- United Arab Emirates

- /

- Capital Markets

- /

- DFM:DFM

Does Dubai Financial Market P.J.S.C (DFM:DFM) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Dubai Financial Market P.J.S.C (DFM:DFM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Dubai Financial Market P.J.S.C with the means to add long-term value to shareholders.

Check out our latest analysis for Dubai Financial Market P.J.S.C

How Quickly Is Dubai Financial Market P.J.S.C Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Dubai Financial Market P.J.S.C has grown EPS by 34% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

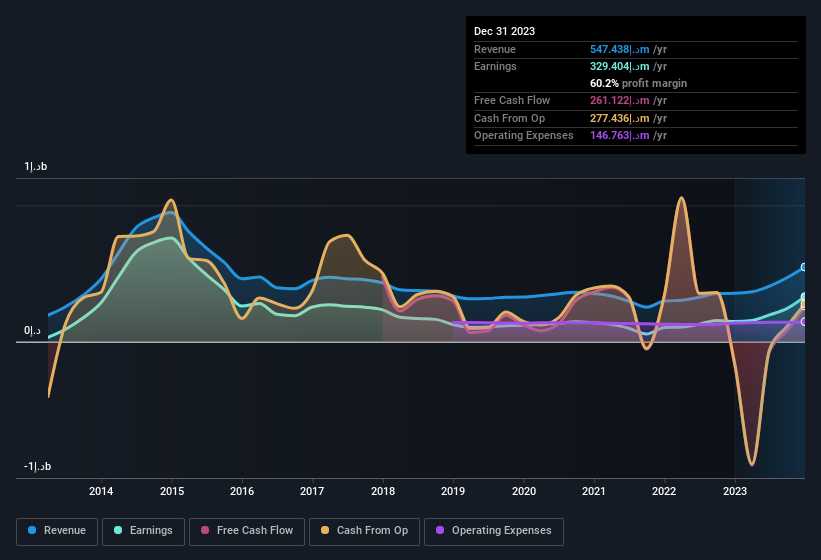

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Dubai Financial Market P.J.S.C's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The good news is that Dubai Financial Market P.J.S.C is growing revenues, and EBIT margins improved by 19.4 percentage points to 60%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Dubai Financial Market P.J.S.C.

Are Dubai Financial Market P.J.S.C Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations between د.إ7.3b and د.إ24b, like Dubai Financial Market P.J.S.C, the median CEO pay is around د.إ2.5m.

Dubai Financial Market P.J.S.C offered total compensation worth د.إ1.9m to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Dubai Financial Market P.J.S.C Worth Keeping An Eye On?

You can't deny that Dubai Financial Market P.J.S.C has grown its earnings per share at a very impressive rate. That's attractive. Strong EPS growth is a great look for the company and reasonable CEO compensation sweetens the deal for investors ass it alludes to management being conscious of frivolous spending. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. Now, you could try to make up your mind on Dubai Financial Market P.J.S.C by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in AE with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:DFM

Dubai Financial Market P.J.S.C

Provides investors and market participants with products and services for trading, clearing, settlement, and depository of securities.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives