- United Arab Emirates

- /

- Insurance

- /

- DFM:SALAMA

Middle Eastern Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

Gulf markets have recently experienced mixed outcomes, influenced by expectations of a Federal Reserve rate cut and soft oil prices. For investors willing to explore beyond the major players, penny stocks—often representing smaller or newer companies—can still offer intriguing opportunities. Despite being an older term, these stocks continue to present potential for growth at lower price points, especially when backed by solid financials and strong fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.34 | SAR1.33B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.772 | ₪198.74M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.01 | AED2.04B | ✅ 4 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.33 | AED14.24B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.785 | AED2.26B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.816 | AED504.24M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.693 | ₪211.4M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

Islamic Arab Insurance (Salama) PJSC (DFM:SALAMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Islamic Arab Insurance (Salama) PJSC, along with its subsidiaries, offers a variety of general, family, health, and auto takaful solutions across Africa and Asia with a market capitalization of AED384.79 million.

Operations: Salama's revenue is primarily derived from AED218.45 million in Family Takaful and AED793.81 million in General Takaful segments.

Market Cap: AED384.79M

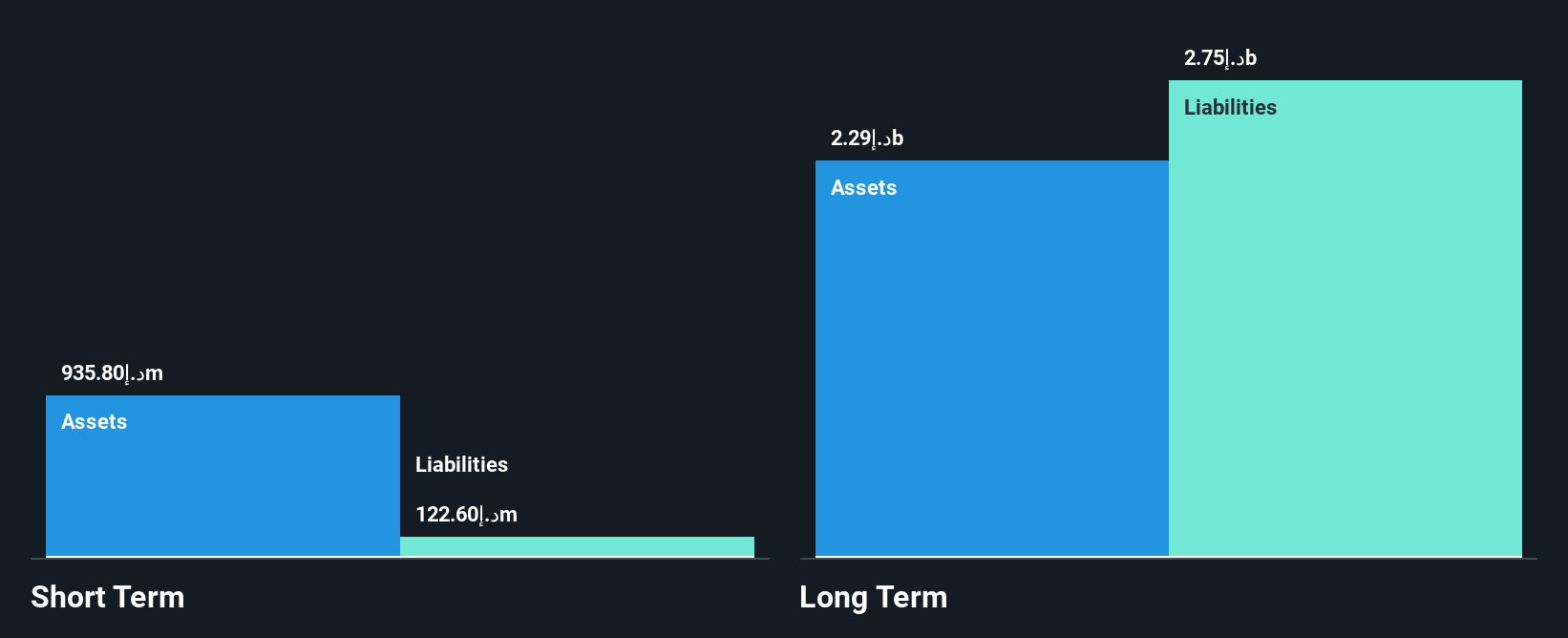

Islamic Arab Insurance (Salama) PJSC, with a market capitalization of AED384.79 million, has shown recent profitability despite a decline in net income for Q3 2025 to AED0.804 million from AED8.08 million the previous year. The company is debt-free but faces challenges with long-term liabilities exceeding its short-term assets by over AED1 billion. Salama's board is relatively new, averaging less than one year of tenure, which may impact governance stability. Recent leadership changes and recapitalization efforts aim to strengthen solvency and support sustainable growth in compliance with UAE regulations, marking a transformative phase for the company.

- Dive into the specifics of Islamic Arab Insurance (Salama) PJSC here with our thorough balance sheet health report.

- Understand Islamic Arab Insurance (Salama) PJSC's track record by examining our performance history report.

Elbit Medical Technologies (TASE:EMTC-M)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elbit Medical Technologies Ltd is an investment holding company involved in the research, development, production, and marketing of therapeutic medical systems globally, with a market cap of ₪18.32 million.

Operations: Elbit Medical Technologies Ltd does not report specific revenue segments.

Market Cap: ₪18.32M

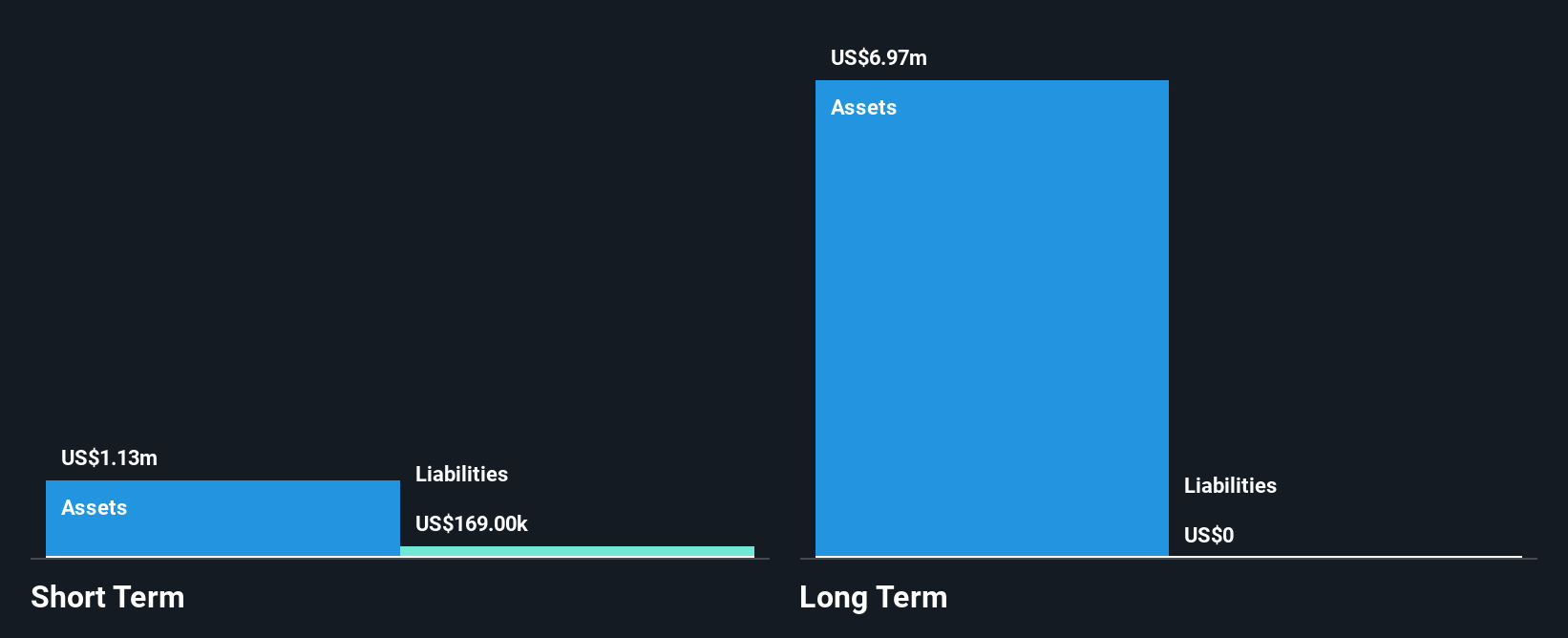

Elbit Medical Technologies Ltd, with a market cap of ₪18.32 million, is pre-revenue, generating less than US$1 million in revenue. Despite becoming profitable this year, the company reported a net loss of US$0.115 million for the first half of 2025 due to large one-off gains impacting its financial results. The company's short-term assets significantly exceed its liabilities at $1.1M versus $169K, and it remains debt-free with no long-term liabilities. However, earnings have declined substantially over the past five years by 73.3% annually, and its share price has been highly volatile recently.

- Click to explore a detailed breakdown of our findings in Elbit Medical Technologies' financial health report.

- Examine Elbit Medical Technologies' past performance report to understand how it has performed in prior years.

Unicorn Technologies - Limited Partnership (TASE:UNCT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Unicorn Technologies - Limited Partnership, based in Tel Aviv, Israel, operates as a principal investment firm with a market cap of ₪13.25 million.

Operations: Unicorn Technologies - Limited Partnership has not reported any revenue segments.

Market Cap: ₪13.25M

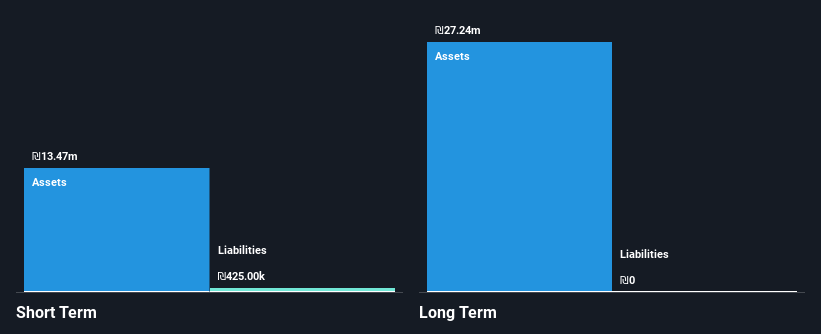

Unicorn Technologies - Limited Partnership, with a market cap of ₪13.25 million, is pre-revenue and unprofitable. The firm has no debt and maintains a sufficient cash runway for over two years if its free cash flow continues to decline at historical rates. Its short-term assets of ₪9.0 million comfortably cover its short-term liabilities of ₪341,000. Despite stable weekly volatility over the past year, the stock remains highly volatile in recent months. A recent 1:8 stock split may impact investor sentiment as it navigates financial challenges without meaningful revenue streams or profitability improvements in sight.

- Get an in-depth perspective on Unicorn Technologies - Limited Partnership's performance by reading our balance sheet health report here.

- Gain insights into Unicorn Technologies - Limited Partnership's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Embark on your investment journey to our 78 Middle Eastern Penny Stocks selection here.

- Curious About Other Options? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:SALAMA

Islamic Arab Insurance (Salama) PJSC

Provides a range of general, family, health, and auto takaful solutions in Africa and Asia.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.