- Israel

- /

- Consumer Durables

- /

- TASE:HMGS

Middle Eastern Gems: 3 Penny Stocks With Over US$10M Market Cap

Reviewed by Simply Wall St

As Gulf markets face pressure from falling oil prices and cautious investor sentiment, the Middle Eastern stock landscape presents unique opportunities for those willing to explore beyond traditional investments. Penny stocks, although an outdated term, continue to highlight smaller or newer companies that can offer significant value when built on solid financials. By focusing on these companies' financial strength and growth potential, investors may uncover hidden gems within the region's evolving market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.00 | SAR1.6B | ✅ 2 ⚠️ 1 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪1.001 | ₪123.29M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.479 | ₪173.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.918 | ₪2.85B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.111 | ₪156.94M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.69 | AED419.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.67 | AED423.88M | ✅ 2 ⚠️ 4 View Analysis > |

| Union Insurance Company P.J.S.C (ADX:UNION) | AED0.601 | AED198.89M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.05 | AED2.12B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.32 | AED9.91B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 94 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Islamic Arab Insurance (Salama) PJSC (DFM:SALAMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Islamic Arab Insurance Co. (Salama) PJSC, along with its subsidiaries, offers a variety of general, family, health, and auto takaful solutions across Africa and Asia with a market cap of AED365.41 million.

Operations: Salama's revenue is primarily derived from its General Takaful segment, contributing AED820.65 million, and its Family Takaful segment, which adds AED225.72 million.

Market Cap: AED365.41M

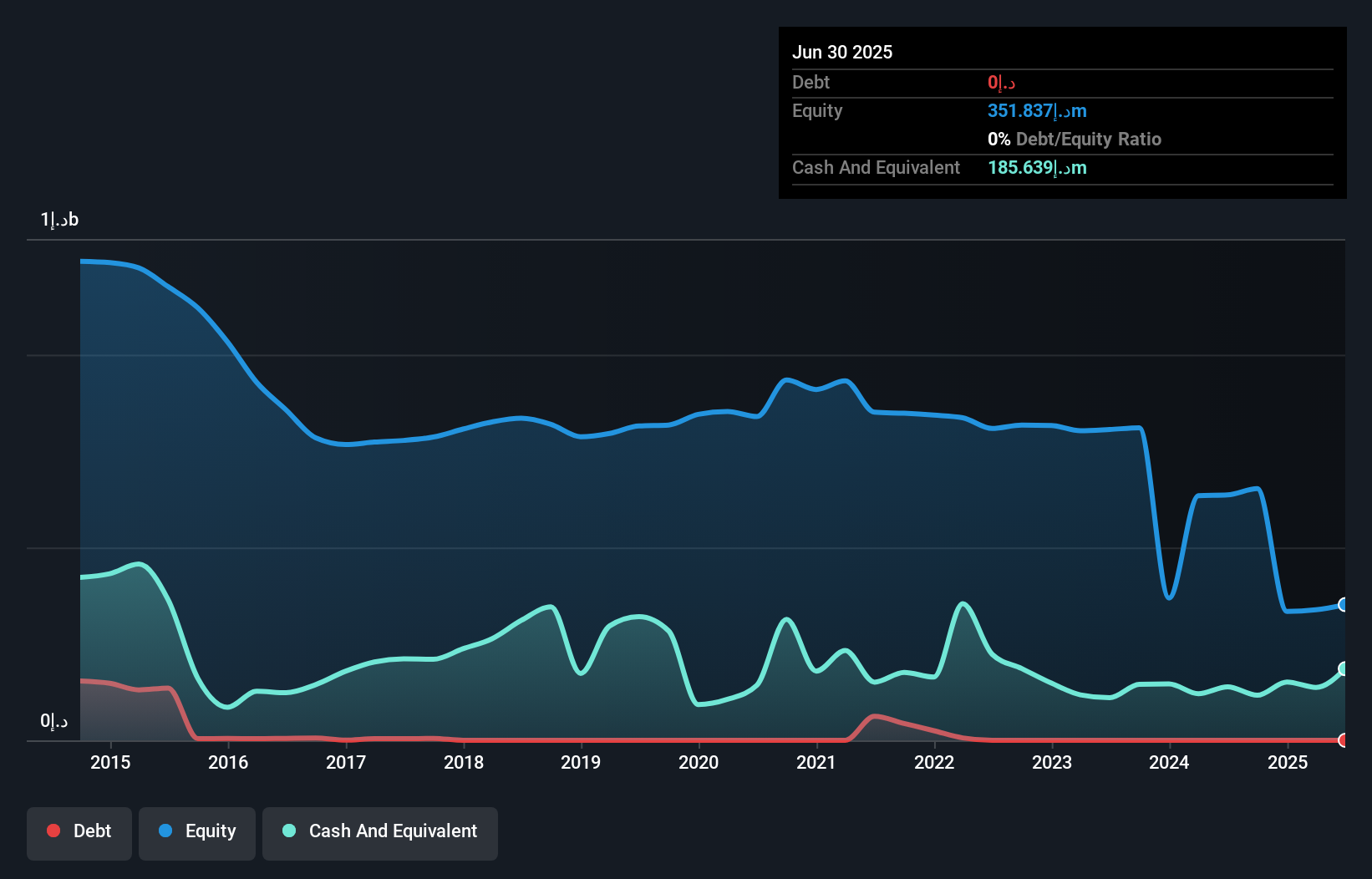

Islamic Arab Insurance Co. (Salama) PJSC has transitioned to profitability, reporting a net income of AED13.09 million for 2024, reversing a significant loss from the previous year. The company's financial health is bolstered by short-term assets of AED956.4 million, which comfortably cover its short-term liabilities but fall short against long-term liabilities of AED2.7 billion. Salama's debt-free status alleviates concerns over interest payments and cash flow coverage, though its Return on Equity remains low at 7.4%. Recent leadership changes include appointing Mohamed Ali Bouabane as CEO in March 2025, indicating potential strategic shifts ahead.

- Click here and access our complete financial health analysis report to understand the dynamics of Islamic Arab Insurance (Salama) PJSC.

- Understand Islamic Arab Insurance (Salama) PJSC's track record by examining our performance history report.

Aerodrome Group (TASE:ARDM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aerodrome Group Ltd specializes in offering solutions for data collection, processing, and analysis using UAVs, advanced software, and AI applications across civil and security sectors, with a market cap of ₪36.91 million.

Operations: Aerodrome Group Ltd has not reported any specific revenue segments.

Market Cap: ₪36.91M

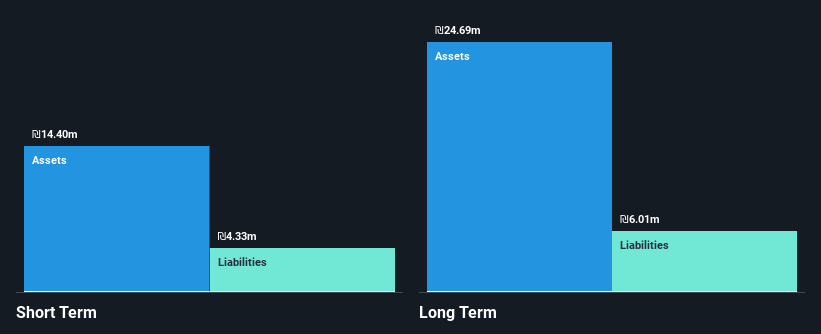

Aerodrome Group Ltd, operating with a market cap of ₪36.91 million, is currently pre-revenue and unprofitable, with sales dropping to ₪14.45 million for the year ending December 2024 from ₪33.87 million the previous year. Despite having short-term assets of ₪14.4 million exceeding both its short-term liabilities of ₪4.3 million and long-term liabilities of ₪6 million, the company faces financial challenges with less than a year of cash runway based on current free cash flow trends. The stock exhibits high volatility compared to peers in Israel, while shareholder dilution has been minimal over the past year.

- Unlock comprehensive insights into our analysis of Aerodrome Group stock in this financial health report.

- Evaluate Aerodrome Group's historical performance by accessing our past performance report.

HomeBiogas (TASE:HMGS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: HomeBiogas LTD develops, produces, and markets biogas systems that convert organic waste into clean energy for various global users, with a market cap of ₪36.84 million.

Operations: HomeBiogas does not have any reported revenue segments.

Market Cap: ₪36.84M

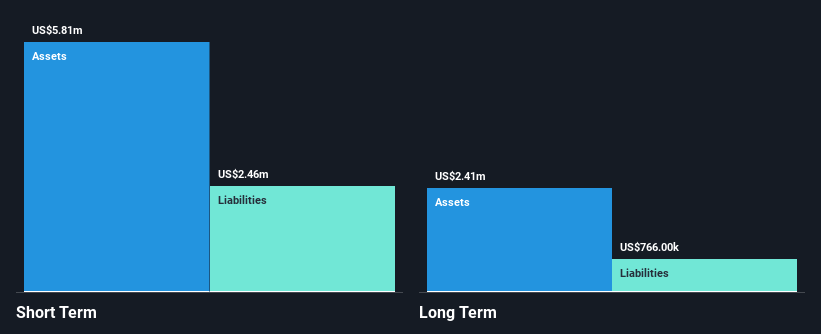

HomeBiogas Ltd, with a market cap of ₪36.84 million, is currently pre-revenue and unprofitable, as evidenced by declining earnings over the past five years at 22.7% annually. Despite generating US$2.63 million in sales for 2024, down from US$4.83 million the previous year, the company reported a net loss of US$9.42 million. Short-term assets of $5.8M cover both short-term liabilities ($2.5M) and long-term liabilities ($766K), but cash runway remains under a year if cash flow trends persist. The stock's high volatility is notable compared to other Israeli stocks, though shareholder dilution has been minimal recently.

- Jump into the full analysis health report here for a deeper understanding of HomeBiogas.

- Review our historical performance report to gain insights into HomeBiogas' track record.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 91 Middle Eastern Penny Stocks now.

- Looking For Alternative Opportunities? Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HomeBiogas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:HMGS

HomeBiogas

HomeBiogas LTD develops, produces, and markets biogas systems for treatment of organic waste into clean energy for households, farmers, businesses, and communities worldwide.

Moderate with adequate balance sheet.

Market Insights

Community Narratives