- United Arab Emirates

- /

- Basic Materials

- /

- ADX:GCEM

Strong week for Gulf Cement Company P.S.C (ADX:GCEM) shareholders doesn't alleviate pain of five-year loss

It is a pleasure to report that the Gulf Cement Company P.S.C. (ADX:GCEM) is up 50% in the last quarter. But that is little comfort to those holding over the last half decade, sitting on a big loss. In that time the share price has delivered a rude shock to holders, who find themselves down 68% after a long stretch. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

While the stock has risen 34% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Gulf Cement Company P.S.C

Given that Gulf Cement Company P.S.C didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Gulf Cement Company P.S.C reduced its trailing twelve month revenue by 1.3% for each year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 11% per year doesn't really surprise us. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

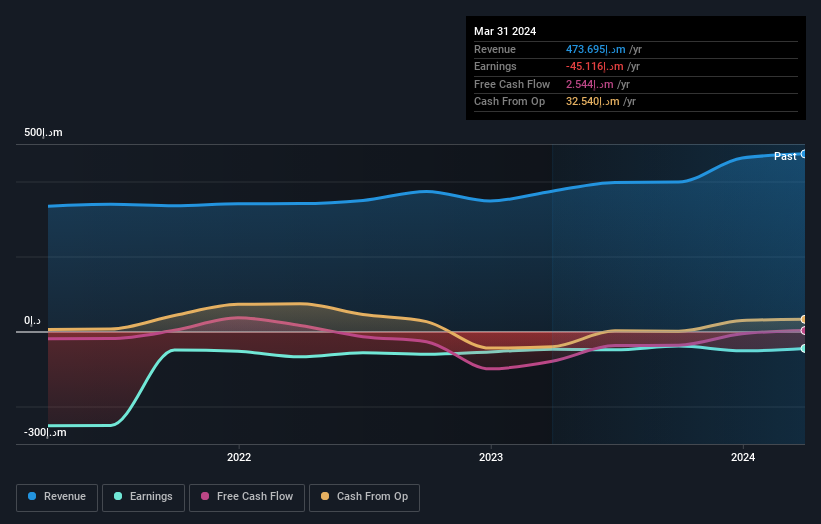

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Gulf Cement Company P.S.C's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Gulf Cement Company P.S.C's TSR, which was a 65% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

It's nice to see that Gulf Cement Company P.S.C shareholders have received a total shareholder return of 34% over the last year. That certainly beats the loss of about 11% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Gulf Cement Company P.S.C has 2 warning signs (and 1 which is significant) we think you should know about.

Of course Gulf Cement Company P.S.C may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Emirian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:GCEM

Gulf Cement Company P.S.C

Produces and markets various types of cement in the United Arab Emirates and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives