- Japan

- /

- Commercial Services

- /

- TSE:7921

3 Reliable Dividend Stocks Yielding Up To 5.5%

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, characterized by inflation concerns and political uncertainties, investors are seeking stability amidst fluctuating indices. In this environment, dividend stocks can offer a reliable income stream and potential cushion against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.27% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.77% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.17% | ★★★★★★ |

Click here to see the full list of 2017 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

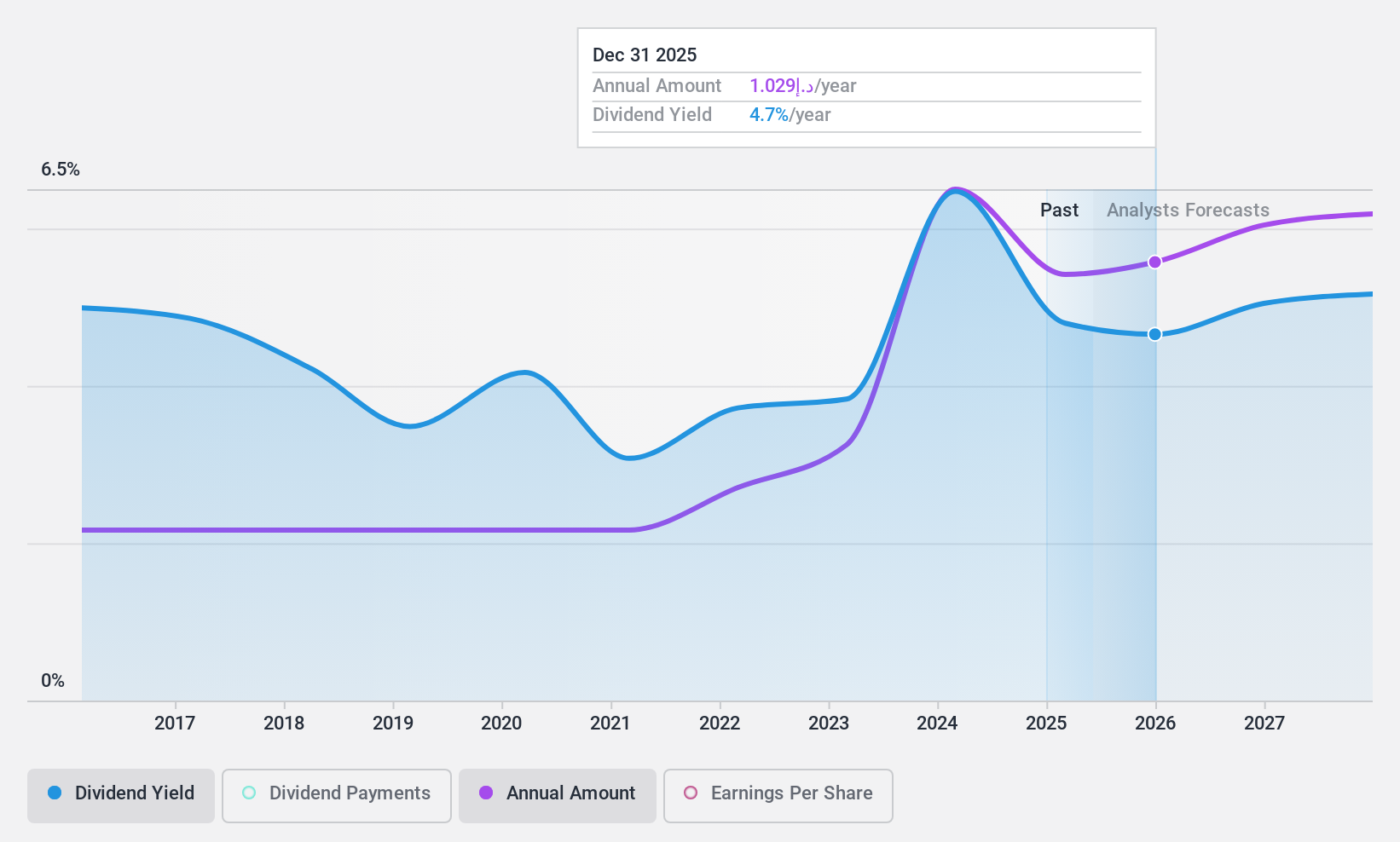

Emirates NBD Bank PJSC (DFM:EMIRATESNBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emirates NBD Bank PJSC, along with its subsidiaries, offers a range of corporate, institutional, retail, treasury, and Islamic banking services and has a market capitalization of AED137.70 billion.

Operations: Emirates NBD Bank PJSC generates revenue through its diverse offerings in corporate, institutional, retail, treasury, and Islamic banking services.

Dividend Yield: 5.5%

Emirates NBD Bank PJSC offers a reliable dividend yield of 5.5%, supported by a stable payout ratio of 33.7% and consistent growth over the past decade. Despite its high level of non-performing loans at 3.9%, the bank's earnings have grown significantly, averaging 24.9% annually over five years, ensuring dividends remain well covered by earnings now and in three years (42.1%). Recent financial activities include completing a $500 million fixed-income offering, reflecting robust capital management strategies.

- Click here and access our complete dividend analysis report to understand the dynamics of Emirates NBD Bank PJSC.

- Our valuation report here indicates Emirates NBD Bank PJSC may be undervalued.

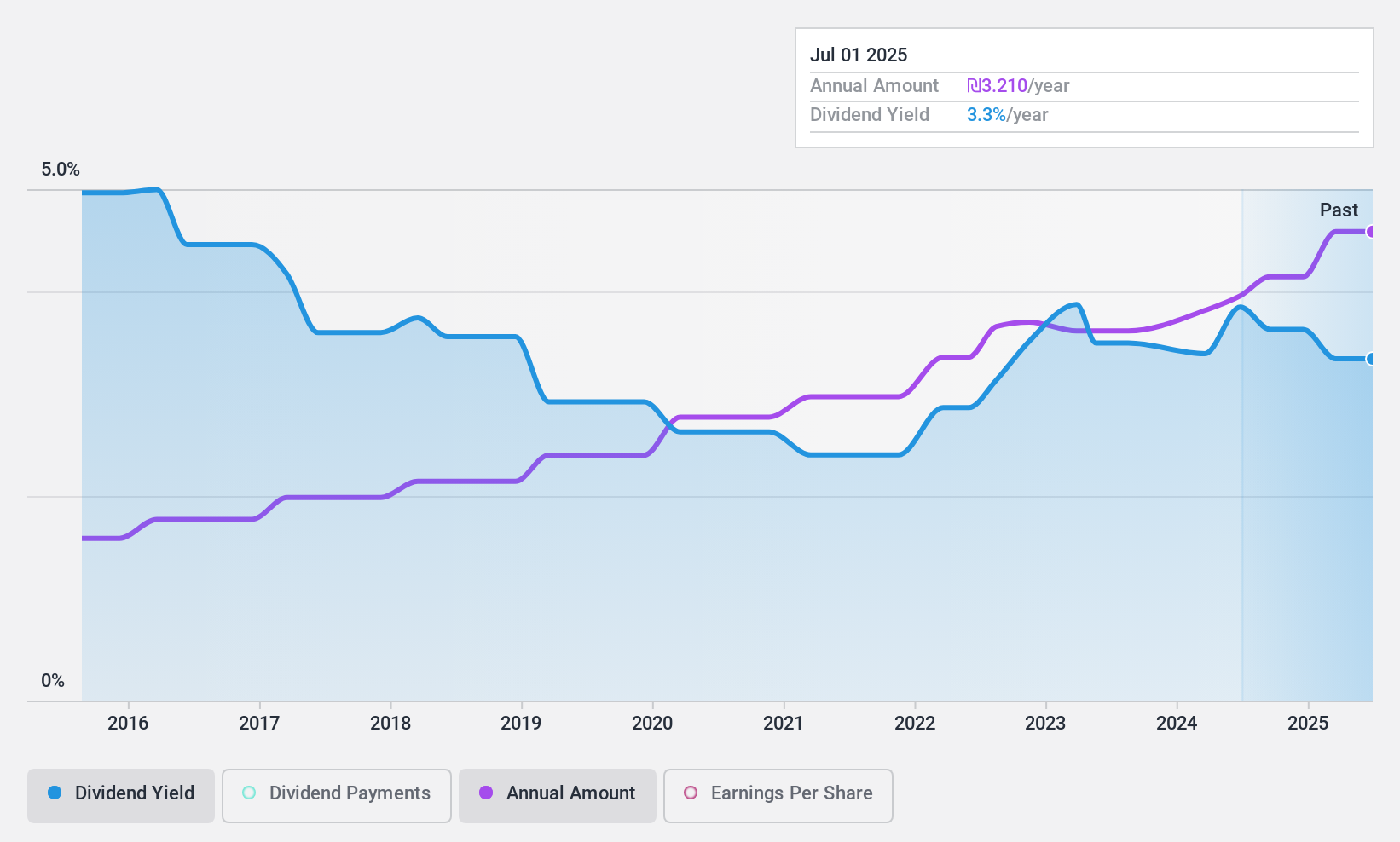

Matrix IT (TASE:MTRX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Matrix IT Ltd., along with its subsidiaries, offers information technology solutions and services in Israel, the United States, Europe, and internationally, with a market cap of ₪5.64 billion.

Operations: Matrix IT Ltd.'s revenue segments include Training and Implementation (₪168.67 million), Cloud and Computing Infrastructure (₪1.53 billion), Marketing and Support of Software Products (₪443.21 million), Information Technology Solutions and Services in the United States (₪478.56 million), and Information Technology Solutions, Consulting, and Management in Israel (₪3.14 billion).

Dividend Yield: 3.3%

Matrix IT's dividends, though stable and growing over the past decade, offer a modest yield of 3.27%, below the top tier of Israeli dividend payers. Despite strong revenue growth—evidenced by recent quarterly sales of ILS 1.42 billion and net income improvement to ILS 64.4 million—the high payout ratio of 124% suggests dividends aren't well covered by earnings. However, with a cash payout ratio at just 32%, dividends are comfortably supported by cash flows, indicating financial prudence in distribution practices.

- Delve into the full analysis dividend report here for a deeper understanding of Matrix IT.

- Insights from our recent valuation report point to the potential undervaluation of Matrix IT shares in the market.

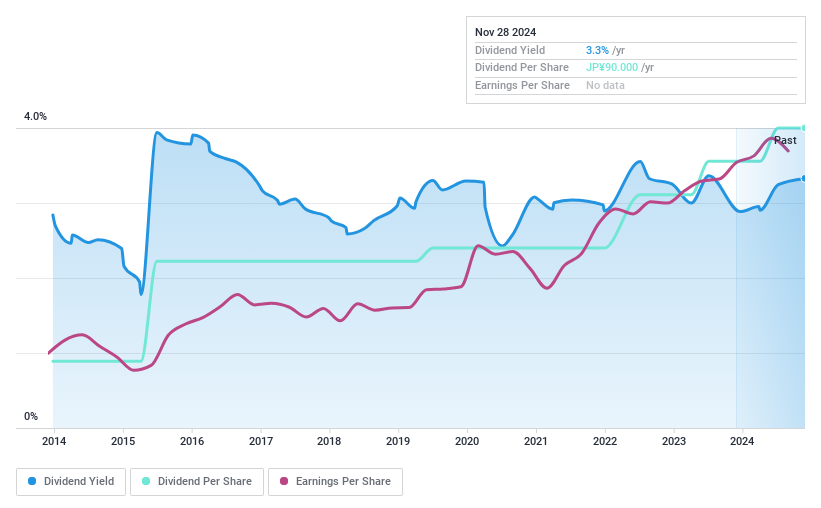

Takara (TSE:7921)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Takara & Company Ltd. engages in the production, consulting, printing, and translation of disclosure and investor relations materials both in Japan and internationally, with a market cap of ¥36.35 billion.

Operations: Takara & Company Ltd. generates revenue from producing, consulting, printing, and translating disclosure and investor relations materials across Japan and international markets.

Dividend Yield: 3.2%

Takara's dividends have been stable and growing over the past decade, offering a yield of 3.21%, which is below the top tier in Japan. The company's low payout ratio of 18.6% indicates dividends are well covered by earnings, while a cash payout ratio of 37.3% shows strong support from cash flows. Recent news highlights an increase in quarterly dividends to ¥45 per share, up from ¥40 last year, reflecting ongoing dividend growth and reliability.

- Unlock comprehensive insights into our analysis of Takara stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Takara is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Discover the full array of 2017 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takara might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7921

Takara

Produces, consults, prints, and translates disclosure and IR-related materials in Japan and internationally.

Flawless balance sheet established dividend payer.