HAYAH Insurance Company P.J.S.C And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets continue to react positively to the Trump administration's initial policy directions, major indices like the S&P 500 have reached record highs, driven by optimism around potential trade deals and AI investments. In this climate of cautious optimism, investors might consider exploring opportunities beyond well-known large-cap stocks. Penny stocks, although an older term, still represent a relevant investment area for those interested in smaller or newer companies with solid financial foundations. This article highlights three penny stocks that show promise through strong balance sheets and potential for significant returns.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.46M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.09B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £465.11M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £791.31M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,718 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

HAYAH Insurance Company P.J.S.C (ADX:HAYAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HAYAH Insurance Company P.J.S.C. offers health and life insurance solutions in the United Arab Emirates and internationally, with a market cap of AED206 million.

Operations: The company's revenue is derived from its life insurance segment, generating AED76.35 million, and its medical insurance segment, contributing AED18.44 million.

Market Cap: AED206M

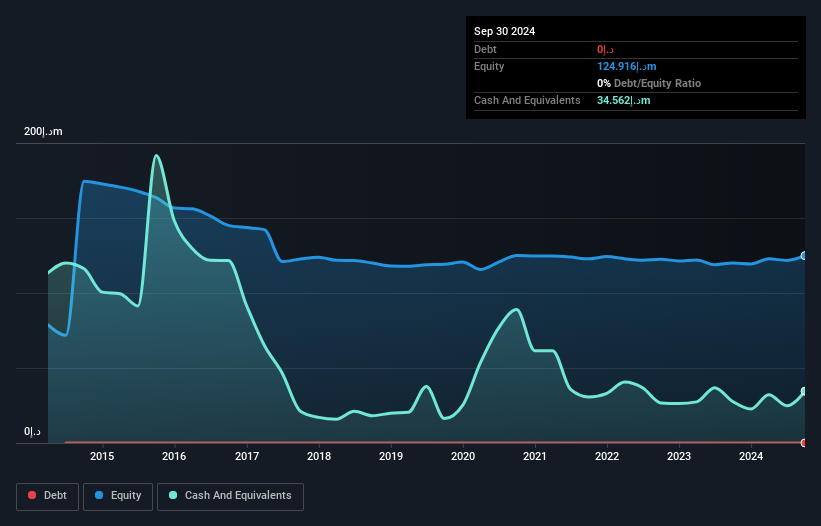

HAYAH Insurance Company P.J.S.C. has recently achieved profitability, reporting a net income of AED 3.92 million for the first nine months of 2024 compared to a net loss the previous year. The company operates without debt, which simplifies its financial structure and reduces risk exposure. Despite high volatility in share price over the past three months, HAYAH's short-term assets comfortably cover both short and long-term liabilities, indicating solid liquidity management. However, its Return on Equity remains low at 0.7%, suggesting room for improvement in generating returns from shareholders' equity. The experienced management team further supports its operational stability amidst these dynamics.

- Take a closer look at HAYAH Insurance Company P.J.S.C's potential here in our financial health report.

- Evaluate HAYAH Insurance Company P.J.S.C's historical performance by accessing our past performance report.

Xinyi Solar Holdings (SEHK:968)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xinyi Solar Holdings Limited is an investment holding company that produces and sells solar glass products across the People's Republic of China, Asia, North America, Europe, and internationally, with a market cap of HK$28.96 billion.

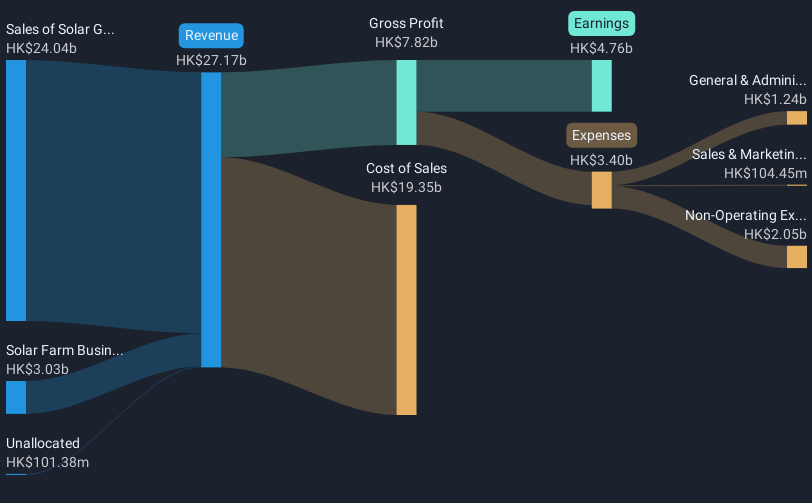

Operations: The company's revenue is primarily derived from the sales of solar glass, amounting to HK$24.04 billion, and its solar farm business, including EPC services, which contributes HK$3.03 billion.

Market Cap: HK$28.96B

Xinyi Solar Holdings Limited, with a market cap of HK$28.96 billion, primarily generates revenue from solar glass sales (HK$24.04 billion) and its solar farm business (HK$3.03 billion). Despite strong past earnings growth and stable weekly volatility, the company faces challenges due to a projected 70-80% decrease in net profit for 2024. This decline is driven by reduced demand and significant price drops in the solar glass market, alongside impairments and inventory write-downs. While its debt levels are well-managed with satisfactory coverage by operating cash flow, the dividend sustainability remains questionable due to insufficient free cash flows.

- Click here and access our complete financial health analysis report to understand the dynamics of Xinyi Solar Holdings.

- Learn about Xinyi Solar Holdings' future growth trajectory here.

Dongguan Rural Commercial Bank (SEHK:9889)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Rural Commercial Bank Co., Ltd. offers a range of banking products and services in China, with a market cap of HK$24.32 billion.

Operations: Dongguan Rural Commercial Bank Co., Ltd. has not reported specific revenue segments.

Market Cap: HK$24.32B

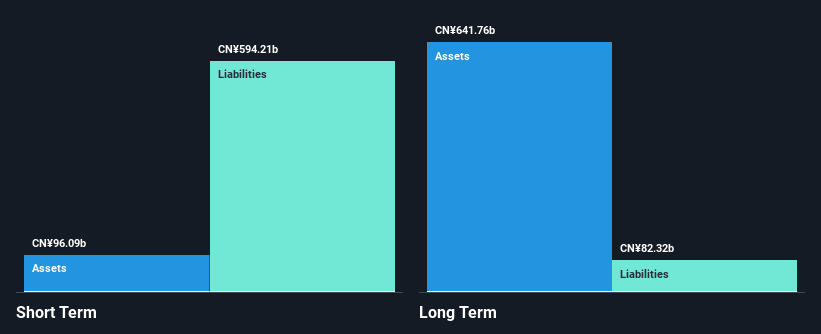

Dongguan Rural Commercial Bank, with a market cap of HK$24.32 billion, is trading significantly below its estimated fair value, indicating potential undervaluation. The bank's management and board are experienced, contributing to stable operations despite recent challenges. While net interest income and net income have declined compared to last year, the bank maintains a high-quality earnings profile with an appropriate allowance for bad loans at 309%. Its funding primarily relies on low-risk customer deposits, reflected in a suitable Loans to Deposits ratio of 70%. However, the return on equity remains low at 7.9%, suggesting room for improvement in profitability metrics.

- Unlock comprehensive insights into our analysis of Dongguan Rural Commercial Bank stock in this financial health report.

- Evaluate Dongguan Rural Commercial Bank's prospects by accessing our earnings growth report.

Seize The Opportunity

- Get an in-depth perspective on all 5,718 Penny Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9889

Dongguan Rural Commercial Bank

Provides various banking products and services in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives