- Israel

- /

- Real Estate

- /

- TASE:AFRE

Taaleem Holdings PJSC And 2 Other Undiscovered Gems In The Middle East

Reviewed by Simply Wall St

The Middle East stock markets have recently experienced a rebound, particularly in the UAE, where energy and financial shares have driven a recovery following several days of declines. In this dynamic environment, identifying stocks with strong fundamentals and growth potential is key to navigating the market's fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Marmaris Altinyunus Turistik Tesisler | NA | 49.75% | -49.65% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Bulbuloglu Vinc Sanayi ve Ticaret Anonim Sirketi | 21.47% | 16.40% | 50.84% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 16.16% | 34.64% | 61.21% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 7.00% | 41.89% | 59.39% | ★★★★★☆ |

| Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi | 1.89% | -4.20% | 70.35% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 54.38% | 44.16% | 40.25% | ★★★★☆☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Taaleem Holdings PJSC is a company that focuses on providing and investing in education services within the United Arab Emirates, with a market capitalization of AED4.34 billion.

Operations: Taaleem Holdings generates revenue primarily from school operations, amounting to AED1.10 billion. The company's financial performance includes a notable net profit margin trend, which is a key indicator of profitability within its educational services sector.

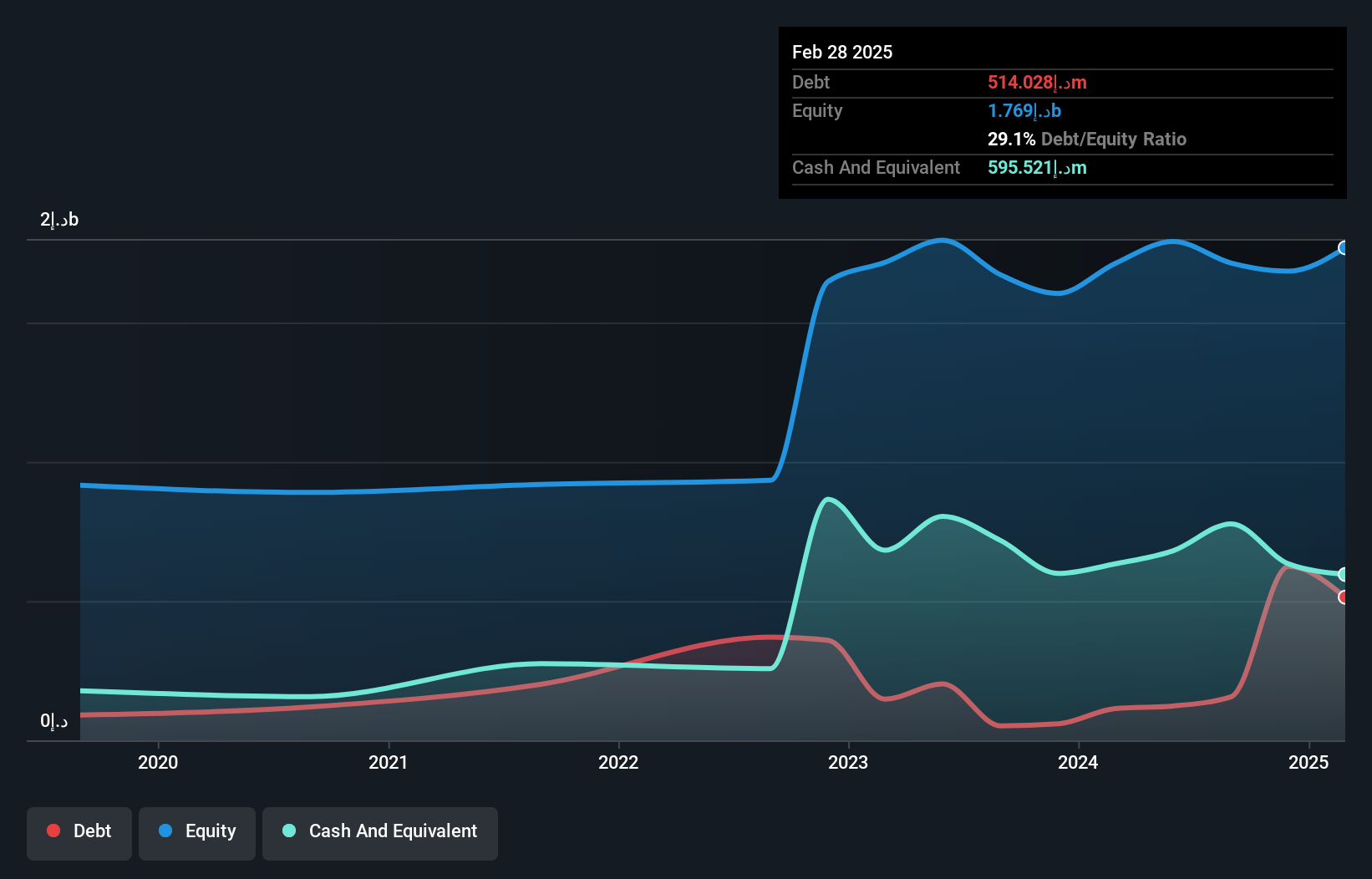

Taaleem Holdings PJSC, a promising player in the UAE's education sector, has demonstrated solid growth with earnings rising 8.6% over the past year, outpacing the industry average of 6.6%. Despite an increase in its debt-to-equity ratio from 25.2% to 30.3% over five years, Taaleem maintains more cash than total debt and covers interest payments well with EBIT at 15 times coverage. Recent results show sales of AED336 million for Q3 compared to AED282 million previously, though net income dipped slightly from AED86 million to AED82 million. Expansion plans could enhance revenue but may pressure margins due to higher costs.

Africa Israel Residences (TASE:AFRE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Africa Israel Residences Ltd focuses on the development and sale of residential units under the Savyonim brand in Israel, with a market cap of ₪3.10 billion.

Operations: Africa Israel Residences Ltd generates revenue primarily from the promotion of projects, which amounts to ₪1.15 billion, and initiation of rental housing at ₪22.29 million. The company's cost structure and profitability metrics can be further analyzed by examining its net profit margin trends over time.

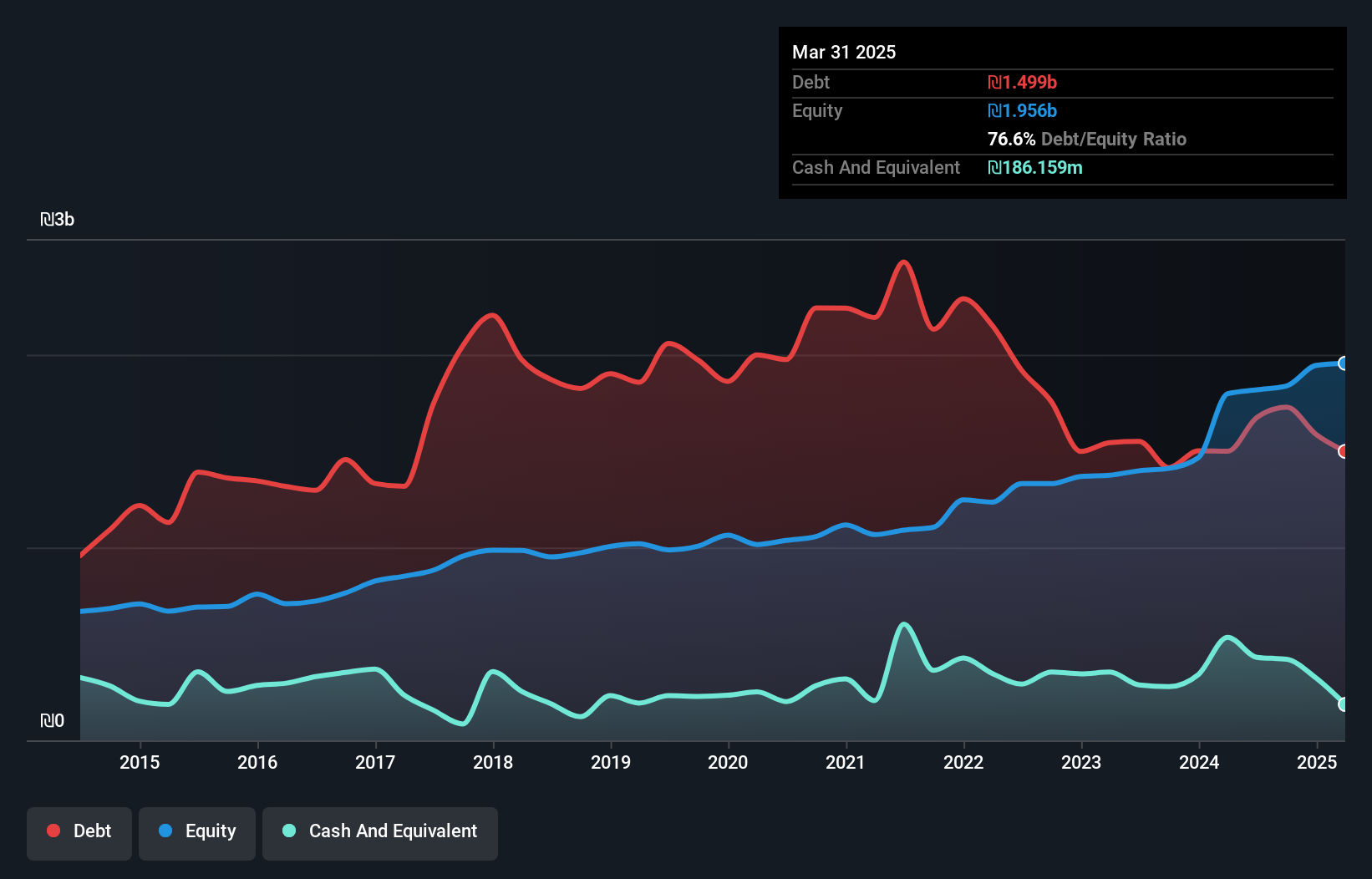

AFRE, a real estate player in the Middle East, showcases a mixed financial landscape. Over the past five years, its debt to equity ratio impressively decreased from 196.9% to 76.6%, reflecting better leverage management. Earnings have grown consistently at an annual rate of 11.7%, indicating solid performance despite recent volatility in share price. However, with a net debt to equity ratio of 67.1%, concerns about high leverage persist as operating cash flow doesn't sufficiently cover this debt level. A notable one-off gain of ₪80M skewed recent results, yet its price-to-earnings ratio remains attractive at 13.5x compared to the IL market's average of 14.4x.

Partner Communications (TASE:PTNR)

Simply Wall St Value Rating: ★★★★★★

Overview: Partner Communications Company Ltd. is an Israeli telecommunications provider offering a range of communication services, with a market capitalization of ₪5.87 billion.

Operations: Partner Communications generates revenue primarily from its Cellular Segment, contributing ₪1.99 billion, and its Stationary Segment, adding ₪1.37 billion.

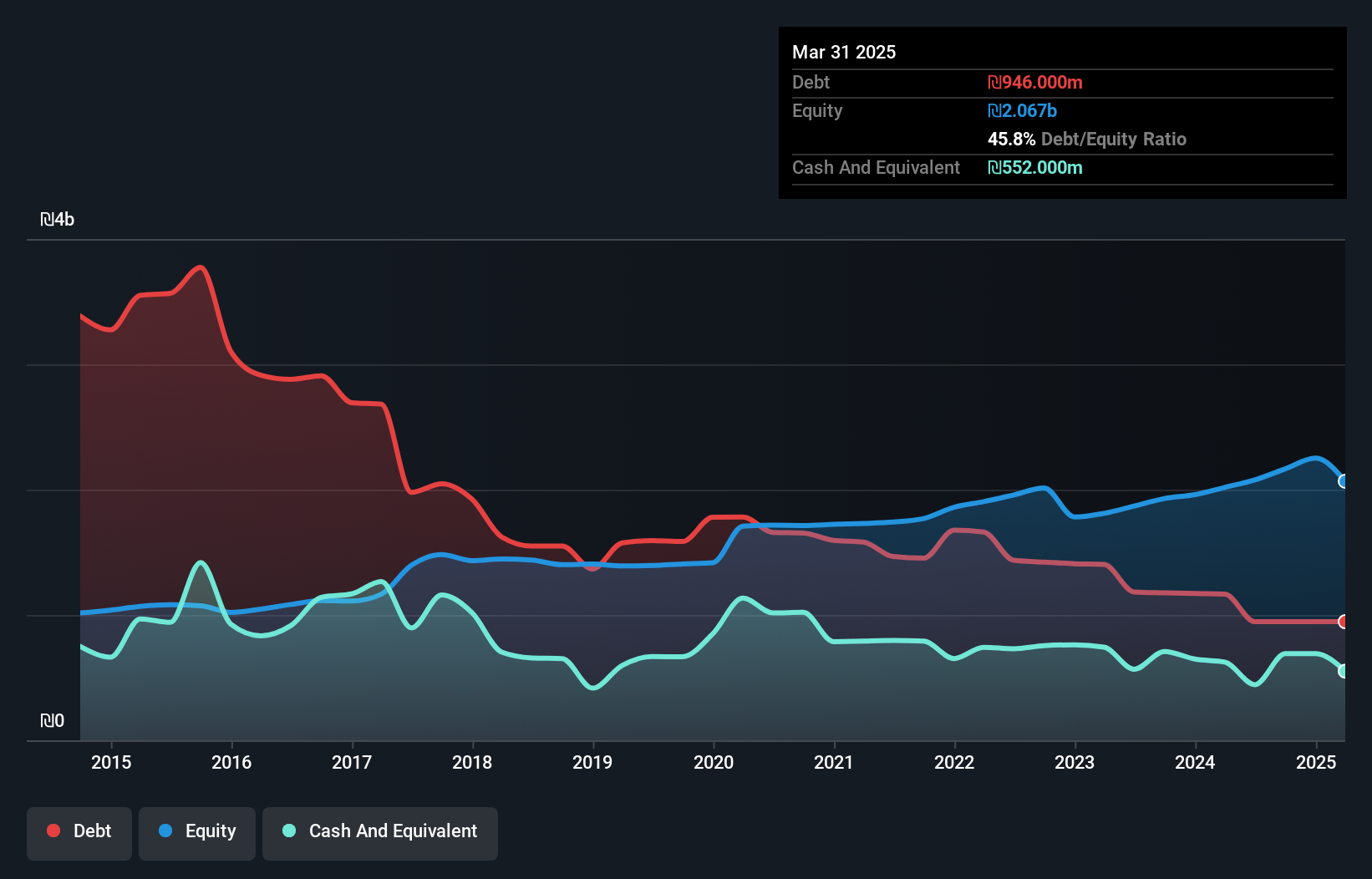

Partner Communications, a notable player in the telecom sector, has shown impressive financial health with a debt to equity ratio dropping from 96.7% to 36.9% over five years. The company reported a net income of ILS 72 million for Q2 2025, up from ILS 57 million the previous year, while sales slightly dipped to ILS 802 million from ILS 823 million. Trading at around two-thirds below its estimated fair value, it boasts high-quality earnings and strong interest coverage at 26.5x EBIT over interest payments. With earnings growth outpacing industry averages by leaps and bounds, Partner seems well-positioned for future opportunities in the wireless telecom market.

- Take a closer look at Partner Communications' potential here in our health report.

Understand Partner Communications' track record by examining our Past report.

Key Takeaways

- Unlock our comprehensive list of 205 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:AFRE

Africa Israel Residences

Engages in the development and sale of residential units under the Savyonim brand in Israel.

Moderate risk with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives