As global markets navigate a period of mixed performance, with most major indexes declining while the Nasdaq Composite reaches new heights, investors are keenly observing economic indicators and central bank actions that hint at potential interest rate adjustments. In this environment of uncertainty and evolving monetary policies, dividend stocks can offer a reliable income stream and stability to portfolios. Selecting dividend stocks involves evaluating companies with strong fundamentals and consistent payout histories, which can provide resilience amid market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.12% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.12% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

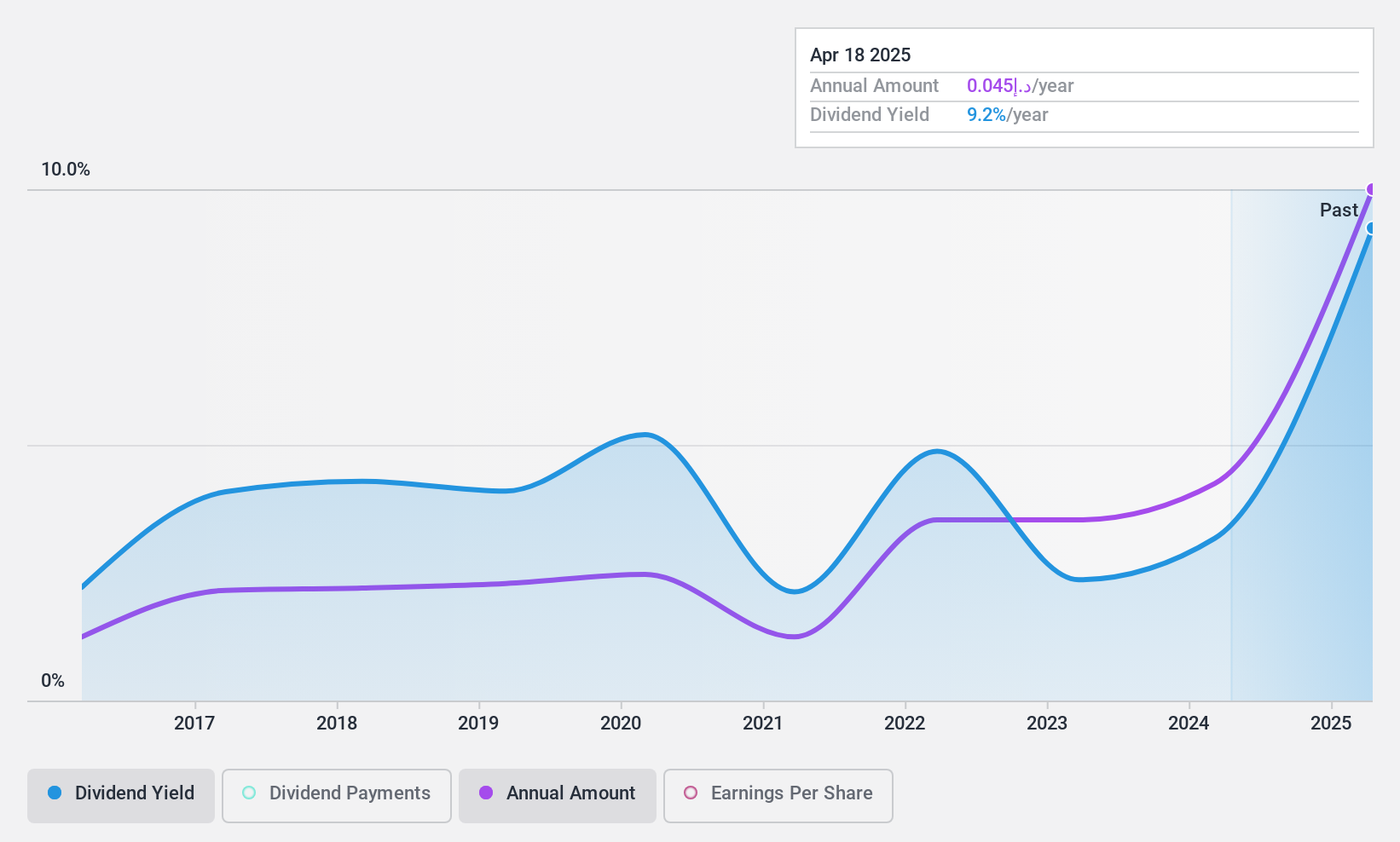

Abu Dhabi National Hotels Company PJSC (ADX:ADNH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Abu Dhabi National Hotels Company PJSC owns and manages hotels in the United Arab Emirates, with a market cap of AED 7.16 billion.

Operations: Abu Dhabi National Hotels Company PJSC generates revenue from its Hotels segment with AED 1.39 billion and Transport Services contributing AED 302.40 million.

Dividend Yield: 3.4%

Abu Dhabi National Hotels Company PJSC offers a dividend yield of 3.36%, lower than the top 25% of payers in the AE market. The dividends are well-covered by earnings with an 18.2% payout ratio and cash flows at a 47.7% payout ratio, suggesting sustainability despite past volatility. Recent financial results show significant revenue growth but declining net income for Q3, highlighting potential challenges in maintaining consistent dividend reliability amid fluctuating earnings performance.

- Navigate through the intricacies of Abu Dhabi National Hotels Company PJSC with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Abu Dhabi National Hotels Company PJSC's share price might be too pessimistic.

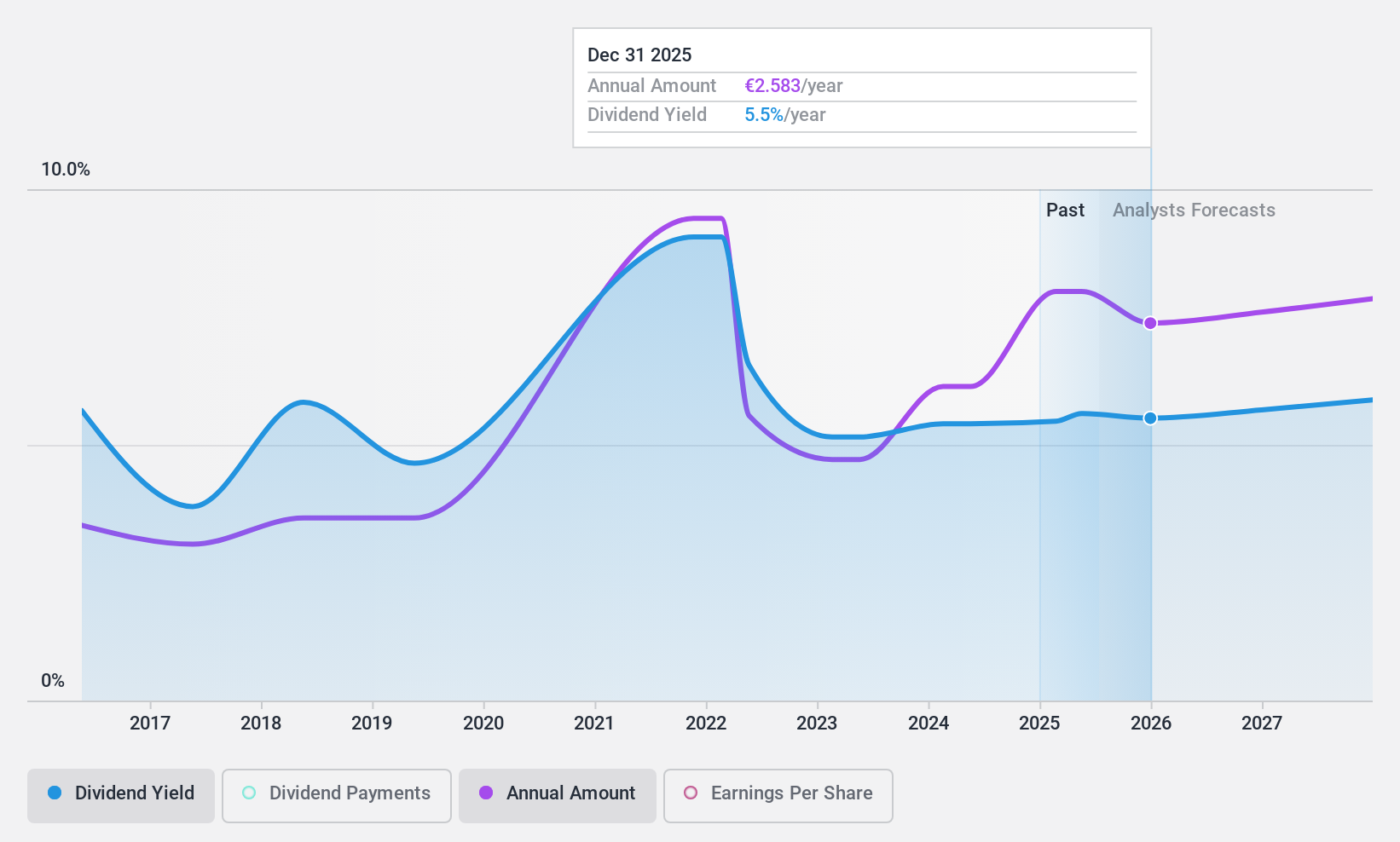

Banca Generali (BIT:BGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banca Generali S.p.A. is an Italian company that distributes financial products and services to affluent and private customers through financial advisors, with a market cap of €5.14 billion.

Operations: Banca Generali S.p.A. generates its revenue by offering a range of financial products and services tailored for affluent and private clients through its network of financial advisors in Italy.

Dividend Yield: 4.7%

Banca Generali's dividend yield of 4.69% is below the top tier in Italy, with a current payout ratio of 59.8%, indicating dividends are covered by earnings. However, its dividend history has been volatile over the past decade, raising concerns about reliability despite recent profit growth. Earnings are expected to decline by 4.4% annually over the next three years, potentially impacting future dividend sustainability despite a forecasted payout coverage of 79.4%.

- Dive into the specifics of Banca Generali here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Banca Generali is trading beyond its estimated value.

What's Cooking Group/SA (ENXTBR:WHATS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: What's Cooking Group NV/SA, along with its subsidiaries, is engaged in the production and sale of meat products and ready meals, with a market capitalization of €189.33 million.

Operations: What's Cooking Group NV/SA generates revenue from its two main segments, with €463.60 million coming from Savoury products and €384.84 million from Ready Meals.

Dividend Yield: 4%

What's Cooking Group/SA offers a reliable dividend yield of 4.04%, though it falls short of the top quartile in Belgium. The company's dividends are well-supported by both earnings and cash flows, with payout ratios of 51.6% and 15.6%, respectively, indicating sustainability. Over the past decade, dividends have shown stability and growth without volatility. Despite recent share price volatility, the stock trades at a favorable price-to-earnings ratio of 12.8x compared to the Belgian market average.

- Get an in-depth perspective on What's Cooking Group/SA's performance by reading our dividend report here.

- The analysis detailed in our What's Cooking Group/SA valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Navigate through the entire inventory of 1937 Top Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if What's Cooking Group/SA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:WHATS

What's Cooking Group/SA

Produces and sells meat products and ready meals.

Solid track record with excellent balance sheet and pays a dividend.