- United Arab Emirates

- /

- Real Estate

- /

- DFM:EMAAR

3 Middle Eastern Dividend Stocks To Consider With Up To 7.4% Yield

Reviewed by Simply Wall St

In the Middle East, stock markets have been experiencing notable highs, with Dubai's main share index recently reaching record levels due to strategic business agreements and regional economic developments. Amidst this backdrop, dividend stocks can offer investors a potential source of steady income, making them an attractive consideration in today's dynamic market environment.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.87% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.43% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.27% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.27% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.69% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.99% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.88% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.63% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.46% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.27% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top Middle Eastern Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Emaar Properties PJSC (DFM:EMAAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emaar Properties PJSC, along with its subsidiaries, operates in property investment, development, and management both in the United Arab Emirates and internationally, with a market cap of AED118.88 billion.

Operations: Emaar Properties PJSC generates revenue through its segments in Real Estate (AED29.70 billion), Leasing, Retail and Related Activities (AED7.11 billion), and Hospitality (AED2.07 billion).

Dividend Yield: 7.4%

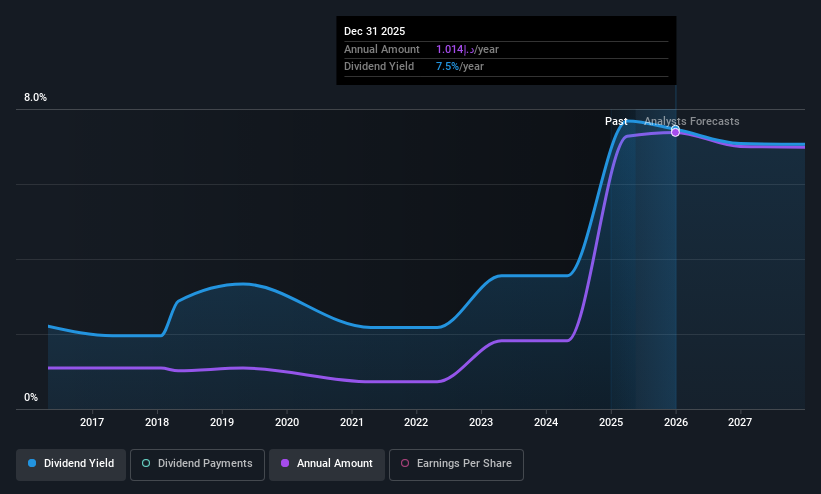

Emaar Properties PJSC offers a compelling dividend yield of 7.43%, placing it in the top quartile of AE market dividend payers. Despite a volatile dividend history, recent earnings growth and a payout ratio of 61.8% indicate dividends are well-covered by earnings and cash flows, with the cash payout ratio at just 29.3%. Trading significantly below fair value estimates suggests potential for capital appreciation alongside income generation, though historical instability in payments warrants cautious optimism.

- Take a closer look at Emaar Properties PJSC's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Emaar Properties PJSC shares in the market.

Naphtha Israel Petroleum (TASE:NFTA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Naphtha Israel Petroleum Corp. Ltd. operates in the exploration, development, production, and sale of oil and gas in Israel and the United States with a market cap of ₪2.35 billion.

Operations: Naphtha Israel Petroleum Corp. Ltd. generates revenue primarily from its oil and gas operations in Israel, contributing ₪1.77 billion, and from its activities in the USA, adding ₪626 million.

Dividend Yield: 7.3%

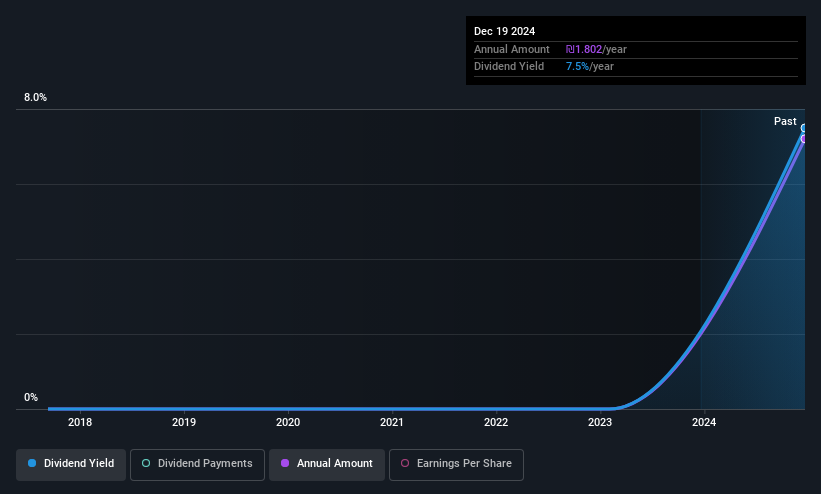

Naphtha Israel Petroleum's dividend yield of 7.26% ranks it among the top 25% in the IL market, supported by a solid cash payout ratio of 22.3%, indicating strong coverage by cash flows. Despite earnings growth and a reasonable payout ratio of 50.3%, its dividend history is marked by volatility and unreliability over six years, with payments having decreased. The stock trades significantly below fair value estimates, suggesting potential for capital gains despite its unstable dividend track record.

- Click here to discover the nuances of Naphtha Israel Petroleum with our detailed analytical dividend report.

- The analysis detailed in our Naphtha Israel Petroleum valuation report hints at an deflated share price compared to its estimated value.

Tigbur - Temporary Professional Personnel (TASE:TIGBUR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tigbur - Temporary Professional Personnel Ltd. operates in the staffing industry, providing temporary professional personnel services, with a market cap of ₪495.33 million.

Operations: Tigbur - Temporary Professional Personnel Ltd. generates its revenue from several segments, including Manpower and Nursing (₪891.74 million), Guarding and Security (₪373.74 million), Accessibility Field (₪23.86 million), and Investment Property (₪2.92 million).

Dividend Yield: 3.2%

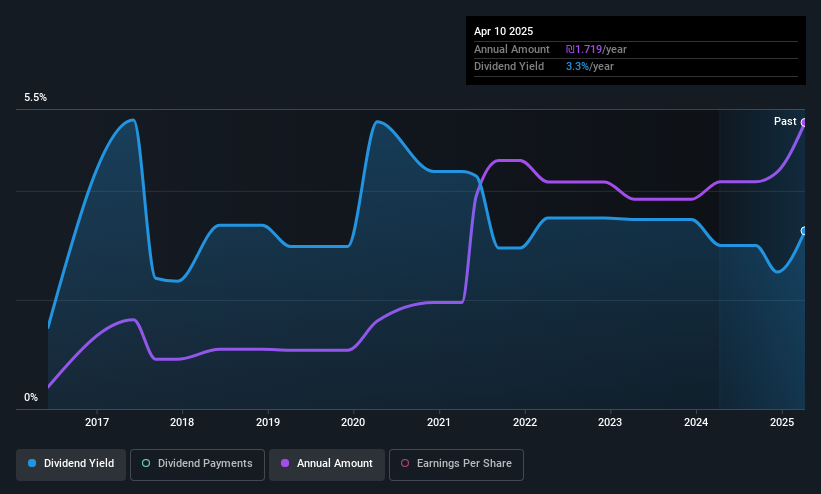

Tigbur's dividend payments have been unreliable and volatile over the past decade, with a current yield of 3.21%, below the IL market's top quartile. Despite this, dividends are covered by earnings (payout ratio: 61.8%) and cash flows (cash payout ratio: 67.1%). Earnings grew significantly by ILS 9.26 million last year, reflecting improved financial performance, though the dividend track record remains unstable. The stock's P/E ratio of 17.7x is slightly below industry average, indicating potential value.

- Click to explore a detailed breakdown of our findings in Tigbur - Temporary Professional Personnel's dividend report.

- According our valuation report, there's an indication that Tigbur - Temporary Professional Personnel's share price might be on the expensive side.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 71 Top Middle Eastern Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Emaar Properties PJSC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Emaar Properties PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:EMAAR

Emaar Properties PJSC

Engages in the property investment, development, and development management business in the United Arab Emirates and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives