- Israel

- /

- Capital Markets

- /

- TASE:TASE

Undiscovered Gems Three Promising Stocks In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, a "red sweep" has fueled optimism for growth and tax reforms, propelling major indices like the S&P 500 and Russell 2000 to significant gains. Amidst this backdrop of economic shifts and policy changes, discerning investors are increasingly seeking out promising small-cap stocks that can thrive under these evolving conditions. Identifying such gems often involves looking for companies with strong fundamentals, innovative strategies, and resilience in navigating market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wema Bank | 53.09% | 32.38% | 56.06% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

National Cement Company (Public Shareholding) (DFM:NCC)

Simply Wall St Value Rating: ★★★★★★

Overview: National Cement Company (Public Shareholding Co.) engages in the manufacturing and sale of cement and related products both within the United Arab Emirates and internationally, with a market capitalization of AED1.12 billion.

Operations: NCC generates revenue primarily from the sale of cement and related products in both domestic and international markets. The company's financial performance is influenced by its ability to manage production costs effectively, impacting its net profit margin.

National Cement, a small player in the industry, has shown impressive earnings growth of 253.8% over the past year, outpacing its peers significantly. Despite this growth, recent financials reveal some challenges; third-quarter sales fell to AED 41.88 million from AED 49.01 million last year, and net income dropped to AED 6.67 million from AED 9.92 million. However, for the nine-month period ending September 2024, net income surged to AED 135.37 million compared to AED 50.34 million previously reported—an encouraging sign of potential resilience despite quarterly setbacks.

Tel-Aviv Stock Exchange (TASE:TASE)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Tel-Aviv Stock Exchange Ltd. operates a stock exchange in Israel with a market capitalization of ₪3.54 billion.

Operations: Revenue from the Tel-Aviv Stock Exchange Ltd. is derived primarily from unclassified services, amounting to ₪410.34 million.

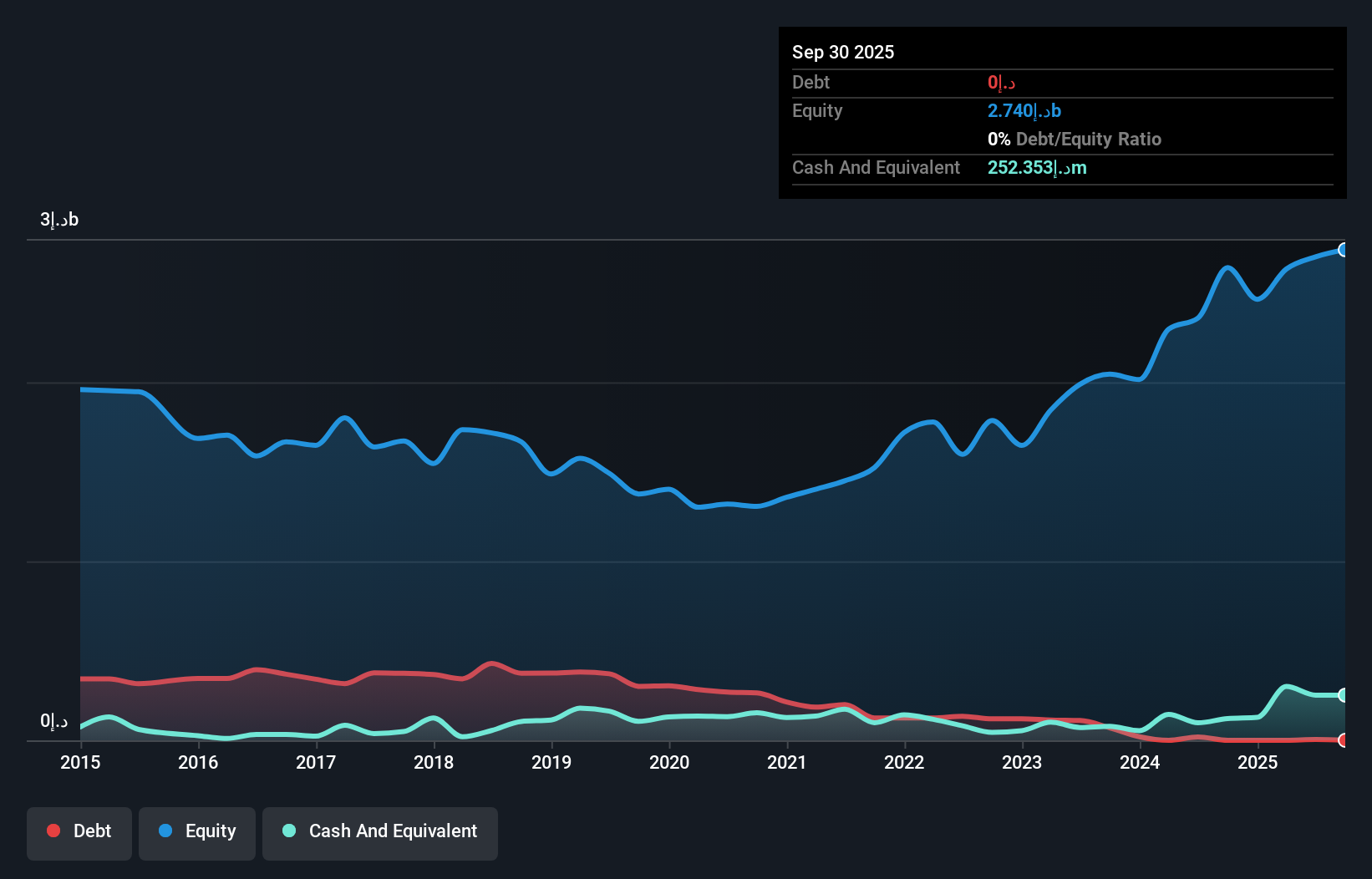

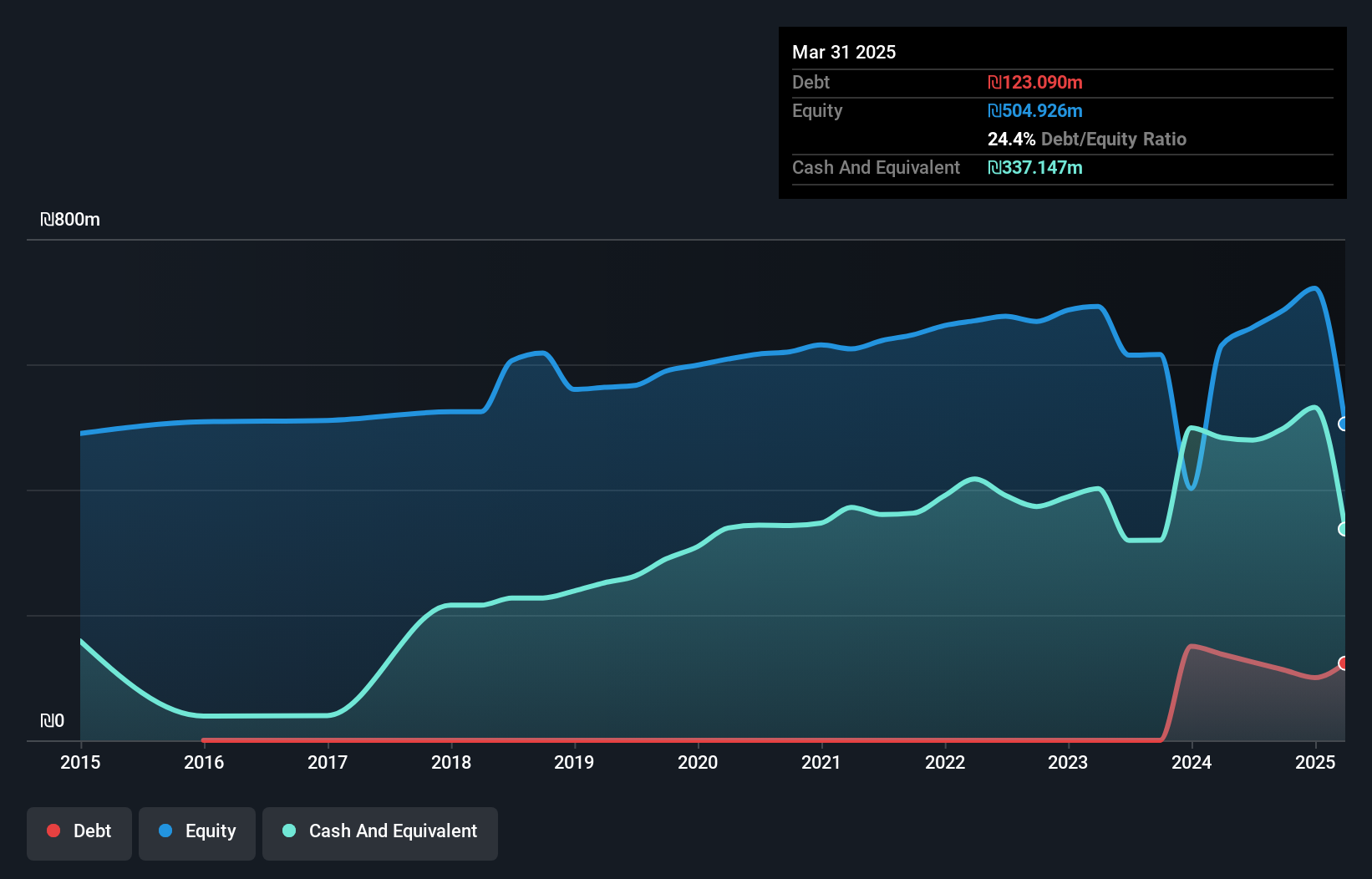

Tel-Aviv Stock Exchange, a smaller player in the financial sector, has demonstrated impressive earnings growth of 34.4% over the past year, outpacing its industry peers' 21.4%. Despite a rise in its debt to equity ratio from 0% to 18.9% over five years, TASE's cash reserves comfortably exceed total debt levels. The company generates high-quality earnings and is free cash flow positive with recent figures showing US$92.43 million as of June 2024. Although its share price has been highly volatile recently, TASE's profitability suggests a stable cash runway moving forward with earnings projected to grow by approximately 10% annually.

- Dive into the specifics of Tel-Aviv Stock Exchange here with our thorough health report.

Evaluate Tel-Aviv Stock Exchange's historical performance by accessing our past performance report.

Tadano (TSE:6395)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tadano Ltd. and its subsidiaries specialize in manufacturing and selling construction and vehicle-mounted cranes both in Japan and internationally, with a market cap of ¥136.75 billion.

Operations: Tadano's revenue primarily stems from the sale of construction and vehicle-mounted cranes across domestic and international markets. The company's financial performance is characterized by its gross profit margin, which reflects its ability to manage production costs relative to sales.

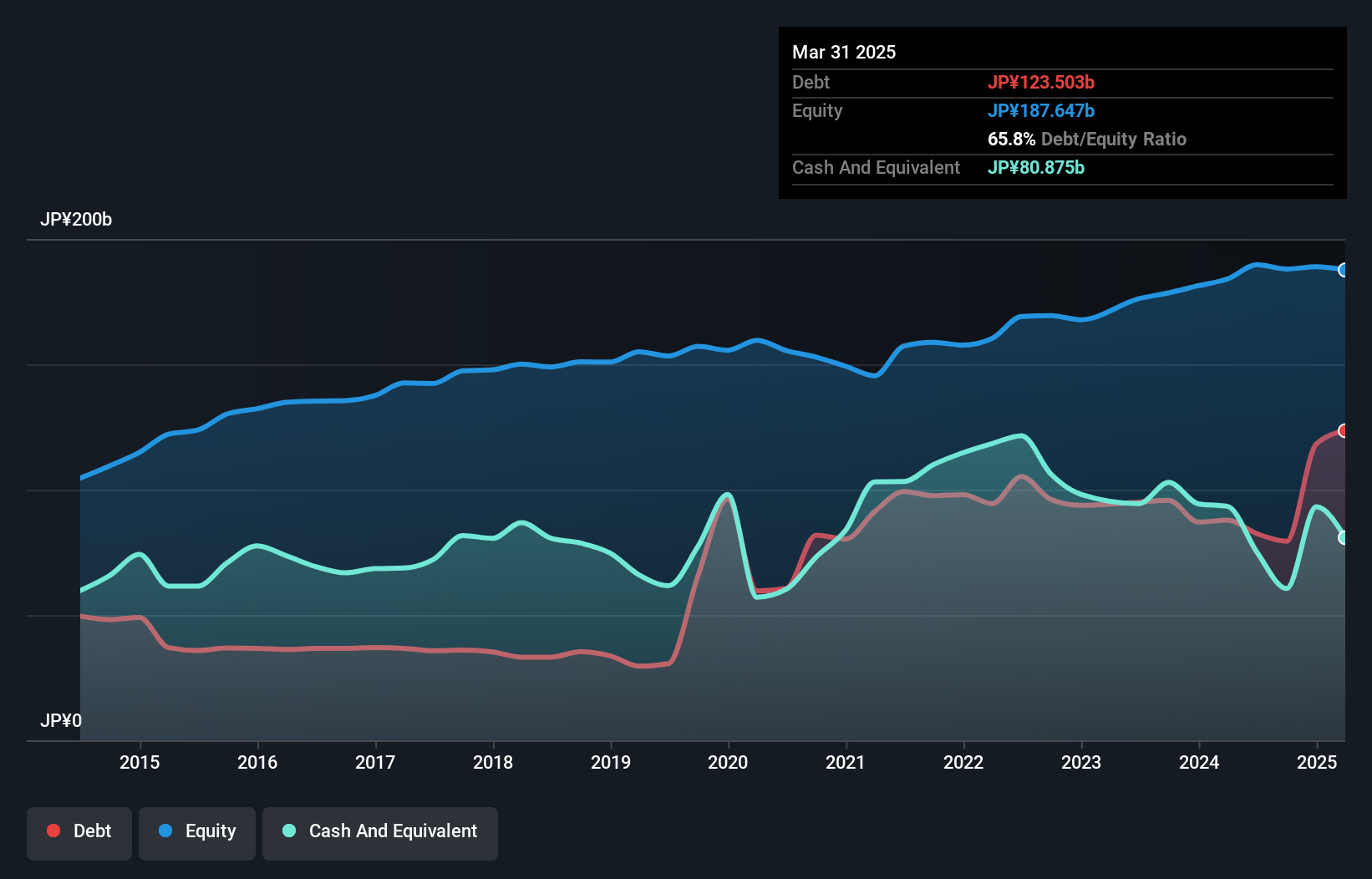

Tadano, a smaller player in the machinery sector, has seen its earnings surge by 172.5% over the past year, outpacing the industry average of 1.5%. Despite a rise in its debt to equity ratio from 20% to 43.4% over five years, interest payments are comfortably covered with EBIT at 13.5 times interest obligations. The company is trading at a value that's approximately 21.6% below estimated fair value and maintains high-quality earnings while being free cash flow positive. This financial health suggests Tadano is poised for steady growth with forecasted annual earnings growth of around 6.61%.

- Click to explore a detailed breakdown of our findings in Tadano's health report.

Explore historical data to track Tadano's performance over time in our Past section.

Taking Advantage

- Click this link to deep-dive into the 4664 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tel-Aviv Stock Exchange might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TASE

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives