- United Arab Emirates

- /

- Hospitality

- /

- ADX:ADNH

Abu Dhabi National Hotels Company PJSC's(ADX:ADNH) Share Price Is Down 16% Over The Past Year.

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the Abu Dhabi National Hotels Company PJSC (ADX:ADNH) share price slid 16% over twelve months. That falls noticeably short of the market return of around 10%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 0.7% in three years. It's up 7.6% in the last seven days.

Check out our latest analysis for Abu Dhabi National Hotels Company PJSC

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

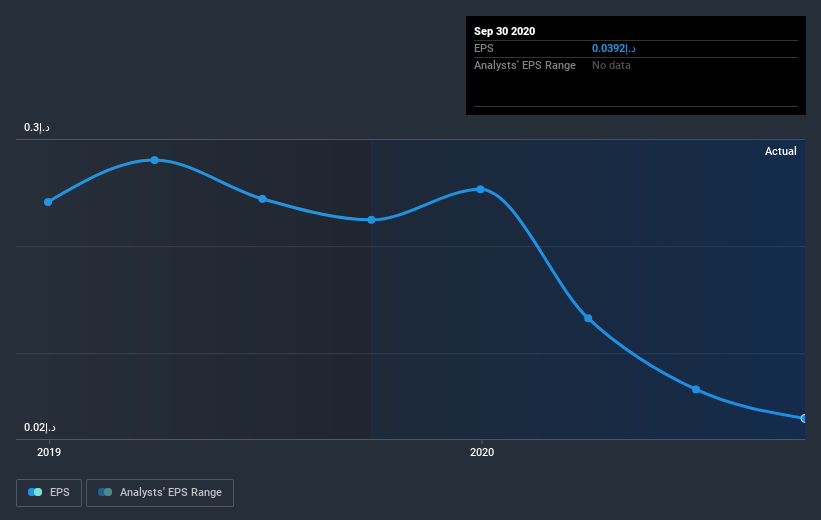

Unhappily, Abu Dhabi National Hotels Company PJSC had to report a 83% decline in EPS over the last year. The share price fall of 16% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult. With a P/E ratio of 68.33, it's fair to say the market sees an EPS rebound on the cards.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Abu Dhabi National Hotels Company PJSC's key metrics by checking this interactive graph of Abu Dhabi National Hotels Company PJSC's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Abu Dhabi National Hotels Company PJSC's TSR for the last year was -13%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Abu Dhabi National Hotels Company PJSC had a tough year, with a total loss of 13% (including dividends), against a market gain of about 10%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Abu Dhabi National Hotels Company PJSC better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Abu Dhabi National Hotels Company PJSC you should be aware of, and 1 of them is a bit concerning.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AE exchanges.

When trading Abu Dhabi National Hotels Company PJSC or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ADX:ADNH

Abu Dhabi National Hotels Company PJSC

Owns and manages hotels in the United Arab Emirates.

Undervalued with solid track record.