- United Arab Emirates

- /

- Basic Materials

- /

- ADX:GCEM

Middle Eastern Penny Stocks: Gulf Cement Company P.S.C And 2 More Promising Picks

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced mixed performance, with the Saudi bourse extending losses due to weak earnings, while Dubai's index saw a slight lift. In this context, penny stocks—though an outdated term—remain relevant as they often represent smaller or younger companies that can offer unique value and growth opportunities. By focusing on those with strong financials and clear growth potential, investors might uncover promising candidates among these lesser-known stocks.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Financial Health Rating |

| Alarum Technologies (TASE:ALAR) | ₪2.404 | ₪166.7M | ★★★★★★ |

| Oil Refineries (TASE:ORL) | ₪1.058 | ₪3.29B | ★★★★★★ |

| Thob Al Aseel (SASE:4012) | SAR4.15 | SAR1.67B | ★★★★★★ |

| Yesil Yapi Endüstrisi (IBSE:YYAPI) | TRY1.43 | TRY1.22B | ★★★★★☆ |

| Tgi Infrastructures (TASE:TGI) | ₪2.367 | ₪175.97M | ★★★★★☆ |

| Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC) | TRY1.83 | TRY512.4M | ★★★★★★ |

| Dubai Investments PJSC (DFM:DIC) | AED2.28 | AED9.69B | ★★★★★☆ |

| Peninsula Group (TASE:PEN) | ₪2.399 | ₪533.56M | ★★★★☆☆ |

| Orad (TASE:ORAD) | ₪0.768 | ₪71.66M | ★★★★★★ |

| Gilat Telecom Global (TASE:GLTL) | ₪0.695 | ₪47.7M | ★★★★☆☆ |

Click here to see the full list of 90 stocks from our Middle Eastern Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Gulf Cement Company P.S.C (ADX:GCEM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gulf Cement Company P.S.C. is engaged in the production and marketing of various types of cement both within the United Arab Emirates and internationally, with a market capitalization of AED233.19 million.

Operations: The company generates revenue primarily from its manufacturing segment, which amounts to AED480.82 million.

Market Cap: AED233.19M

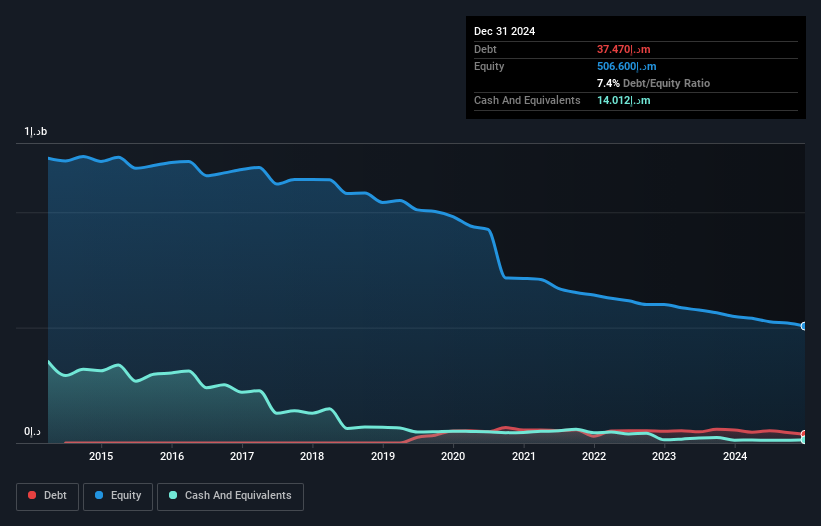

Gulf Cement Company P.S.C., with a market cap of AED233.19 million, reported annual sales of AED480.82 million and a reduced net loss of AED41.45 million for 2024, reflecting improved financial management despite ongoing unprofitability. The company benefits from a stable cash runway exceeding three years and positive free cash flow, although it faces challenges with short-term liabilities surpassing short-term assets (AED348.1M vs AED235.4M). Trading at 77% below estimated fair value suggests potential undervaluation, but increased debt levels over five years indicate caution is warranted in assessing its financial health amidst high volatility stability.

- Click here and access our complete financial health analysis report to understand the dynamics of Gulf Cement Company P.S.C.

- Gain insights into Gulf Cement Company P.S.C's historical outcomes by reviewing our past performance report.

HAYAH Insurance Company P.J.S.C (ADX:HAYAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HAYAH Insurance Company P.J.S.C. offers health and life insurance solutions both within the United Arab Emirates and internationally, with a market capitalization of AED316 million.

Operations: The company's revenue is primarily derived from its life insurance segment, generating AED76.35 million, and its medical insurance segment, contributing AED18.44 million.

Market Cap: AED316M

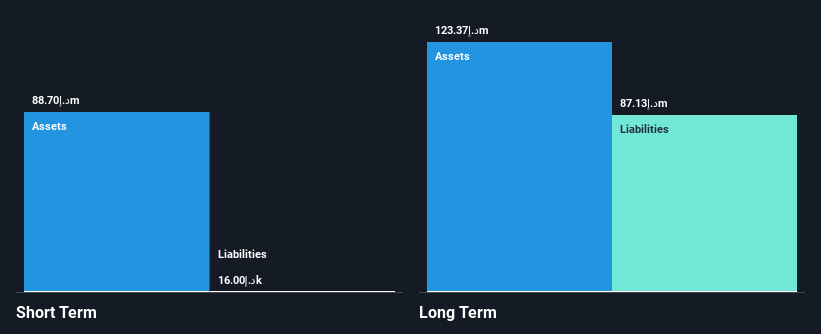

HAYAH Insurance Company P.J.S.C., with a market cap of AED316 million, has recently turned profitable, primarily driven by its life insurance segment. The company is financially stable with short-term assets of AED88.7 million exceeding both short and long-term liabilities and operates debt-free, eliminating concerns over interest coverage. Despite this financial health, its share price remains highly volatile compared to other UAE stocks. HAYAH's board and management team are experienced, which may contribute positively to strategic decisions moving forward. However, its return on equity remains low at 0.7%, suggesting room for improvement in generating shareholder value.

- Unlock comprehensive insights into our analysis of HAYAH Insurance Company P.J.S.C stock in this financial health report.

- Learn about HAYAH Insurance Company P.J.S.C's historical performance here.

United Arab Bank P.J.S.C (ADX:UAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Arab Bank P.J.S.C. offers commercial banking products and services to institutional and corporate clients in the United Arab Emirates, with a market capitalization of AED2.89 billion.

Operations: The company's revenue is derived from three main segments: Retail Banking (AED68.24 million), Wholesale Banking (AED391.12 million), and Treasury and Capital Markets (AED189.27 million).

Market Cap: AED2.89B

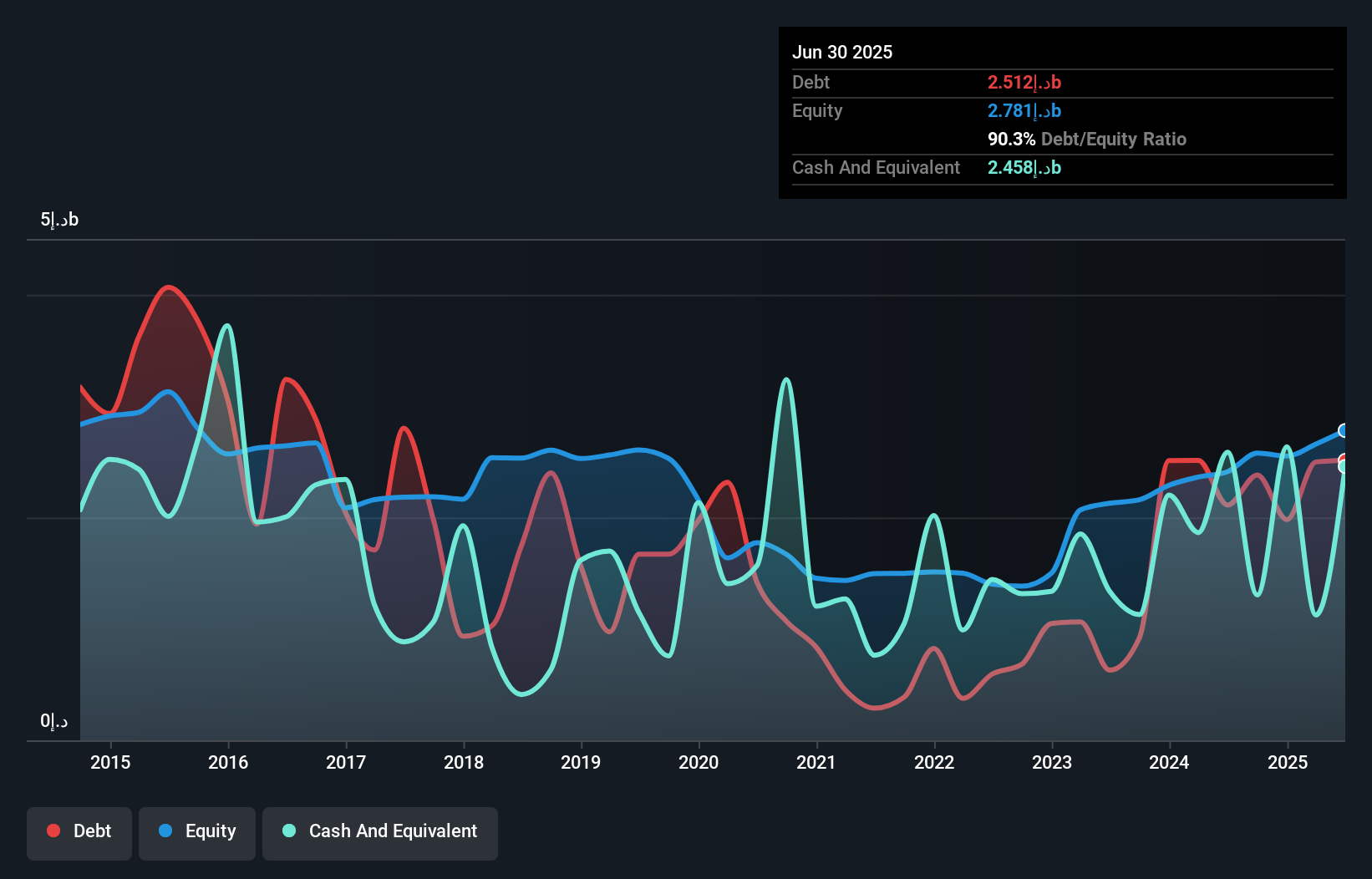

United Arab Bank P.J.S.C., with a market cap of AED2.89 billion, has shown robust financial performance with net interest income reaching AED466.56 million and net income at AED300.96 million for 2024. The bank's loans to deposits ratio is appropriate at 72%, and it maintains a low assets to equity ratio of 8.4x, indicating prudent asset management. However, the high level of bad loans at 3.9% poses some risk, despite a sufficient allowance for these loans (118%). While earnings growth outpaced the industry last year, future earnings are forecasted to decline by an average of 8.7% per year over the next three years.

- Click to explore a detailed breakdown of our findings in United Arab Bank P.J.S.C's financial health report.

- Learn about United Arab Bank P.J.S.C's future growth trajectory here.

Seize The Opportunity

- Unlock more gems! Our Middle Eastern Penny Stocks screener has unearthed 87 more companies for you to explore.Click here to unveil our expertly curated list of 90 Middle Eastern Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:GCEM

Gulf Cement Company P.S.C

Produces and markets various types of cement in the United Arab Emirates and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives