- China

- /

- Electrical

- /

- SHSE:605117

Global Market's Hidden Value: 3 Stocks Priced Below Estimated Worth

Reviewed by Simply Wall St

As global markets continue to reach new heights, with major U.S. indices like the S&P 500 and Nasdaq Composite hitting record highs, investors are keenly observing the economic landscape shaped by robust job growth and evolving trade dynamics. In this environment of heightened market activity, identifying stocks that are priced below their estimated worth can offer unique opportunities for those looking to capitalize on potential value plays amidst a backdrop of economic resilience and cautious optimism.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lucky Harvest (SZSE:002965) | CN¥35.45 | CN¥70.60 | 49.8% |

| Jiangxi Rimag Group (SEHK:2522) | HK$13.72 | HK$27.26 | 49.7% |

| Green Oleo (BIT:GRN) | €0.795 | €1.58 | 49.6% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥28.30 | CN¥56.47 | 49.9% |

| Dive (TSE:151A) | ¥935.00 | ¥1858.89 | 49.7% |

| cyan (XTRA:CYR) | €2.20 | €4.39 | 49.9% |

| cottaLTD (TSE:3359) | ¥429.00 | ¥856.03 | 49.9% |

| Cambi (OB:CAMBI) | NOK21.70 | NOK43.04 | 49.6% |

| BalnibarbiLtd (TSE:3418) | ¥1173.00 | ¥2329.70 | 49.7% |

| Almirall (BME:ALM) | €10.68 | €21.21 | 49.6% |

Let's dive into some prime choices out of the screener.

Fertiglobe (ADX:FERTIGLB)

Overview: Fertiglobe plc, with a market cap of AED20.50 billion, operates globally in the production and sale of nitrogen-based products across Europe, the Americas, Africa, the Middle East, Asia, and Oceania.

Operations: The company's revenue is primarily derived from the production and marketing of owned produced volumes, accounting for $2 billion, followed by third-party trading at $156.30 million.

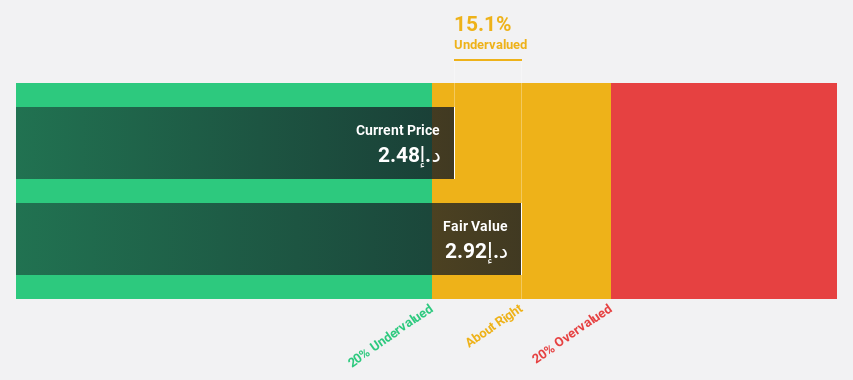

Estimated Discount To Fair Value: 13.2%

Fertiglobe's recent earnings report showed a decline in net income to US$72.6 million, despite an increase in sales to US$694.9 million. The stock is trading at AED2.47, below its estimated fair value of AED2.85, indicating potential undervaluation based on cash flows. However, profit margins have decreased significantly from last year, and the company carries a high level of debt which could impact financial stability despite its strong forecasted earnings growth of over 26% annually.

- Our growth report here indicates Fertiglobe may be poised for an improving outlook.

- Click here to discover the nuances of Fertiglobe with our detailed financial health report.

Ningbo Deye Technology Group (SHSE:605117)

Overview: Ningbo Deye Technology Group Co., Ltd. is involved in the production and sales of heat exchangers, inverters, and dehumidifiers across various international markets including China, the UK, the US, Germany, and India with a market cap of CN¥46.80 billion.

Operations: Ningbo Deye Technology Group generates revenue through its production and sales of heat exchangers, inverters, and dehumidifiers across China, the UK, the US, Germany, India, and other international markets.

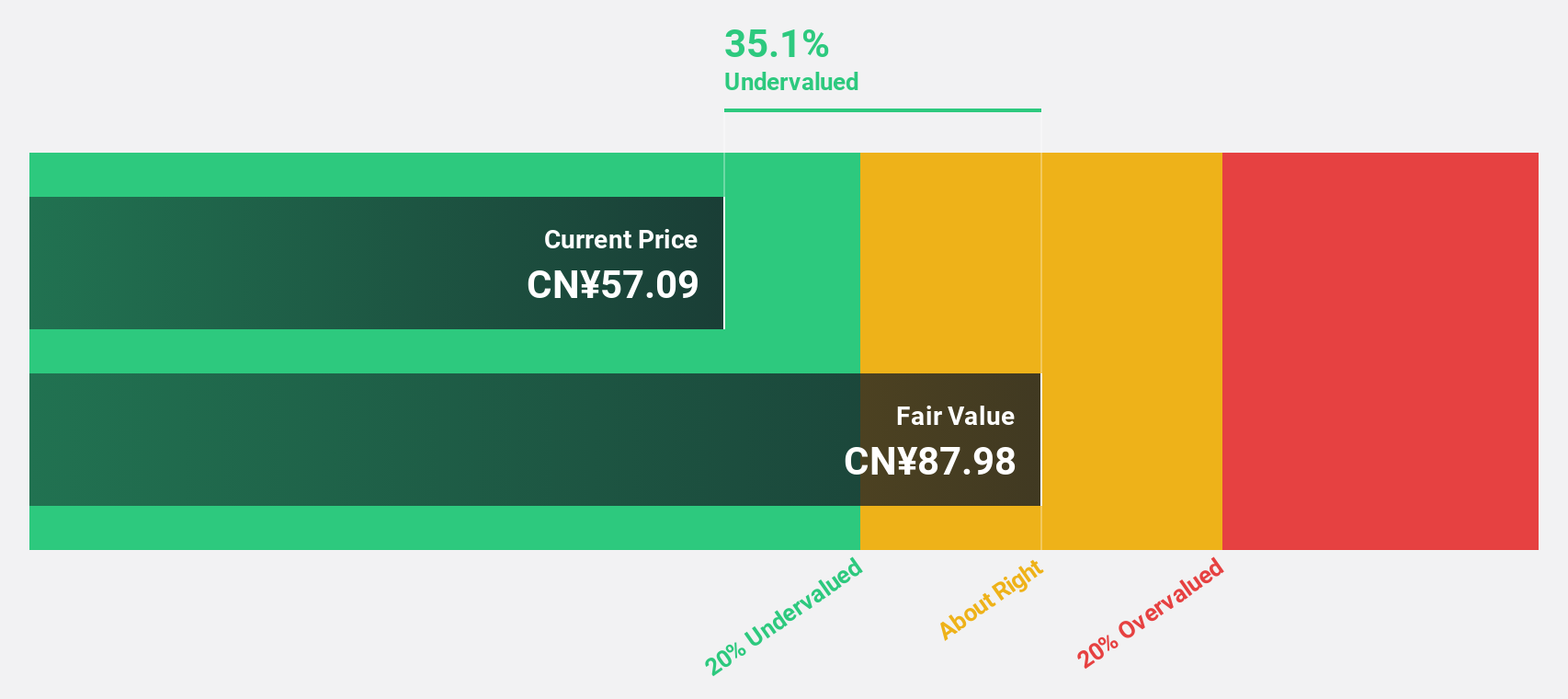

Estimated Discount To Fair Value: 40.5%

Ningbo Deye Technology Group's stock is trading at CN¥54.94, significantly below its estimated fair value of CN¥92.28, suggesting undervaluation based on cash flows. Despite being removed from the Shanghai Stock Exchange 180 Value Index, recent earnings showed strong growth with net income rising to CNY 705.54 million in Q1 2025 from CNY 432.91 million a year ago. The company has initiated a share buyback program worth up to CNY 200 million, potentially enhancing shareholder value further.

- Our earnings growth report unveils the potential for significant increases in Ningbo Deye Technology Group's future results.

- Navigate through the intricacies of Ningbo Deye Technology Group with our comprehensive financial health report here.

Bizlink Holding (TWSE:3665)

Overview: Bizlink Holding Inc. specializes in the research, design, development, manufacture, and sale of interconnect products for cable harnesses across various international markets including the United States, China, Germany, Malaysia, Taiwan, and Italy with a market cap of NT$163.66 billion.

Operations: The company's revenue segments include the Computer Transmission Department with NT$67.53 billion, the Home Electric Appliance Division with NT$10.31 billion, and the Industrial Application Department with NT$23.92 billion.

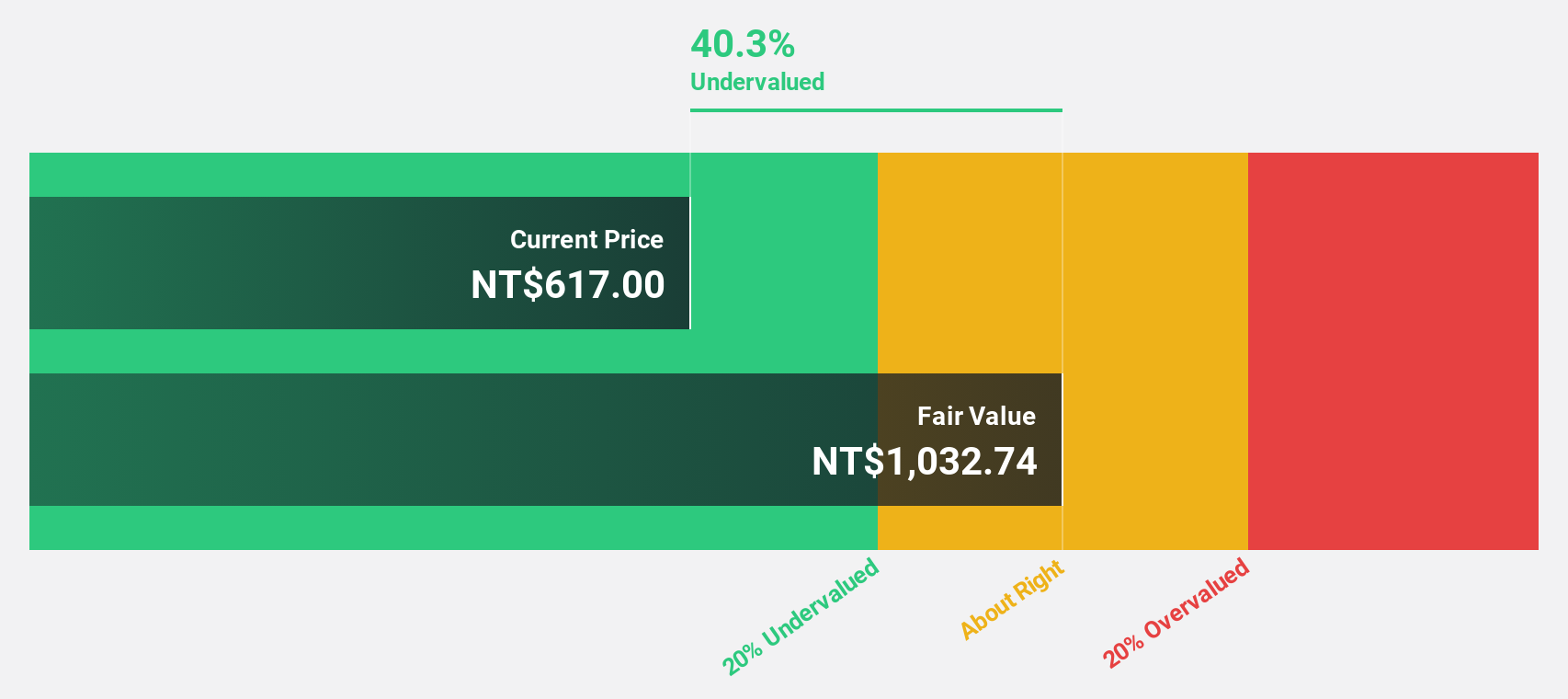

Estimated Discount To Fair Value: 20.4%

Bizlink Holding is trading at NT$878, below its estimated fair value of NT$1102.9, highlighting potential undervaluation based on cash flows. Recent financials show robust earnings growth, with net income rising to TWD 1.61 billion in Q1 2025 from TWD 580.67 million a year ago. The company approved a cash dividend of US$69.21 million, reflecting strong cash flow management despite share price volatility and past shareholder dilution concerns.

- Our comprehensive growth report raises the possibility that Bizlink Holding is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Bizlink Holding stock in this financial health report.

Seize The Opportunity

- Access the full spectrum of 478 Undervalued Global Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Deye Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605117

Ningbo Deye Technology Group

Engages in the production and sales of heat exchangers, inverters, and dehumidifiers in China, the United Kingdom, the United States, Germany, India, and internationally.

Outstanding track record, undervalued and pays a dividend.

Market Insights

Community Narratives