- United Arab Emirates

- /

- Banks

- /

- DFM:CBD

Commercial Bank of Dubai PSC's (DFM:CBD) five-year earnings growth trails the strong shareholder returns

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. To wit, the Commercial Bank of Dubai PSC share price has climbed 91% in five years, easily topping the market return of 52% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 57%, including dividends.

The past week has proven to be lucrative for Commercial Bank of Dubai PSC investors, so let's see if fundamentals drove the company's five-year performance.

See our latest analysis for Commercial Bank of Dubai PSC

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

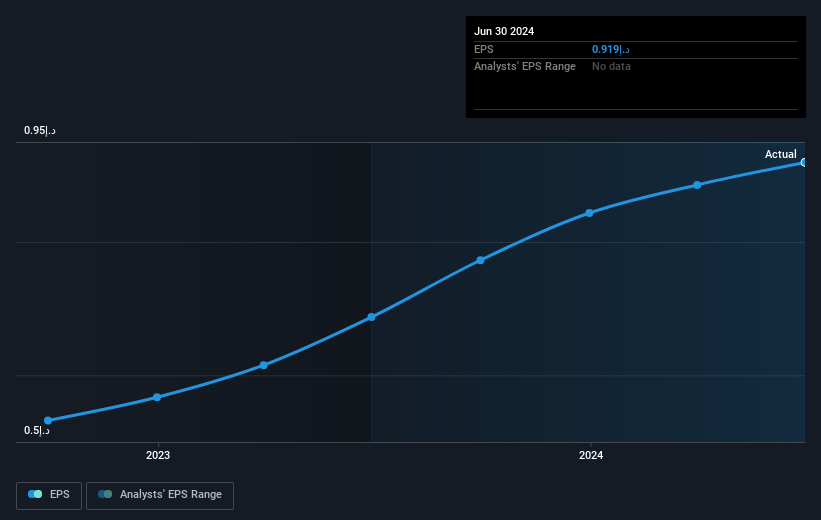

Over half a decade, Commercial Bank of Dubai PSC managed to grow its earnings per share at 16% a year. This EPS growth is reasonably close to the 14% average annual increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. In fact, the share price seems to largely reflect the EPS growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Commercial Bank of Dubai PSC has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Commercial Bank of Dubai PSC's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Commercial Bank of Dubai PSC's TSR for the last 5 years was 150%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Commercial Bank of Dubai PSC shareholders have received a total shareholder return of 57% over one year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 20%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Keeping this in mind, a solid next step might be to take a look at Commercial Bank of Dubai PSC's dividend track record. This free interactive graph is a great place to start.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Emirian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:CBD

Commercial Bank of Dubai PSC

Provides commercial and retail banking services in the United Arab Emirates.

6 star dividend payer with adequate balance sheet.

Market Insights

Community Narratives