- United Arab Emirates

- /

- Consumer Services

- /

- DFM:TAALEEM

Middle Eastern Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

Most Gulf markets have recently faced downward pressure due to escalating trade war fears, impacting major indices and investor sentiment. Despite these challenges, penny stocks—often representing smaller or emerging companies—remain an intriguing area for investors seeking unique opportunities. While the term "penny stocks" may seem outdated, these investments can still offer significant potential when backed by strong financials and strategic positioning.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Financial Health Rating |

| Alarum Technologies (TASE:ALAR) | ₪2.498 | ₪173.21M | ★★★★★★ |

| Oil Refineries (TASE:ORL) | ₪1.016 | ₪3.16B | ★★★★★★ |

| Thob Al Aseel (SASE:4012) | SAR3.98 | SAR1.59B | ★★★★★★ |

| Tgi Infrastructures (TASE:TGI) | ₪2.21 | ₪164.3M | ★★★★★☆ |

| Yesil Yapi Endüstrisi (IBSE:YYAPI) | TRY1.48 | TRY1.26B | ★★★★★☆ |

| Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC) | TRY1.74 | TRY487.2M | ★★★★★★ |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.656 | ₪17.57M | ★★★★★★ |

| Dubai Investments PJSC (DFM:DIC) | AED2.25 | AED9.61B | ★★★★★☆ |

| Peninsula Group (TASE:PEN) | ₪2.465 | ₪548.24M | ★★★★☆☆ |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.628 | AED381.98M | ★★★★★★ |

Click here to see the full list of 92 stocks from our Middle Eastern Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Apex Investment PSC (ADX:APEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Apex Investment PSC operates in the manufacturing, distribution, and sale of clinkers and cement products both in the United Arab Emirates and internationally, with a market cap of AED15.74 billion.

Operations: The company's revenue segments include AED595.66 million from catering, AED38.01 million from contracting, AED0.05 million from investments, AED235.34 million from manufacturing, and AED106.16 million from facility management services.

Market Cap: AED15.74B

Apex Investment PSC, with a market cap of AED15.74 billion, recently reported significant financial improvements, achieving profitability with net income of AED75.64 million for 2024 compared to a loss the previous year. The company’s revenue reached AED852.85 million, driven by diverse segments such as manufacturing and facility management services. Apex's short-term assets significantly exceed both its long-term and short-term liabilities, reflecting strong liquidity without any debt burden. Despite experiencing a large one-off loss impacting past earnings quality and having low return on equity at 3.8%, Apex has shown resilience by stabilizing its weekly volatility at 5%.

- Dive into the specifics of Apex Investment PSC here with our thorough balance sheet health report.

- Gain insights into Apex Investment PSC's past trends and performance with our report on the company's historical track record.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Taaleem Holdings PJSC operates in the education sector in the United Arab Emirates and has a market capitalization of AED3.83 billion.

Operations: The company's revenue is primarily derived from its school operations, totaling AED987.13 million.

Market Cap: AED3.83B

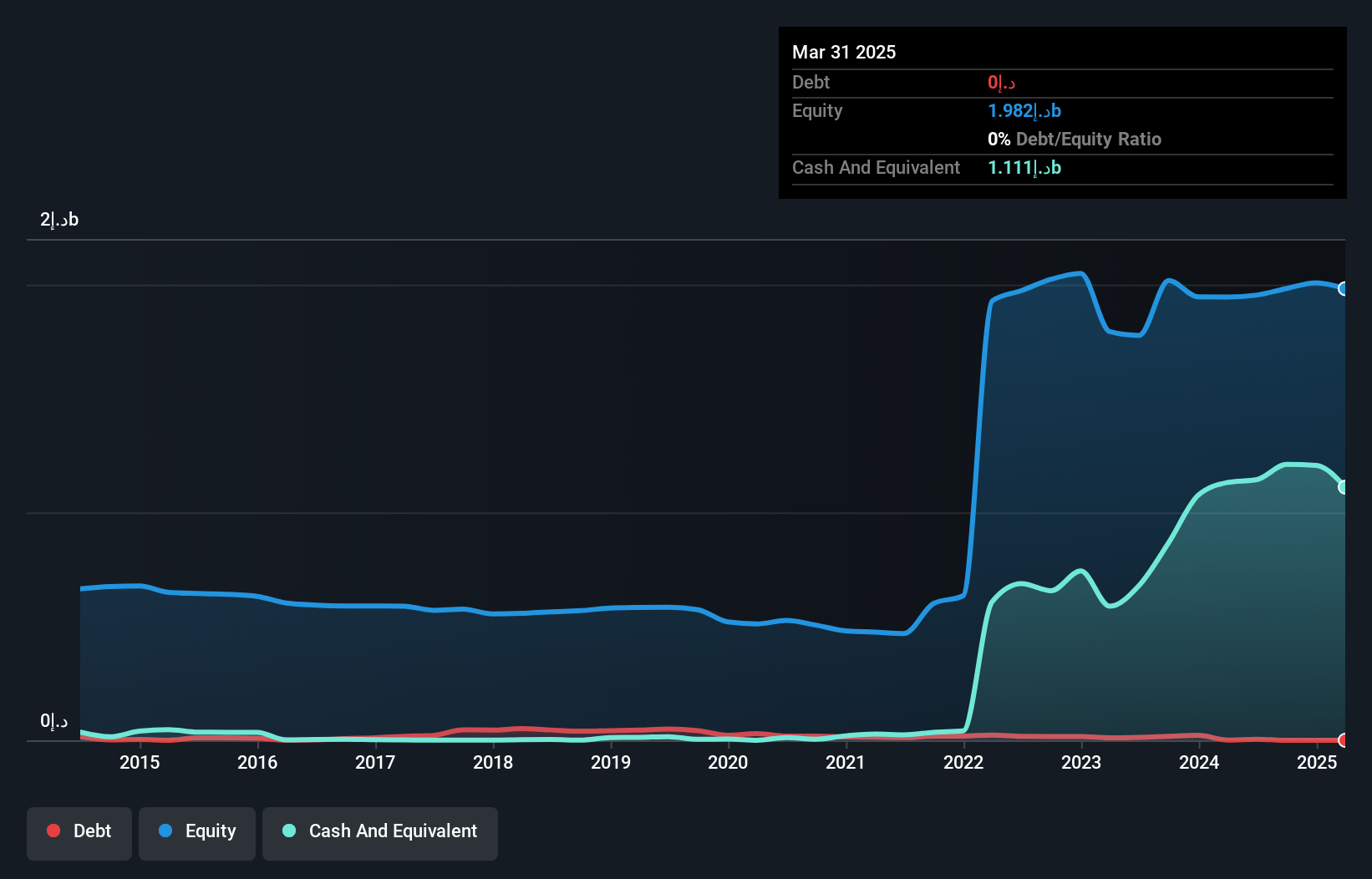

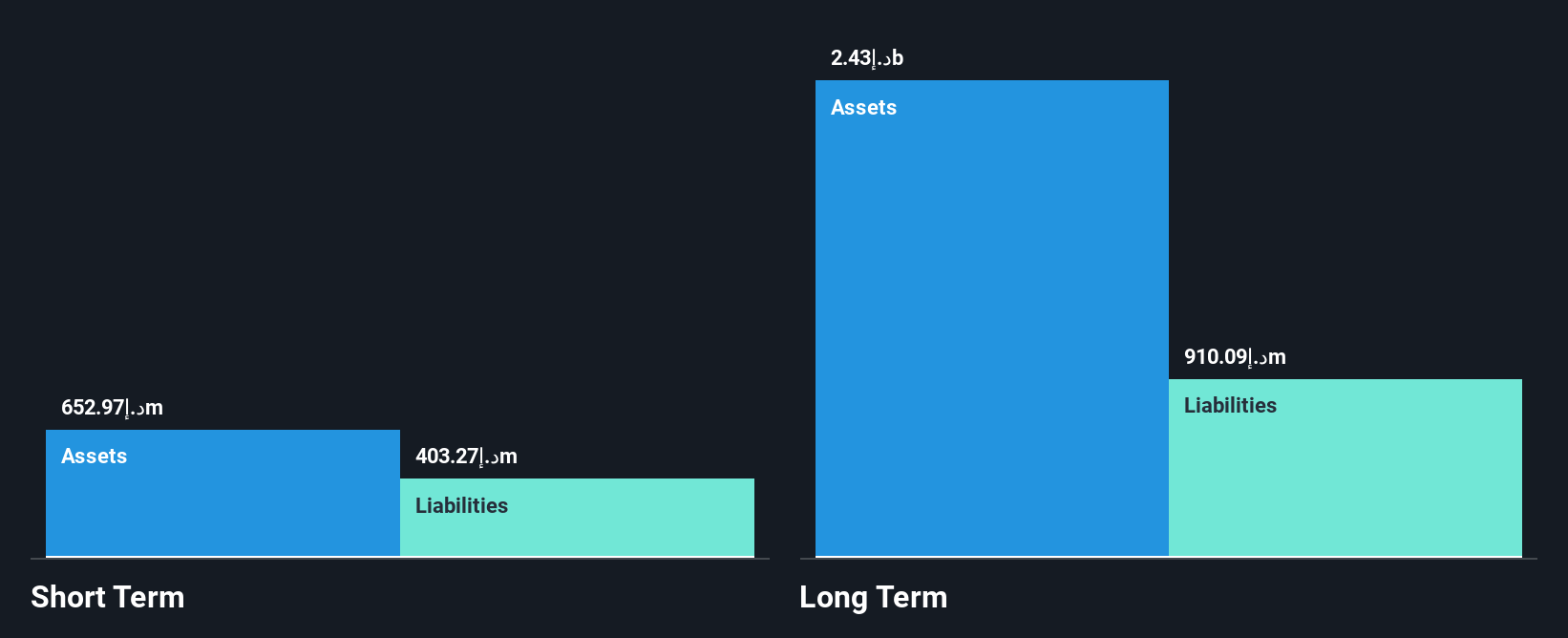

Taaleem Holdings PJSC, with a market cap of AED3.83 billion, demonstrates strong financial health in the education sector. Its short-term assets of AED733.9 million exceed short-term liabilities, while earnings have grown significantly by 41.1% over the past year, surpassing industry averages. The company maintains more cash than total debt and covers interest payments comfortably. However, its long-term liabilities exceed short-term assets and return on equity remains low at 9.5%. Despite an increased debt-to-equity ratio over five years, Taaleem's seasoned management team contributes to steady operations and stable weekly volatility at 3%.

- Click to explore a detailed breakdown of our findings in Taaleem Holdings PJSC's financial health report.

- Examine Taaleem Holdings PJSC's earnings growth report to understand how analysts expect it to perform.

Fitaihi Holding Group (SASE:4180)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fitaihi Holding Group operates in the gold, jewelry, and luxury products sector mainly in Saudi Arabia, with a market capitalization of SAR1.13 billion.

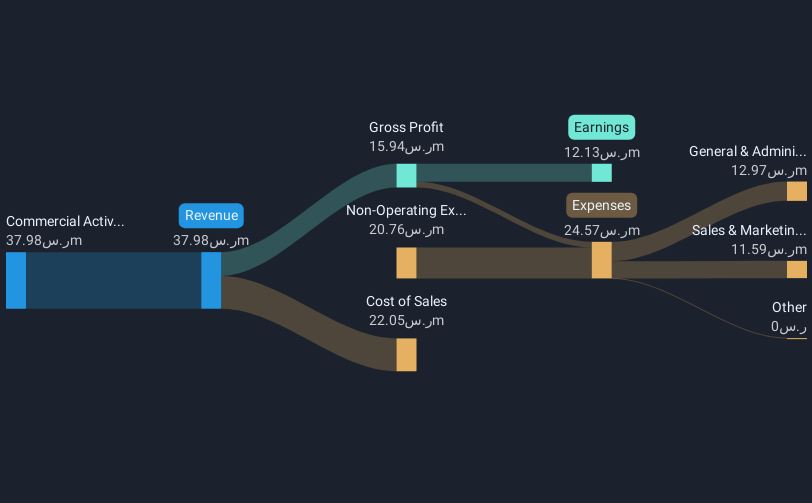

Operations: The company generates revenue from its commercial activity, amounting to SAR38.00 million.

Market Cap: SAR1.13B

Fitaihi Holding Group, with a market cap of SAR1.13 billion, operates debt-free in the gold and luxury products sector. Its financial stability is underscored by short-term assets of SAR109 million exceeding both its long-term liabilities (SAR3.3 million) and short-term liabilities (SAR16.9 million). The company became profitable this year, although earnings have declined by 20.4% annually over the past five years, and its return on equity remains low at 2.6%. Despite these challenges, Fitaihi's board is experienced with an average tenure of 4.4 years, supporting stable operations amidst moderate weekly volatility of 4%.

- Unlock comprehensive insights into our analysis of Fitaihi Holding Group stock in this financial health report.

- Understand Fitaihi Holding Group's track record by examining our performance history report.

Key Takeaways

- Access the full spectrum of 92 Middle Eastern Penny Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taaleem Holdings PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:TAALEEM

Taaleem Holdings PJSC

Provides and invests in education services in the United Arab Emirates.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives