- United Arab Emirates

- /

- Chemicals

- /

- ADX:FERTIGLB

Time To Worry? Analysts Just Downgraded Their Fertiglobe plc (ADX:FERTIGLB) Outlook

Today is shaping up negative for Fertiglobe plc (ADX:FERTIGLB) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well. The stock price has risen 5.1% to د.إ5.37 over the past week. Investors could be forgiven for changing their mind on the business following the downgrade; but it's not clear if the revised forecasts will lead to selling activity.

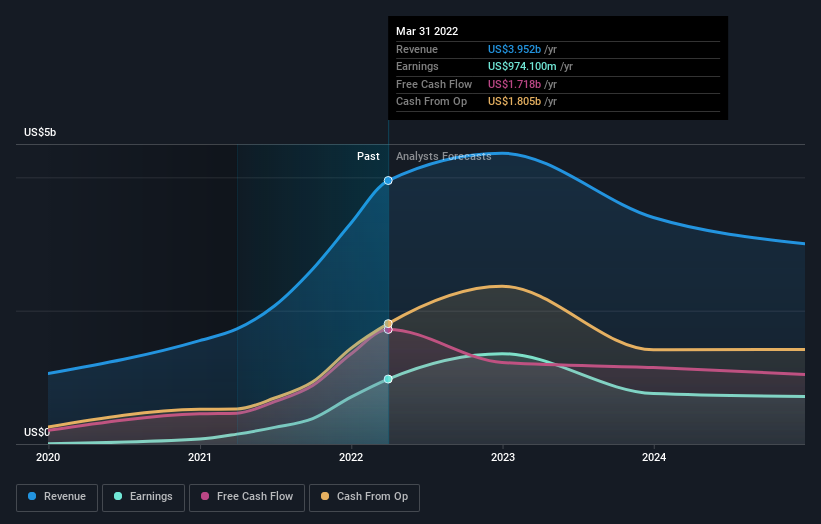

Following the downgrade, the most recent consensus for Fertiglobe from its nine analysts is for revenues of US$4.4b in 2022 which, if met, would be a notable 10% increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$5.0b in 2022. The consensus view seems to have become more pessimistic on Fertiglobe, noting the measurable cut to revenue estimates in this update.

See our latest analysis for Fertiglobe

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that Fertiglobe's revenue growth will slow down substantially, with revenues to the end of 2022 expected to display 14% growth on an annualised basis. This is compared to a historical growth rate of 129% over the past year. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 11% per year. So it's pretty clear that, while Fertiglobe's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Fertiglobe this year. They're also forecasting more rapid revenue growth than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Fertiglobe after today.

Unsatisfied? At least one of Fertiglobe's nine analysts has provided estimates out to 2024, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:FERTIGLB

Fertiglobe

Produces and sells nitrogen-based products in Europe, North and South America, Africa, the Middle East, Asia, and Oceania.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion