- United Arab Emirates

- /

- Insurance

- /

- ADX:AWNIC

Middle Eastern Penny Stocks: 3 Picks With Market Caps Over US$8M

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently faced challenges, with Saudi Arabia's index experiencing its worst session in six weeks and other major Gulf markets also closing lower due to investor concerns over fiscal pressures. Despite these market fluctuations, penny stocks—often representing smaller or newer companies—remain an intriguing area for investors seeking growth opportunities at lower price points. Although the term "penny stocks" might seem outdated, they can still offer significant potential when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.13 | SAR1.65B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.93 | ₪205.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Terminal X Online (TASE:TRX) | ₪4.485 | ₪569.62M | ✅ 2 ⚠️ 1 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.90 | ₪2.8B | ✅ 1 ⚠️ 2 View Analysis > |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.719 | ₪12.49M | ✅ 1 ⚠️ 4 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.152 | ₪159.98M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.713 | AED433.68M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.88 | AED326.87M | ✅ 2 ⚠️ 5 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.00 | AED2B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.40 | AED10.2B | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 95 stocks from our Middle Eastern Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Al Seer Marine Supplies and Equipment Company PJSC (ADX:ASM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Seer Marine Supplies and Equipment Company PJSC operates in the management, maintenance, crewing, and operation of yachts in the United Arab Emirates with a market cap of AED3.43 billion.

Operations: Al Seer Marine generates revenue from three primary segments: IDT with AED64.18 million, Yachting contributing AED916.18 million, and Commercial Shipping at AED301.05 million.

Market Cap: AED3.43B

Al Seer Marine Supplies and Equipment Company PJSC, with a market cap of AED3.43 billion, operates in the yacht management sector in the UAE. Despite generating substantial revenue from its yachting segment (AED916.18 million), the company is currently unprofitable, with earnings declining by 51.1% annually over five years. Its net debt to equity ratio stands at a satisfactory 36.4%, though debt coverage by operating cash flow is weak at 6.3%. While short-term assets comfortably cover liabilities, share price volatility remains high compared to regional peers, reflecting investor caution amidst financial challenges and management uncertainties.

- Click here and access our complete financial health analysis report to understand the dynamics of Al Seer Marine Supplies and Equipment Company PJSC.

- Examine Al Seer Marine Supplies and Equipment Company PJSC's past performance report to understand how it has performed in prior years.

Al Wathba National Insurance Company PJSC (ADX:AWNIC)

Simply Wall St Financial Health Rating: ★★★★★☆

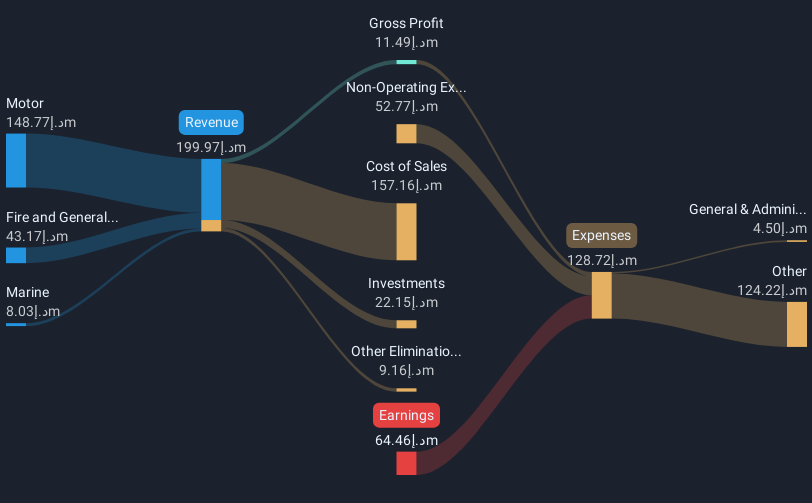

Overview: Al Wathba National Insurance Company PJSC operates in the general insurance and reinsurance sectors both within the United Arab Emirates and internationally, with a market cap of AED724.50 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: AED724.5M

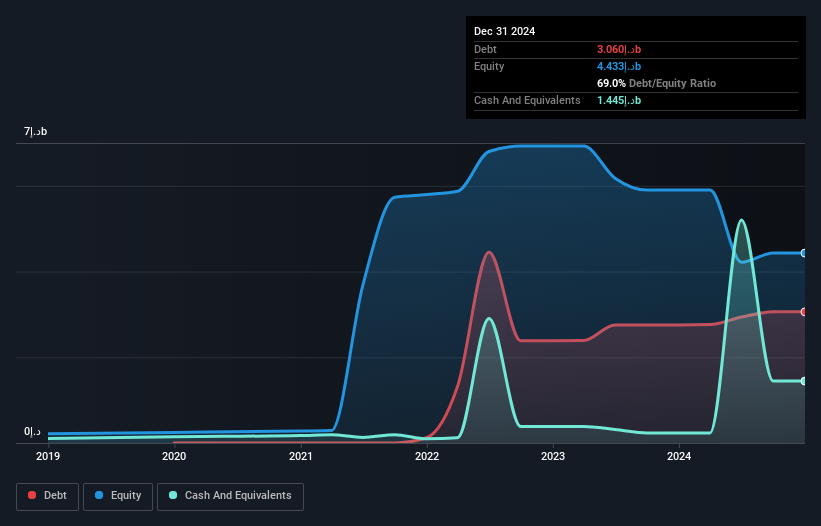

Al Wathba National Insurance Company PJSC, with a market cap of AED724.50 million, has experienced financial challenges despite some positive aspects. The company reported a net loss of AED16.05 million for Q1 2025, an improvement from the previous year's larger loss. While its short-term assets significantly exceed both short and long-term liabilities, indicating strong liquidity, the company's earnings have been negatively impacted by large one-off gains and negative growth over the past year. Despite reducing its debt-to-equity ratio substantially over five years and having more cash than total debt, share price volatility remains high amidst an unstable dividend track record.

- Click to explore a detailed breakdown of our findings in Al Wathba National Insurance Company PJSC's financial health report.

- Understand Al Wathba National Insurance Company PJSC's track record by examining our performance history report.

Allmed Solutions (TASE:ALMD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Allmed Solutions Ltd develops, manufactures, and markets minimally invasive products across various medical disciplines both in Israel and internationally, with a market cap of ₪28.54 million.

Operations: Allmed Solutions Ltd has not reported any specific revenue segments.

Market Cap: ₪28.54M

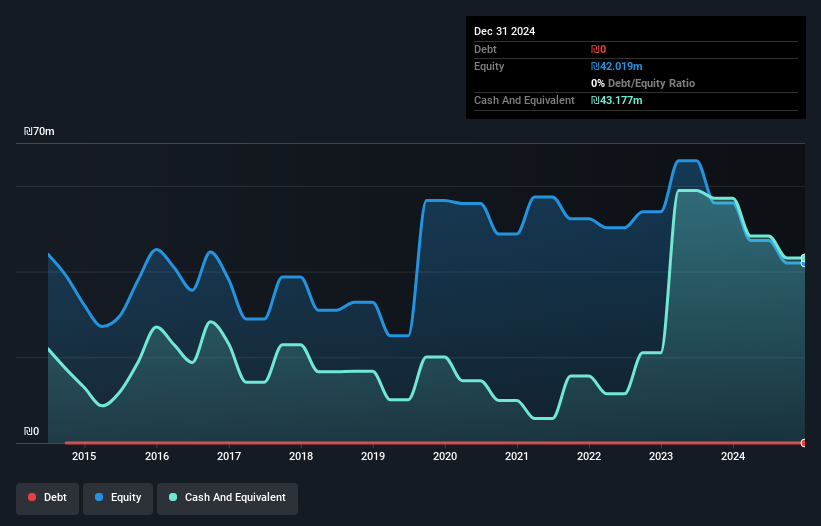

Allmed Solutions Ltd, with a market cap of ₪28.54 million, is currently pre-revenue and unprofitable. Despite this, the company exhibits strong financial health as its short-term assets of ₪43.8 million comfortably cover both its short-term liabilities of ₪2.5 million and long-term liabilities of ₪235,000. The firm has been debt-free for five years and maintains a cash runway exceeding three years based on current free cash flow levels. However, Allmed's share price remains highly volatile and earnings have declined significantly over the past five years, with recent results showing a net loss of ILS 8.75 million for 2024.

- Take a closer look at Allmed Solutions' potential here in our financial health report.

- Gain insights into Allmed Solutions' historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Investigate our full lineup of 95 Middle Eastern Penny Stocks right here.

- Ready For A Different Approach? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:AWNIC

Al Wathba National Insurance Company PJSC

Engages in general insurance and reinsurance business in the United Arab Emirates and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives