- Hong Kong

- /

- Consumer Services

- /

- SEHK:1969

Undiscovered Gems Three Stocks to Watch in November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, small-cap stocks have felt the impact, with indices like the Russell 2000 showing notable fluctuations. Amidst this backdrop of economic shifts and policy changes, identifying promising investment opportunities requires a keen eye for companies that demonstrate resilience and potential in their respective sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Arab Insurance Group (B.S.C.) | NA | -59.46% | 20.33% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 12.19% | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Spright Agro | 0.24% | 85.62% | 88.80% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Al Ansari Financial Services PJSC (DFM:ALANSARI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Al Ansari Financial Services PJSC offers a variety of integrated financial services both in the United Arab Emirates and internationally, with a market capitalization of AED7.39 billion.

Operations: Al Ansari Financial Services PJSC generates revenue primarily from its Money Exchange and Remittances segment, totaling AED1.14 billion.

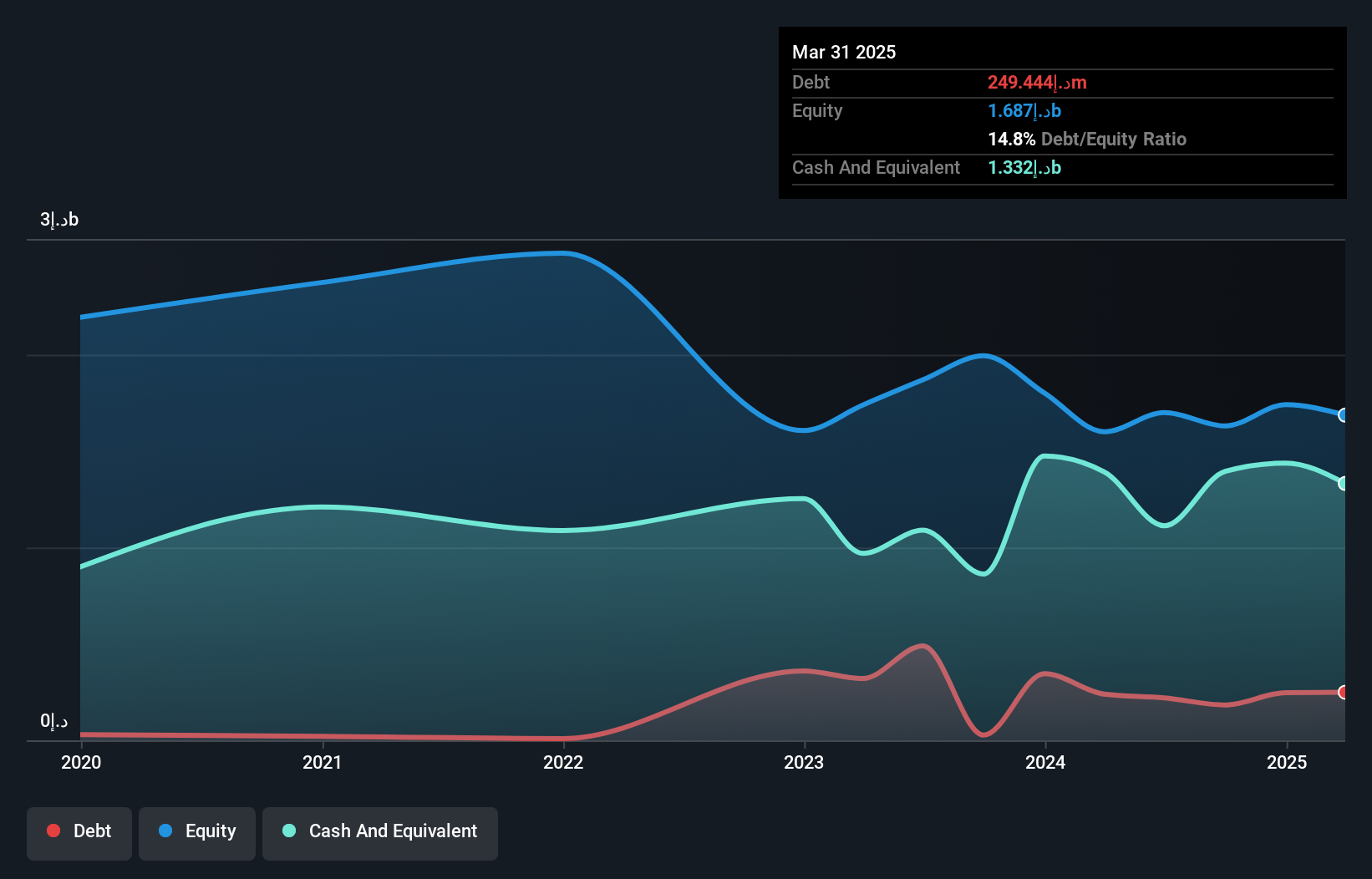

Al Ansari Financial Services PJSC, a relatively small player in the financial sector, seems to be navigating some challenges. Despite having more cash than total debt and positive free cash flow, recent earnings have dipped. The company reported third-quarter revenue of AED 297 million with net income at AED 103 million, both showing a decrease from last year. Earnings per share also fell to AED 0.0138 from AED 0.0166 previously. While profitability isn't an immediate concern due to high-quality past earnings and a promising forecasted growth rate of over 20% annually, the recent negative earnings growth of -24% raises questions about its short-term trajectory amidst industry-wide declines.

Al Masane Al Kobra Mining (SASE:1322)

Simply Wall St Value Rating: ★★★★★★

Overview: Al Masane Al Kobra Mining Company focuses on the production of non-ferrous metal ores and precious metals in Saudi Arabia, with a market capitalization of SAR6.19 billion.

Operations: Al Masane Al Kobra Mining Company generates revenue primarily from its Al Masane Mine and Mount Guyan Mine, with revenues of SAR353.54 million and SAR190.02 million, respectively.

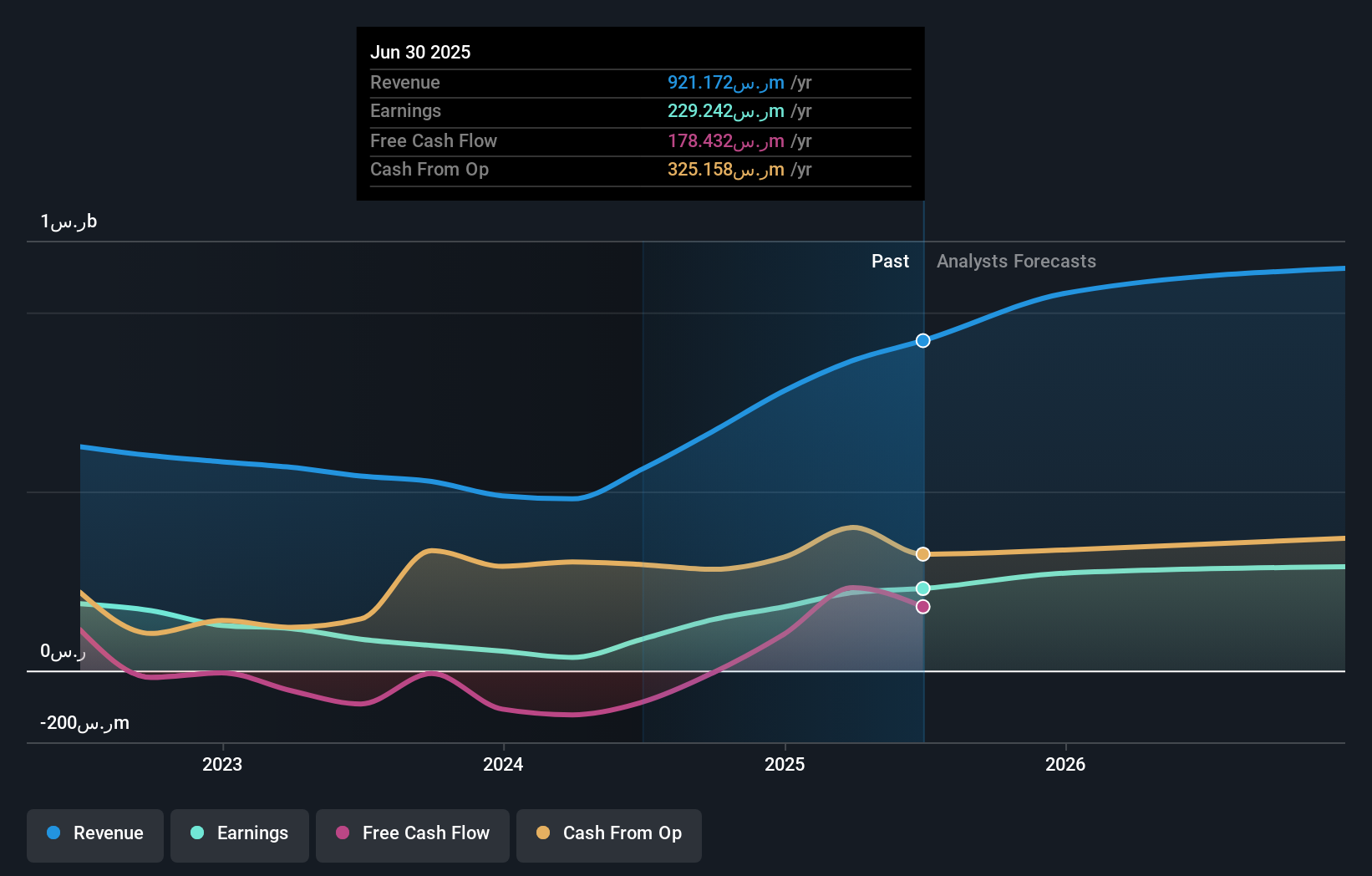

Al Masane Al Kobra Mining has been making strides with a notable sales jump to SAR 215.96 million in Q3 2024, up from SAR 110.18 million the previous year, while net income surged to SAR 59.75 million from SAR 5.18 million. The company boasts a strong interest coverage of 42.8x EBIT and a satisfactory net debt to equity ratio at just 2.3%, reflecting prudent financial management over five years as it reduced its debt level significantly from 62.8% to just over 4%. Despite not being free cash flow positive, earnings have grown annually by an impressive average of 18.5%.

- Click to explore a detailed breakdown of our findings in Al Masane Al Kobra Mining's health report.

Understand Al Masane Al Kobra Mining's track record by examining our Past report.

China Chunlai Education Group (SEHK:1969)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Chunlai Education Group Co., Ltd. operates private higher education institutions in the People’s Republic of China and has a market capitalization of HK$5.30 billion.

Operations: Chunlai Education generates its revenue primarily from operating private higher education institutions, amounting to CN¥1.56 billion. The company focuses on optimizing its cost structure to enhance profitability, with a notable emphasis on achieving an efficient net profit margin.

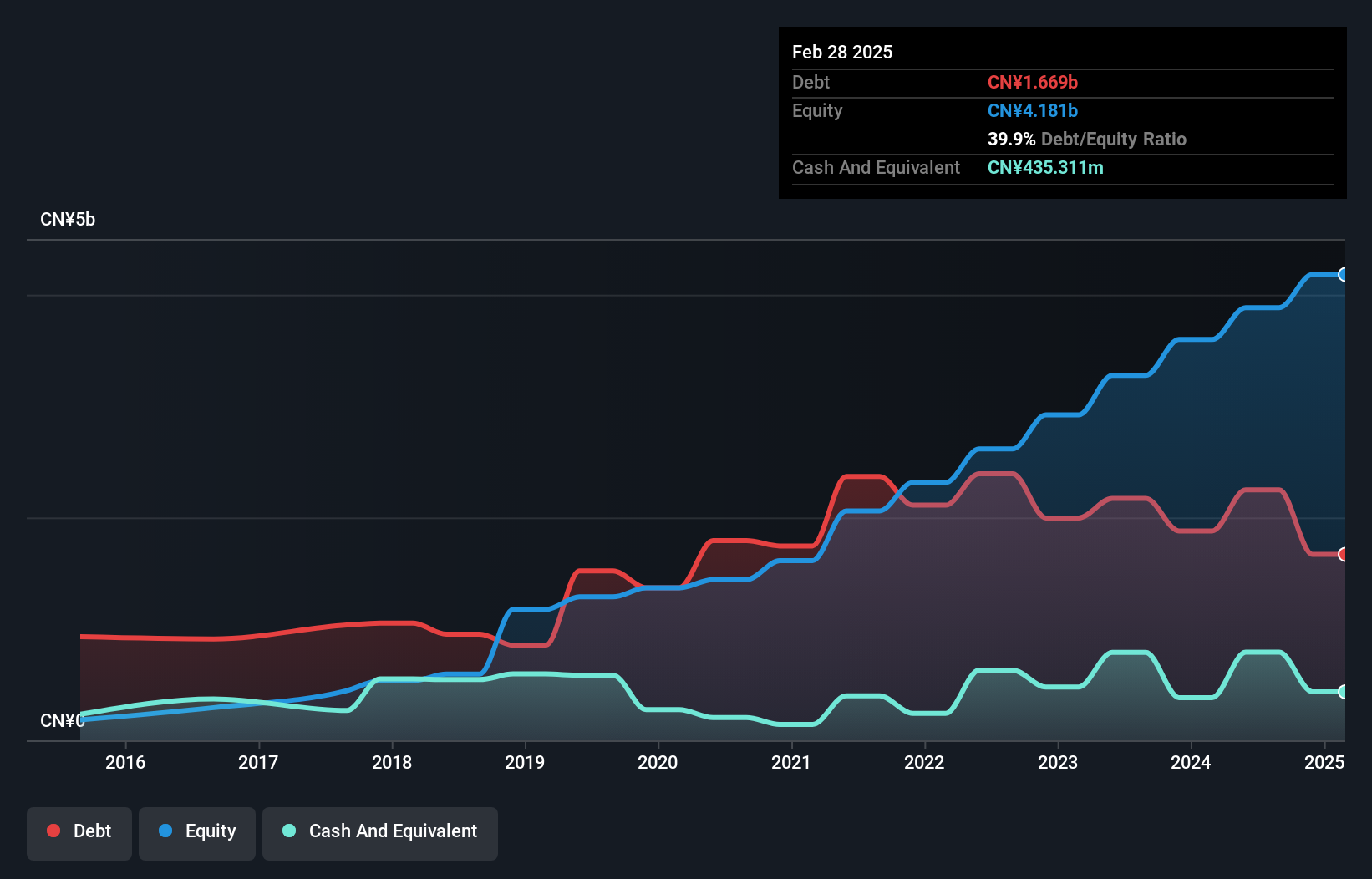

Chunlai Education, a relatively small player in the education sector, has shown promising financial resilience. The company reported a levered free cash flow of US$498.76 million as of February 2024, reflecting its ability to generate cash despite high capital expenditures of US$477.07 million during the same period. Over five years, Chunlai's debt-to-equity ratio decreased from 72.7% to 52.2%, indicating improved financial management and reduced leverage risk. With earnings growth at 16.6% over the past year surpassing industry averages, Chunlai seems poised for continued expansion while trading significantly below estimated fair value by about 75%.

- Take a closer look at China Chunlai Education Group's potential here in our health report.

Learn about China Chunlai Education Group's historical performance.

Turning Ideas Into Actions

- Dive into all 4653 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1969

China Chunlai Education Group

Provides private higher education services in the People’s Republic of China.

Solid track record with excellent balance sheet.