- United Arab Emirates

- /

- Insurance

- /

- DFM:WATANIA

Middle Eastern Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

As Gulf markets show gains amid hopes for U.S. interest rate cuts, the region's stock indices are also navigating challenges from ongoing trade tensions and fluctuating oil prices. In this context, penny stocks—though an older term—remain relevant as they often represent smaller or emerging companies with potential value. By focusing on those with strong financials and clear growth prospects, investors can uncover opportunities within these lesser-known stocks that might offer both stability and potential upside.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.77 | SAR1.51B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.596 | ₪327.67M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.12B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.40 | AED703.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.98 | AED344.19M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.31 | AED13.99B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.83 | AED504.85M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.874 | ₪225.6M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 77 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Al Dhafra Insurance Company P.S.C (ADX:DHAFRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Al Dhafra Insurance Company P.S.C. operates in the insurance and reinsurance sectors across the United Arab Emirates, other GCC countries, and internationally, with a market cap of AED486 million.

Operations: The company's revenue is derived from two main segments: Investments, contributing AED54.09 million, and Underwriting, which accounts for AED74.23 million.

Market Cap: AED486M

Al Dhafra Insurance Company P.S.C., with a market cap of AED486 million, shows a mixed picture for penny stock investors. The company's Price-To-Earnings ratio of 11.2x is below the AE market average, suggesting potential value. Despite having no debt and high-quality earnings, its Return on Equity remains low at 7.6%. Recent earnings growth has improved to 4.4%, though it lags behind the industry average of 9.8%. Al Dhafra's net income for Q2 increased to AED10.09 million from AED6.89 million year-on-year, indicating some positive momentum despite an unstable dividend track record and past profit declines.

- Jump into the full analysis health report here for a deeper understanding of Al Dhafra Insurance Company P.S.C.

- Assess Al Dhafra Insurance Company P.S.C's previous results with our detailed historical performance reports.

Hily Holding PJSC (ADX:HH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hily Holding PJSC, along with its subsidiaries, manages securities portfolios across the United Arab Emirates, the Kingdom of Saudi Arabia, Kuwait, and Bahrain, with a market cap of AED276 million.

Operations: The company's revenue is primarily derived from investment in financial securities (AED65.01 million), trading activities (AED51.33 million), investment in properties (AED23.38 million), and freight forwarding and storage services (AED15.78 million).

Market Cap: AED276M

Hily Holding PJSC, with a market cap of AED276 million, presents both opportunities and challenges for penny stock investors. The company has demonstrated strong revenue growth, reaching AED91.5 million in the first half of 2025 compared to AED53.11 million a year earlier. However, its earnings are affected by large one-off items and high volatility in share price remains a concern. Despite achieving profitability with net income rising to AED26.33 million from AED13.87 million year-on-year, its low Return on Equity at 5.6% and insufficient debt coverage by operating cash flow highlight areas needing improvement for sustainable growth.

- Get an in-depth perspective on Hily Holding PJSC's performance by reading our balance sheet health report here.

- Gain insights into Hily Holding PJSC's past trends and performance with our report on the company's historical track record.

Watania International Holding PJSC (DFM:WATANIA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Watania International Holding PJSC is an investment holding company that operates as a takaful provider in the United Arab Emirates, with a market cap of AED174.39 million.

Operations: The company generates revenue through various segments, including AED5.92 million from investments, AED21.18 million from Family Takaful, AED762.26 million from General Takaful, and AED117.94 million from Group Life (Employee Benefits) Takaful.

Market Cap: AED174.39M

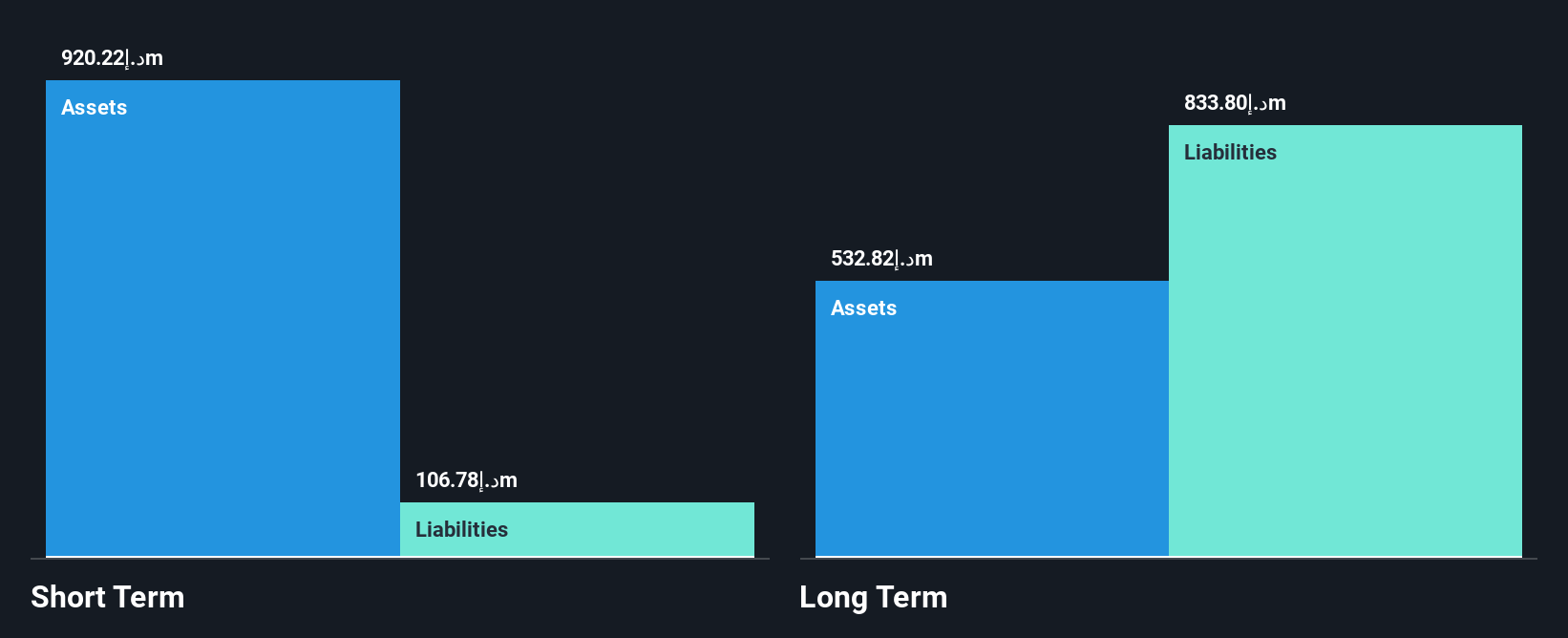

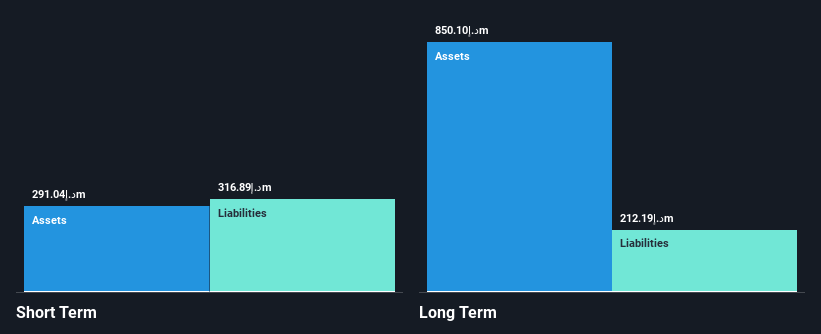

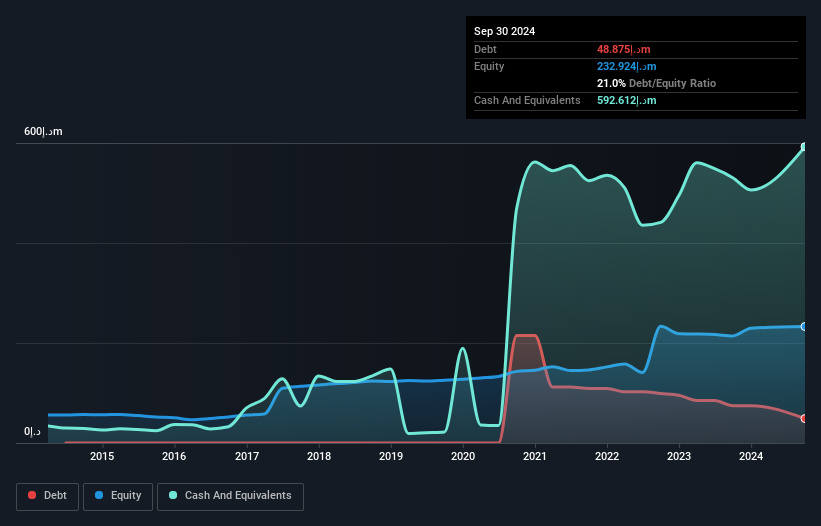

Watania International Holding PJSC, with a market cap of AED174.39 million, offers a mixed picture for penny stock investors. The company reported improved net income of AED7.48 million in Q2 2025, up from AED1.53 million the previous year, yet profit margins have decreased to 1.3% from 2.6%. While short-term and long-term liabilities are well covered by assets totaling AED1.3 billion, interest coverage remains weak at 0.2x EBIT. Despite stable weekly volatility and experienced management with an average tenure of 7.8 years, declining earnings growth and increased debt-to-equity ratio signal potential risks ahead.

- Take a closer look at Watania International Holding PJSC's potential here in our financial health report.

- Understand Watania International Holding PJSC's track record by examining our performance history report.

Seize The Opportunity

- Gain an insight into the universe of 77 Middle Eastern Penny Stocks by clicking here.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Watania International Holding PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:WATANIA

Watania International Holding PJSC

An investment holding company, operates as takaful providers in the United Arab Emirates.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives