- United Arab Emirates

- /

- Banks

- /

- DFM:AJMANBANK

What Type Of Shareholders Make Up Ajman Bank PJSC's (DFM:AJMANBANK) Share Registry?

Every investor in Ajman Bank PJSC (DFM:AJMANBANK) should be aware of the most powerful shareholder groups. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

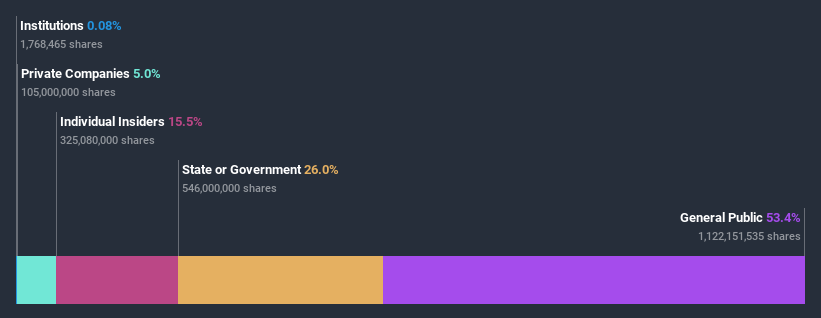

With a market capitalization of د.إ1.6b, Ajman Bank PJSC is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutional investors have not yet purchased shares. We can zoom in on the different ownership groups, to learn more about Ajman Bank PJSC.

See our latest analysis for Ajman Bank PJSC

What Does The Lack Of Institutional Ownership Tell Us About Ajman Bank PJSC?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

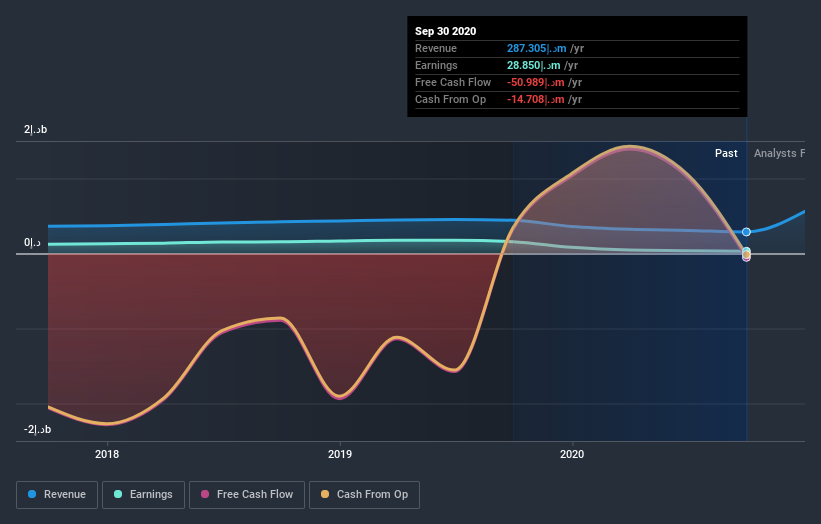

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. Alternatively, there might be something about the company that has kept institutional investors away. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of Ajman Bank PJSC, for yourself, below.

Hedge funds don't have many shares in Ajman Bank PJSC. Government of Ajman is currently the company's largest shareholder with 26% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 10% and 5.0%, of the shares outstanding, respectively.

Our studies suggest that the top 6 shareholders collectively control less than half of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Ajman Bank PJSC

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders maintain a significant holding in Ajman Bank PJSC. Insiders have a د.إ254m stake in this د.إ1.6b business. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public, mostly retail investors, hold a substantial 53% stake in Ajman Bank PJSC, suggesting it is a fairly popular stock. This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Private Company Ownership

We can see that Private Companies own 5.0%, of the shares on issue. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Ajman Bank PJSC you should be aware of, and 1 of them shouldn't be ignored.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade Ajman Bank PJSC, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DFM:AJMANBANK

Ajman Bank PJSC

Provides various banking products and services for individuals, businesses, and government institutions in the United Arab Emirates.

Adequate balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)