- United Arab Emirates

- /

- Banks

- /

- ADX:ADCB

Middle Eastern Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

Amidst the backdrop of China's economic stimulus measures boosting market sentiment and a modest rebound in oil prices, Middle Eastern stock markets have shown resilience, with most Gulf indices closing higher. In this environment, dividend stocks offer an attractive option for investors seeking steady income streams and potential growth, as they typically provide regular payouts that can help cushion against market volatility.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.77% | ★★★★★★ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.41% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.91% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.66% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.35% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.63% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 5.93% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.61% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.91% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.44% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Abu Dhabi Commercial Bank PJSC (ADX:ADCB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Abu Dhabi Commercial Bank PJSC, along with its subsidiaries, offers a range of banking products and services both in the United Arab Emirates and internationally, with a market capitalization of AED77.57 billion.

Operations: Abu Dhabi Commercial Bank PJSC's revenue is primarily derived from Corporate and Investment Banking (AED6.75 billion), Retail Banking (AED4.86 billion), and Investments and Treasury (AED4.84 billion), with additional contributions from Property Management (AED141.03 million) and Private Banking (AED11.52 million).

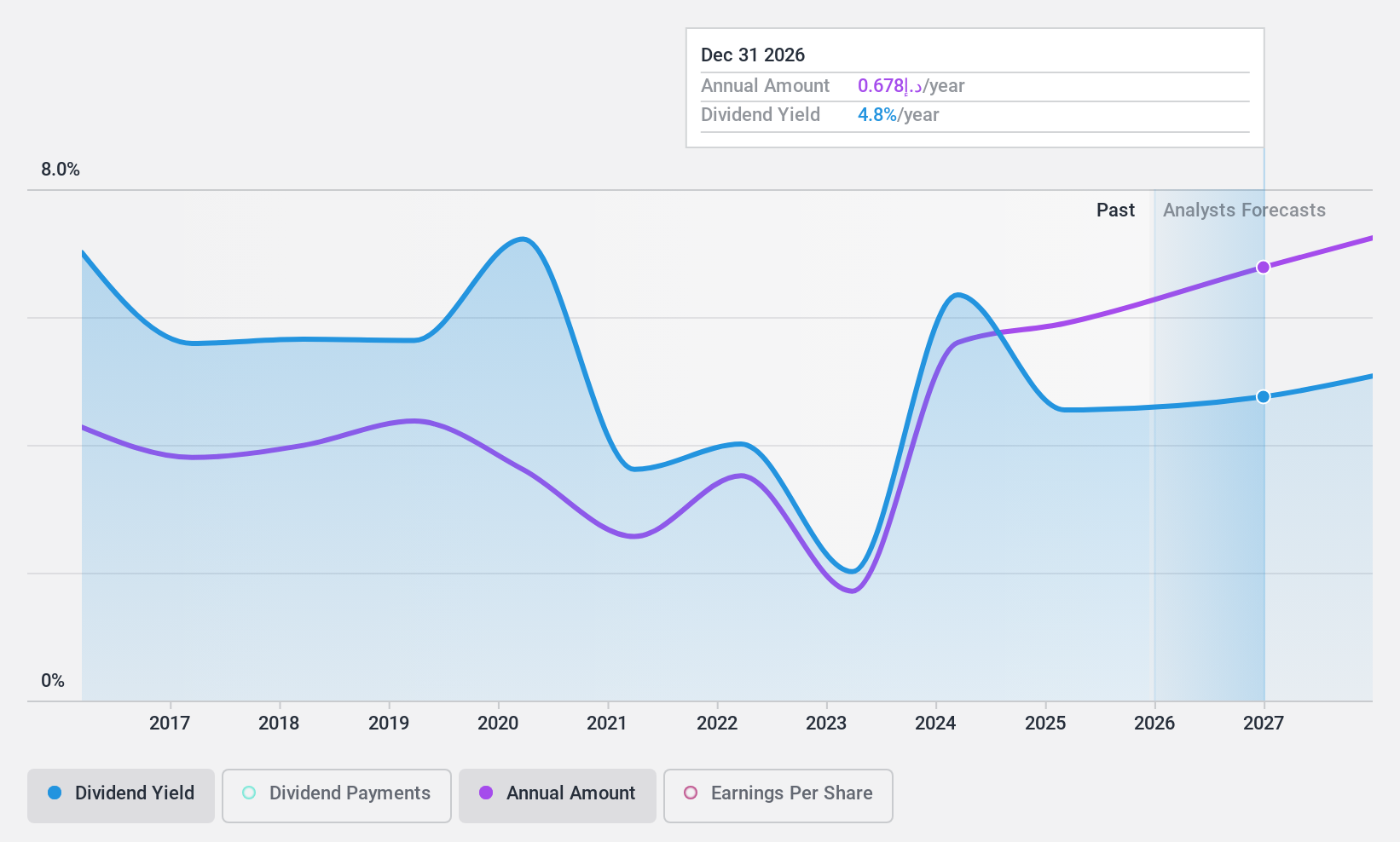

Dividend Yield: 5.6%

Abu Dhabi Commercial Bank PJSC's recent financial performance shows a strong net income of AED 9.42 billion, supporting its dividend distribution of AED 0.59 per share, totaling AED 4.32 billion. The payout ratio is a manageable 49.3%, indicating dividends are well covered by earnings despite a volatile dividend history over the past decade. While the bank's dividend yield of 5.57% is below top-tier payers in the AE market, its price-to-earnings ratio of 8.9x suggests good value relative to peers.

- Navigate through the intricacies of Abu Dhabi Commercial Bank PJSC with our comprehensive dividend report here.

- Our valuation report here indicates Abu Dhabi Commercial Bank PJSC may be undervalued.

Emaar Properties PJSC (DFM:EMAAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emaar Properties PJSC, along with its subsidiaries, is involved in property investment, development, and management both in the United Arab Emirates and internationally, with a market cap of AED119.32 billion.

Operations: Emaar Properties PJSC generates revenue through three main segments: Hospitality (AED2.02 billion), Real Estate (AED26.53 billion), and Leasing, Retail and Related Activities (AED6.96 billion).

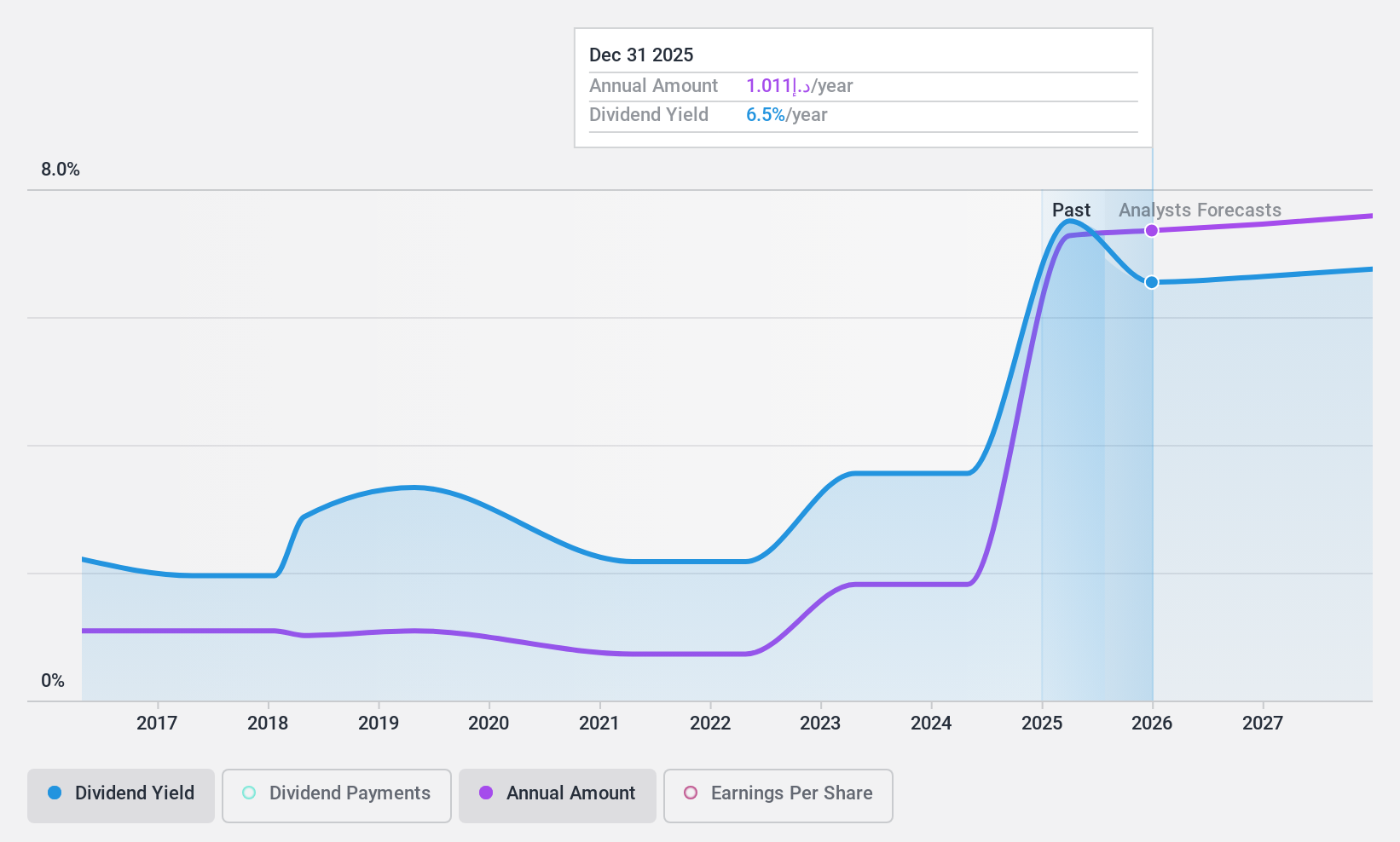

Dividend Yield: 7.4%

Emaar Properties PJSC's full-year 2024 earnings report highlights sales of AED 35.51 billion and net income of AED 13.51 billion, reflecting solid financial growth that supports its dividend strategy. Despite a volatile dividend history, the company maintains a payout ratio of 65.4%, ensuring dividends are covered by earnings and cash flows (cash payout ratio: 36.9%). Trading below estimated fair value, Emaar offers attractive relative value with a top-tier dividend yield in the AE market at 7.41%.

- Delve into the full analysis dividend report here for a deeper understanding of Emaar Properties PJSC.

- Our valuation report unveils the possibility Emaar Properties PJSC's shares may be trading at a discount.

Al Hammadi Holding (SASE:4007)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Hammadi Holding Company is a healthcare group offering a range of medical services in the Kingdom of Saudi Arabia, with a market cap of SAR6.69 billion.

Operations: Al Hammadi Holding Company generates revenue through its diverse medical services across Saudi Arabia.

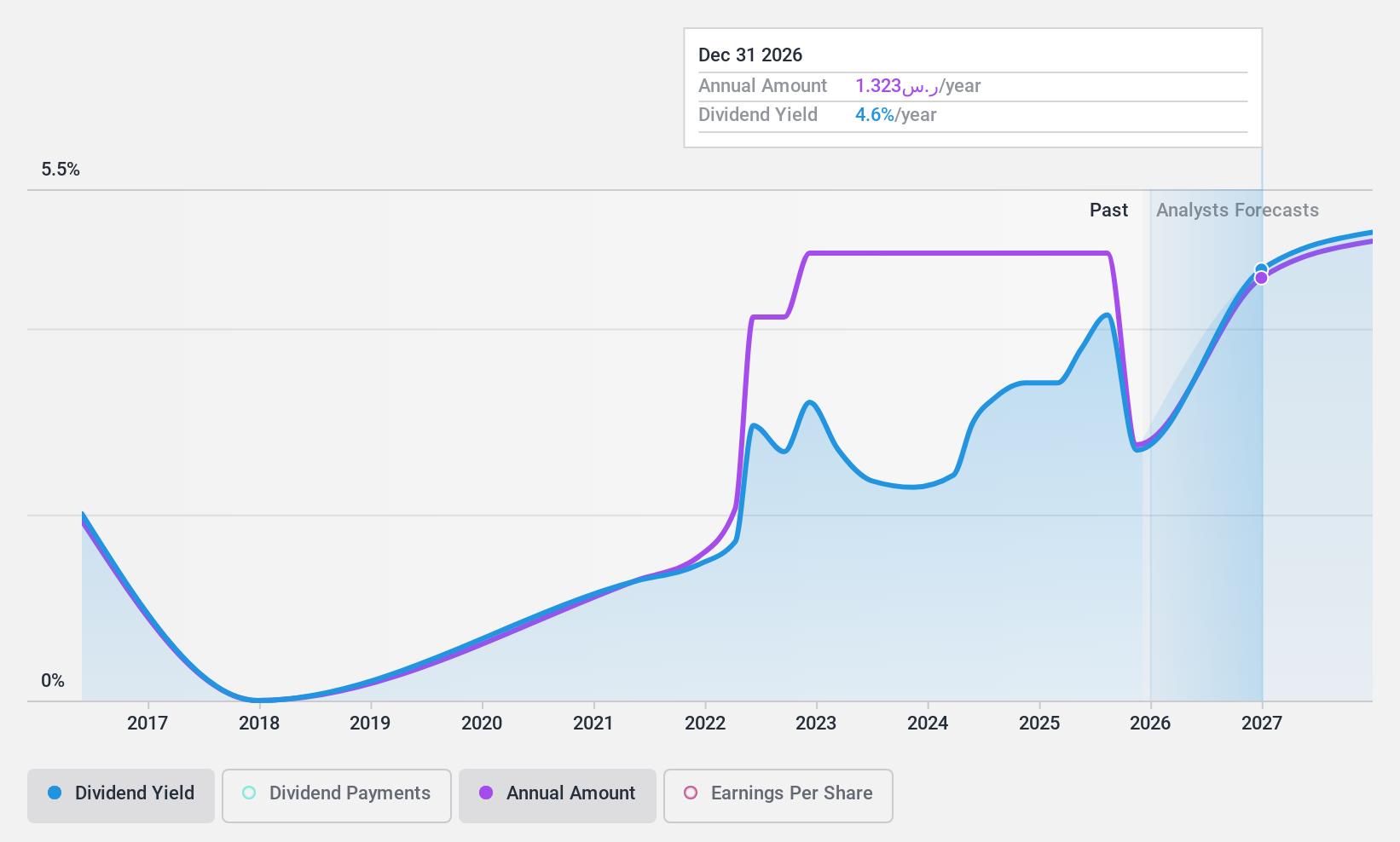

Dividend Yield: 3.4%

Al Hammadi Holding's recent earnings report shows a net income increase to SAR 338.8 million, supporting its dividend strategy with a payout ratio of 68.7% and cash payout ratio of 48.3%, indicating dividends are well-covered by earnings and cash flows. Despite past volatility, dividends have grown over the last decade, with the latest quarterly dividend set at SAR 0.35 per share. Trading slightly below fair value, it offers good relative value compared to peers in the region.

- Get an in-depth perspective on Al Hammadi Holding's performance by reading our dividend report here.

- The analysis detailed in our Al Hammadi Holding valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Discover the full array of 59 Top Middle Eastern Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:ADCB

Abu Dhabi Commercial Bank PJSC

Provides banking products and services in the United Arab Emirates and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives