- United Arab Emirates

- /

- Insurance

- /

- ADX:AWNIC

Middle Eastern Penny Stocks With Market Caps Over US$5M

Reviewed by Simply Wall St

As most Gulf stock markets gain on the prospects of a U.S. rate cut, investor sentiment in the Middle East is buoyed by potential monetary easing and its implications for regional economies. Penny stocks, a term that may seem outdated, continue to capture interest due to their unique blend of affordability and growth potential. These smaller or newer companies can offer promising opportunities when supported by strong financials, making them an intriguing option for investors seeking under-the-radar investments with long-term potential.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| E.E.A.M.I (TASE:EEAM-M) | ₪0.081 | ₪7.94M | ✅ 2 ⚠️ 4 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.72 | SAR1.49B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.12B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.40 | AED703.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.98 | AED344.19M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.29 | AED13.86B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.83 | AED504.85M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.878 | ₪225.92M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 76 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Al Wathba National Insurance Company PJSC (ADX:AWNIC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Al Wathba National Insurance Company PJSC operates in the general insurance and reinsurance sectors both within the United Arab Emirates and internationally, with a market cap of AED703.80 million.

Operations: The company's revenue is primarily derived from its motor insurance segment, amounting to AED256.71 million.

Market Cap: AED703.8M

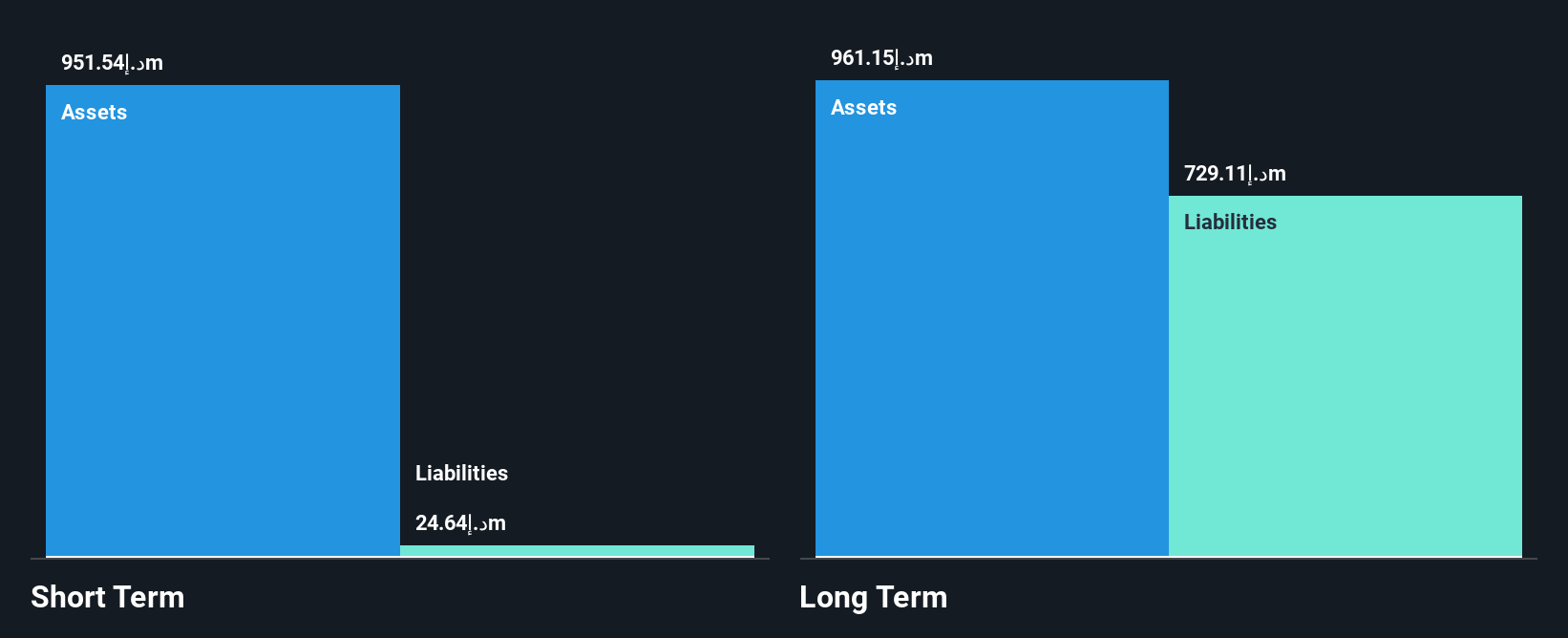

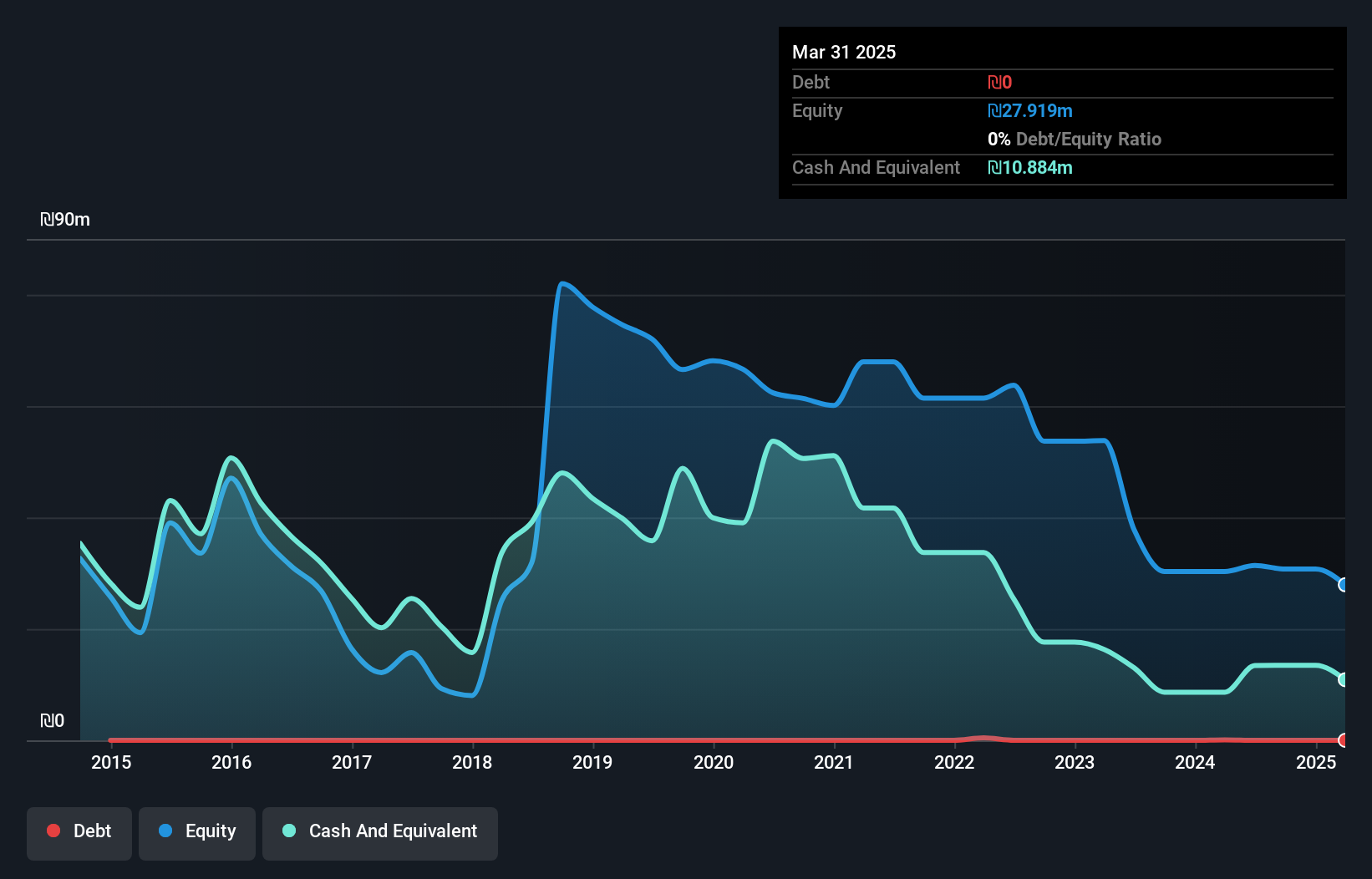

Al Wathba National Insurance Company PJSC has demonstrated significant financial improvement, with a notable turnaround from a net loss to a net income of AED 25.1 million for the first half of 2025. The company maintains a low price-to-earnings ratio of 4.5x compared to the UAE market average, indicating potential undervaluation. Its debt reduction over five years and strong cash position enhance its financial stability, while recent leadership changes bring seasoned expertise to drive strategic growth and de-risking efforts. However, high share price volatility and an unstable dividend track record present challenges for investors seeking consistent returns.

- Unlock comprehensive insights into our analysis of Al Wathba National Insurance Company PJSC stock in this financial health report.

- Learn about Al Wathba National Insurance Company PJSC's historical performance here.

Ras Al Khaimah National Insurance Company P.S.C (ADX:RAKNIC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ras Al Khaimah National Insurance Company P.S.C. operates as an insurance provider in the United Arab Emirates with a market capitalization of AED400.21 million.

Operations: The company generates revenue from two main segments: Life and Health Insurance, which accounts for AED173.75 million, and Motor and General Insurance, contributing AED155.44 million.

Market Cap: AED400.21M

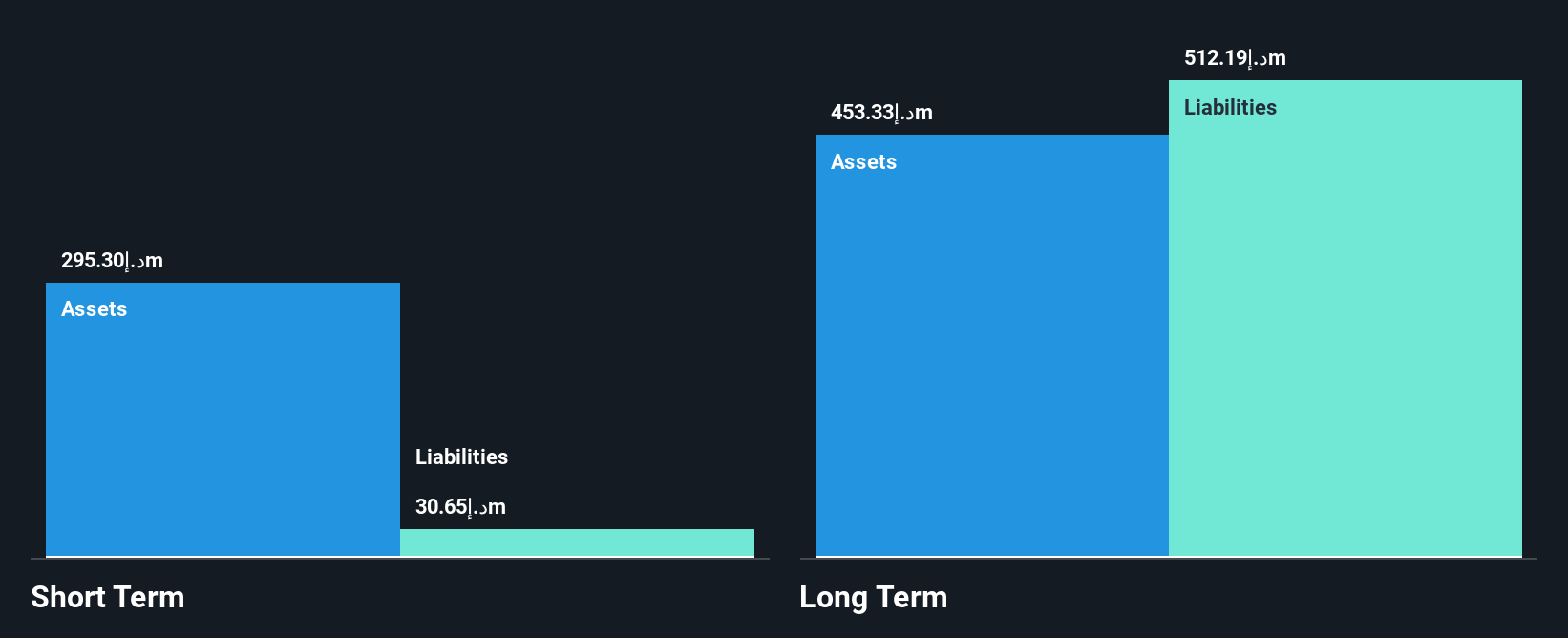

Ras Al Khaimah National Insurance Company P.S.C. has shown robust earnings growth, with net income rising to AED 24.09 million for the first half of 2025, a significant increase from AED 1.74 million the previous year. The company benefits from being debt-free and has stable weekly volatility at 1%. Its price-to-earnings ratio of 10.6x is below the market average, suggesting potential undervaluation. However, while short-term assets exceed short-term liabilities significantly, they fall short of covering long-term liabilities completely. The board's relative inexperience might pose strategic challenges despite strong management tenure and high-quality earnings performance.

- Jump into the full analysis health report here for a deeper understanding of Ras Al Khaimah National Insurance Company P.S.C.

- Gain insights into Ras Al Khaimah National Insurance Company P.S.C's historical outcomes by reviewing our past performance report.

BioLight Life Sciences (TASE:BOLT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BioLight Life Sciences Ltd. is an ophthalmic company focused on discovering, developing, and commercializing products for eye conditions, with a market cap of ₪19.37 million.

Operations: BioLight Life Sciences Ltd. has not reported any specific revenue segments.

Market Cap: ₪19.37M

BioLight Life Sciences Ltd. is a pre-revenue ophthalmic company with a market cap of ₪19.37 million and has recently filed a Shelf Registration, indicating potential future capital raising activities. Despite being debt-free, the company faces financial challenges with less than one year of cash runway and increasing losses over the past five years at 19.7% annually. The recent net loss of ₪6.11 million for the first half of 2025 highlights its unprofitable status, while short-term assets comfortably cover both short-term and long-term liabilities. The management team is seasoned, yet share price volatility remains high over recent months.

- Take a closer look at BioLight Life Sciences' potential here in our financial health report.

- Examine BioLight Life Sciences' past performance report to understand how it has performed in prior years.

Key Takeaways

- Unlock more gems! Our Middle Eastern Penny Stocks screener has unearthed 73 more companies for you to explore.Click here to unveil our expertly curated list of 76 Middle Eastern Penny Stocks.

- Contemplating Other Strategies? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:AWNIC

Al Wathba National Insurance Company PJSC

Engages in general insurance and reinsurance business in the United Arab Emirates and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives