- Israel

- /

- Medical Equipment

- /

- TASE:EMTC-M

Middle Eastern Penny Stocks Under The Radar With Market Caps Below US$1B

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently faced significant challenges, with Gulf bourses experiencing declines amid global recession worries sparked by U.S. tariffs. Despite these broader market concerns, certain investment opportunities still exist within the region's smaller companies. Penny stocks, often representing smaller or newer firms, can offer a blend of affordability and growth potential when supported by robust financials. In this article, we explore three promising Middle Eastern penny stocks that may appeal to investors seeking under-the-radar opportunities with strong financial foundations.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.85 | SAR1.65B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR3.97 | SAR528M | ✅ 2 ⚠️ 3 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.261 | ₪156.78M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.899 | ₪2.79B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.202 | ₪163.7M | ✅ 1 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.522 | AED2.23B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.767 | AED465.92M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Ansari Financial Services PJSC (DFM:ALANSARI) | AED0.967 | AED7.24B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.36 | AED10.08B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 98 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

Dubai Islamic Insurance & Reinsurance (Aman) (P.J.S.C) (DFM:AMAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dubai Islamic Insurance & Reinsurance (Aman) (P.J.S.C) operates in the insurance sector, providing Sharia-compliant insurance and reinsurance services, with a market cap of AED 80.59 million.

Operations: The company does not have any revenue segments to report in its financial disclosures.

Market Cap: AED80.59M

Dubai Islamic Insurance & Reinsurance (Aman) (P.J.S.C) operates with a market cap of AED 80.59 million but remains pre-revenue, generating less than US$1 million. Despite being unprofitable with a negative return on equity of -117.19%, the company holds more cash than its total debt and has sufficient short-term assets to cover both short- and long-term liabilities. The board is experienced, averaging 5.4 years in tenure, although the stock's high volatility poses risks for investors seeking stability in penny stocks within the Middle East market. Upcoming financial disclosures could provide further insights into its strategic direction.

- Take a closer look at Dubai Islamic Insurance & Reinsurance (Aman) (P.J.S.C)'s potential here in our financial health report.

- Review our historical performance report to gain insights into Dubai Islamic Insurance & Reinsurance (Aman) (P.J.S.C)'s track record.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Taaleem Holdings PJSC operates in the education services sector in the United Arab Emirates and has a market capitalization of AED3.63 billion.

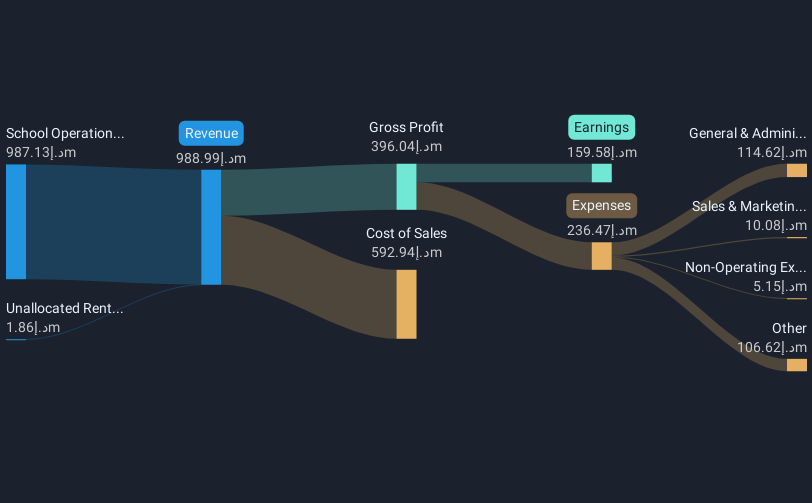

Operations: The company's revenue is primarily derived from its school operations, totaling AED1.05 billion.

Market Cap: AED3.63B

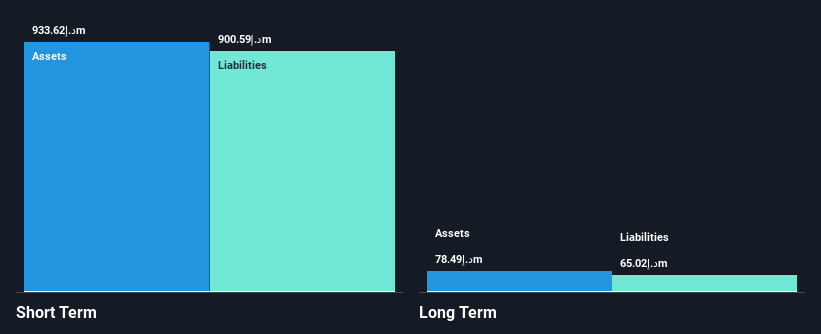

Taaleem Holdings PJSC, with a market cap of AED3.63 billion, shows strong financial fundamentals for a penny stock in the education sector. The company's revenue from school operations is AED1.05 billion, and earnings have grown 22% annually over five years, though recent growth slowed to 16.9%. Its debt is well-managed with operating cash flow covering 59.3% of it and interest payments covered 49.6 times by EBIT. Despite short-term assets exceeding liabilities, long-term liabilities remain uncovered by short-term assets (AED653 million vs AED910 million). Recent earnings reports indicate stable net income and consistent shareholder returns without dilution.

- Click to explore a detailed breakdown of our findings in Taaleem Holdings PJSC's financial health report.

- Assess Taaleem Holdings PJSC's future earnings estimates with our detailed growth reports.

Elbit Medical Technologies (TASE:EMTC-M)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elbit Medical Technologies Ltd is an investment holding company involved in the research, development, production, and marketing of therapeutic medical systems globally, with a market cap of ₪16.60 million.

Operations: No specific revenue segments are reported for Elbit Medical Technologies Ltd.

Market Cap: ₪16.6M

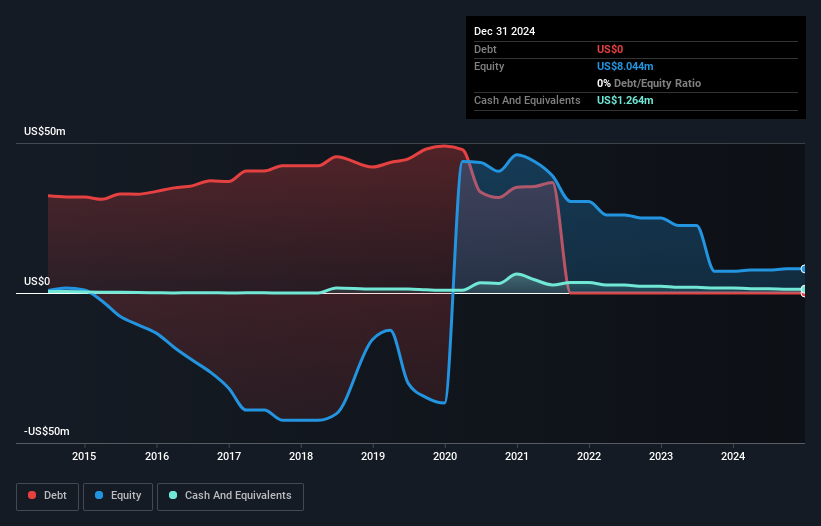

Elbit Medical Technologies Ltd, with a market cap of ₪16.60 million, has recently turned profitable, reporting US$1.33 million in revenue for 2024 compared to US$0.348 million the previous year and achieving a net income of US$0.827 million from a prior loss of US$17.79 million. The company is debt-free and its short-term assets significantly exceed liabilities, though it lacks meaningful revenue streams given its industry context. Despite high volatility and low return on equity at 10.3%, its price-to-earnings ratio of 5.4x suggests potential undervaluation relative to the broader IL market average of 13.4x.

- Get an in-depth perspective on Elbit Medical Technologies' performance by reading our balance sheet health report here.

- Assess Elbit Medical Technologies' previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Take a closer look at our Middle Eastern Penny Stocks list of 98 companies by clicking here.

- Ready To Venture Into Other Investment Styles? Explore 21 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elbit Medical Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:EMTC-M

Elbit Medical Technologies

An investment holding company, engages in the research, development, production, and marketing of therapeutic medical systems in the United States, Europe, and internationally.

Flawless balance sheet slight.

Market Insights

Community Narratives