- United Arab Emirates

- /

- Oil and Gas

- /

- ADX:DANA

Growth Investors: Industry Analysts Just Upgraded Their Dana Gas PJSC (ADX:DANA) Revenue Forecasts By 96%

Dana Gas PJSC (ADX:DANA) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The analysts have sharply increased their revenue numbers, with a view that Dana Gas PJSC will make substantially more sales than they'd previously expected.

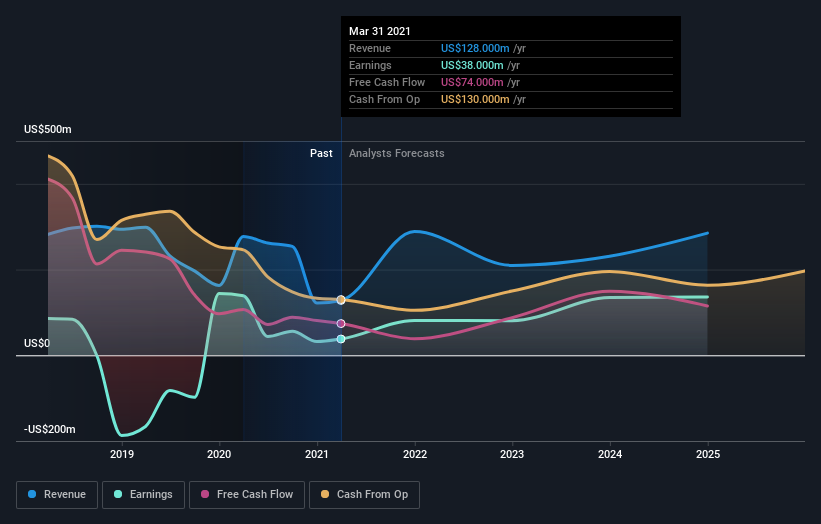

Following the upgrade, the latest consensus from Dana Gas PJSC's four analysts is for revenues of US$289m in 2021, which would reflect a substantial 126% improvement in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$147m in 2021. It looks like there's been a clear increase in optimism around Dana Gas PJSC, given the great increase in revenue forecasts.

View our latest analysis for Dana Gas PJSC

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Dana Gas PJSC's past performance and to peers in the same industry. For example, we noticed that Dana Gas PJSC's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 196% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 6.4% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 4.5% per year. So it looks like Dana Gas PJSC is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The most important thing to take away from this upgrade is that analysts lifted their revenue estimates for this year. Analysts also expect revenues to grow faster than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Dana Gas PJSC.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 2 potential risk with Dana Gas PJSC, including the risk of cutting its dividend. For more information, you can click through to our platform to learn more about this and the 1 other risk we've identified .

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ADX:DANA

Dana Gas PJSC

Engages in the exploration, production, ownership, transportation, processing, distribution, marketing, and sale of natural gas and petroleum related products in the United Arab Emirates, Iraq, and Egypt.

Flawless balance sheet, undervalued and pays a dividend.