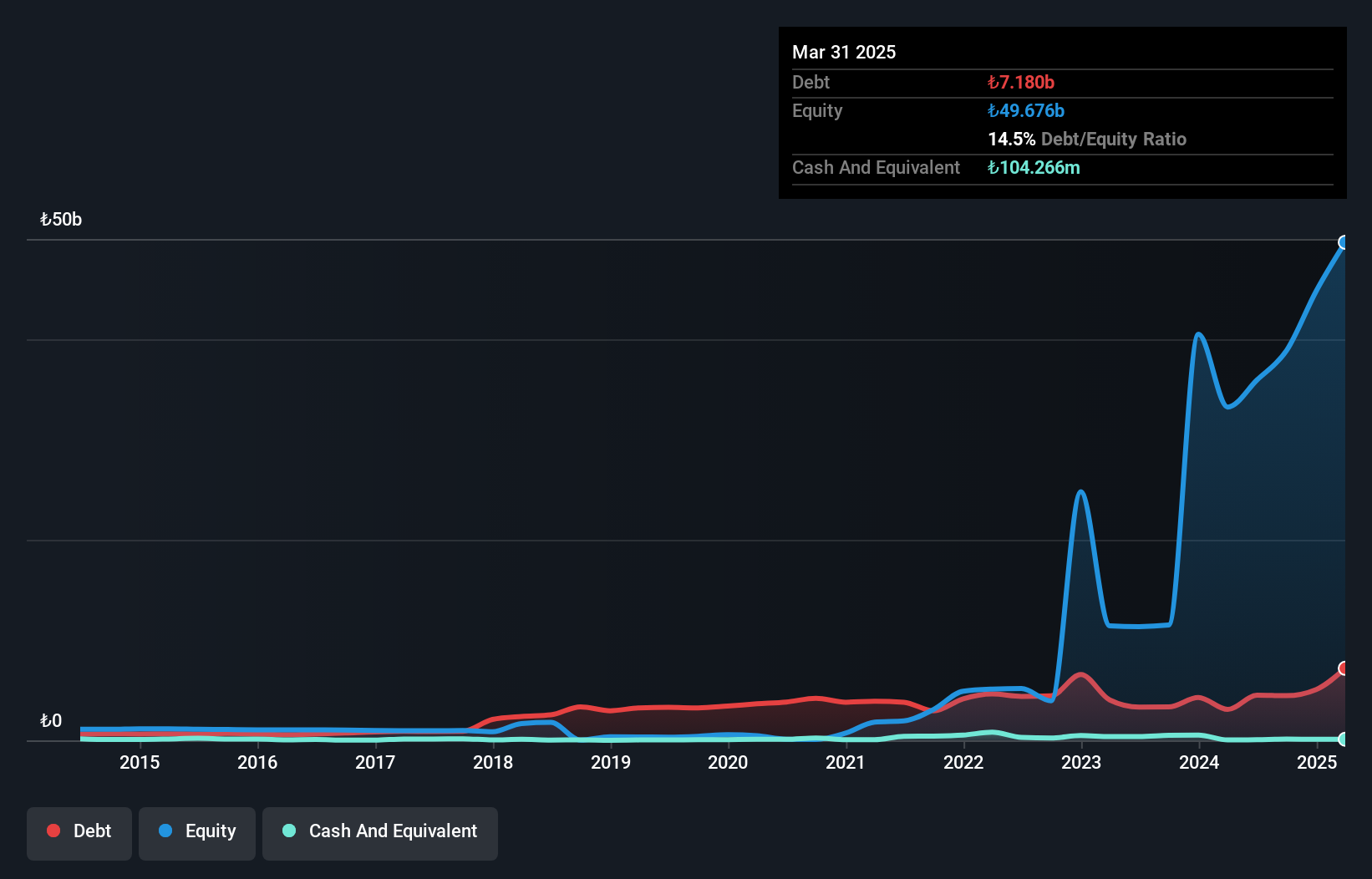

Sinpas Gayrimenkul Yatirim Ortakligi has demonstrated significant earnings growth, reporting a net income of TRY5.23 billion for 2024, up from TRY1.69 billion the previous year. Despite this growth, its profit margins have declined to 38.9% from last year's 68.3%, influenced by large one-off gains of TRY5.3 billion impacting results. The company's short-term assets exceed both short and long-term liabilities, indicating solid financial health despite interest payments not being well covered by EBIT at 2.3 times coverage. Its debt management has improved significantly over five years with a reduced debt to equity ratio now at 11.1%.

- Take a closer look at Sinpas Gayrimenkul Yatirim Ortakligi's potential here in our financial health report.

- Review our historical performance report to gain insights into Sinpas Gayrimenkul Yatirim Ortakligi's track record.

Alarum Technologies (TASE:ALAR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alarum Technologies Ltd. offers web data collection solutions across multiple regions, including the Americas, Europe, Southeast Asia, the Middle East, and Africa, with a market cap of ₪213.93 million.

Operations: Alarum Technologies generates revenue primarily from web data collection ($30.91 million), with additional income from consumer internet access services ($0.87 million) and advertising services ($0.038 million).

Market Cap: ₪213.93M

Alarum Technologies has shown profitability with a net income of US$5.78 million for 2024, reversing a prior loss, and maintains strong financial health as short-term assets exceed liabilities. The firm's debt is well-covered by operating cash flow, and it trades at a good value relative to its peers. However, the company's share price has been highly volatile recently. Despite filing a $12 million shelf registration for common stock issuance, legal challenges have emerged with class action lawsuits alleging misleading investor communications and overstated business prospects impacting revenue growth expectations last year.

- Click here to discover the nuances of Alarum Technologies with our detailed analytical financial health report.

- Gain insights into Alarum Technologies' future direction by reviewing our growth report.

Where To Now?

- Access the full spectrum of 97 Middle Eastern Penny Stocks by clicking on this link.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Union Properties, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:UPP

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives