- United Arab Emirates

- /

- Banks

- /

- ADX:UAB

Middle Eastern Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

As the Middle Eastern markets experience gains driven by upbeat corporate earnings and easing tariff concerns, investors are increasingly attentive to opportunities beyond the major indices. Penny stocks, often representing smaller or newer companies, continue to attract interest due to their potential for growth at lower price points. Despite being a somewhat outdated term, these stocks can offer compelling opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.07 | SAR1.63B | ✅ 2 ⚠️ 1 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪0.987 | ₪121.56M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.54 | ₪177.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.912 | ₪2.84B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.13 | ₪158.35M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.715 | AED425.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.69 | AED426.19M | ✅ 2 ⚠️ 4 View Analysis > |

| Union Insurance Company P.J.S.C (ADX:UNION) | AED0.601 | AED198.89M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.10 | AED2.2B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.30 | AED9.78B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 96 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Commercial Bank International P.S.C (ADX:CBI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Commercial Bank International P.S.C. offers a range of banking products and services to individuals and businesses in the United Arab Emirates and internationally, with a market cap of AED1.29 billion.

Operations: The company's revenue is primarily derived from its Wholesale Banking segment at AED301.08 million, followed by Real Estate at AED188.80 million, Retail Banking at AED61.32 million, and Treasury operations contributing AED43.23 million.

Market Cap: AED1.29B

Commercial Bank International P.S.C., with a market cap of AED1.29 billion, has shown significant earnings growth of 32.9% annually over the past five years, though recent growth slowed to 12.8%. The bank's seasoned management and board bring stability, while its low Price-To-Earnings ratio (7.4x) suggests good value compared to the AE market average (12.8x). However, challenges include a high level of bad loans at 15% and declining net profit margins from 31.4% to 28.9%. Recent news includes an upcoming board meeting discussing potential temporary trading suspension and changes in executive leadership with the resignation of their SVP - Head of Legal.

- Unlock comprehensive insights into our analysis of Commercial Bank International P.S.C stock in this financial health report.

- Evaluate Commercial Bank International P.S.C's historical performance by accessing our past performance report.

E7 Group PJSC (ADX:E7)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E7 Group PJSC operates in the commercial printing, packaging, and distribution sectors within the United Arab Emirates and has a market capitalization of AED2.20 billion.

Operations: The company's revenue is generated from its printing segment, which accounts for AED621.37 million, and its distribution segment, contributing AED80.71 million.

Market Cap: AED2.2B

E7 Group PJSC, with a market cap of AED2.20 billion, has transitioned to profitability, reporting sales of AED700.71 million and net income of AED233.09 million for 2024. The company benefits from being debt-free and having short-term assets exceeding both its long-term and short-term liabilities significantly. Its Price-To-Earnings ratio of 9.4x indicates potential value against the AE market average (12.8x). However, its dividend yield is not well supported by free cash flows, posing sustainability concerns despite recent affirmations of a substantial cash dividend distribution at their AGM on April 29, 2025.

- Jump into the full analysis health report here for a deeper understanding of E7 Group PJSC.

- Review our growth performance report to gain insights into E7 Group PJSC's future.

United Arab Bank P.J.S.C (ADX:UAB)

Simply Wall St Financial Health Rating: ★★★★★☆

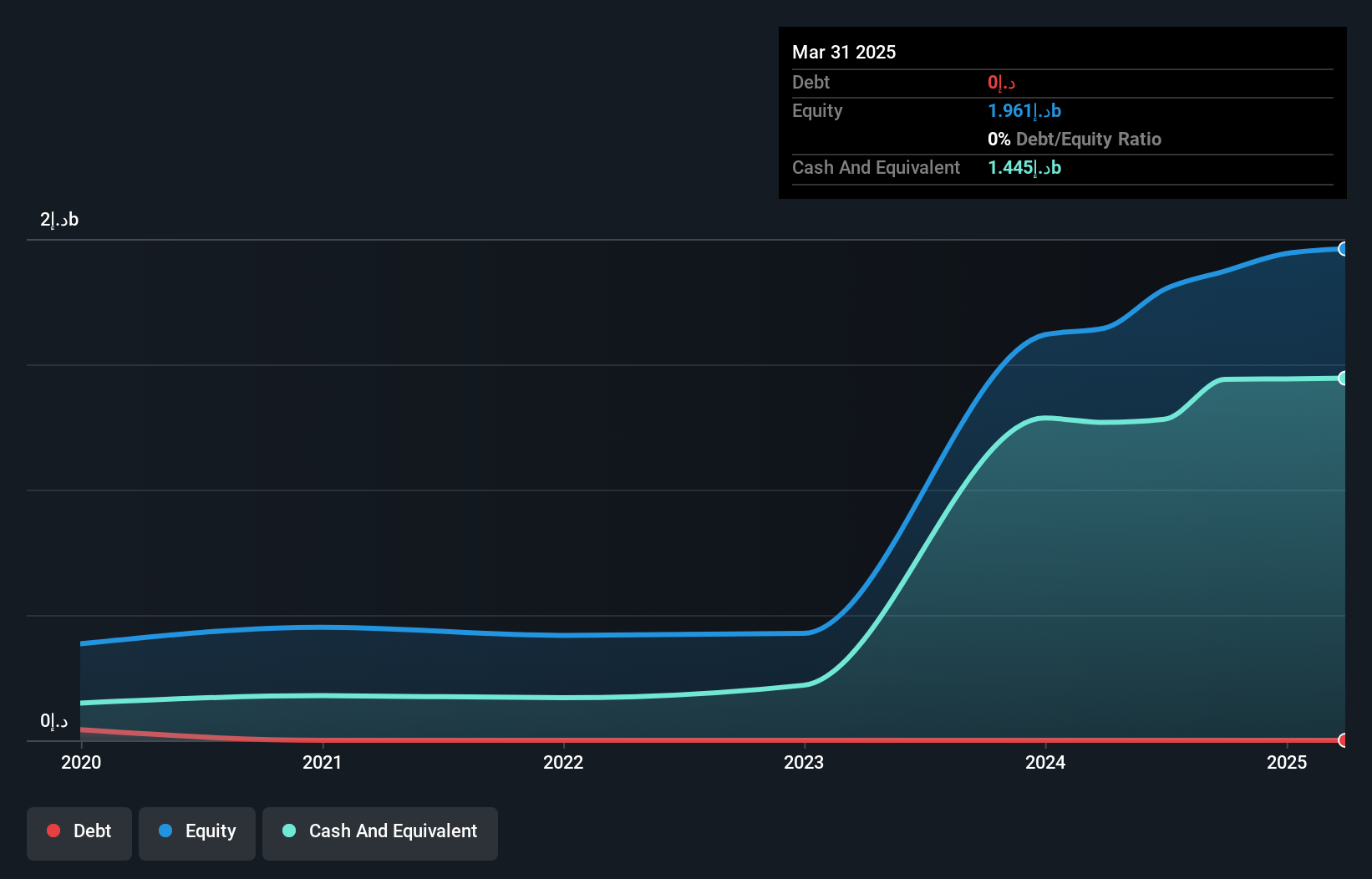

Overview: United Arab Bank P.J.S.C., along with its subsidiary, offers commercial banking products and services to institutional and corporate clients in the United Arab Emirates, with a market capitalization of AED2.89 billion.

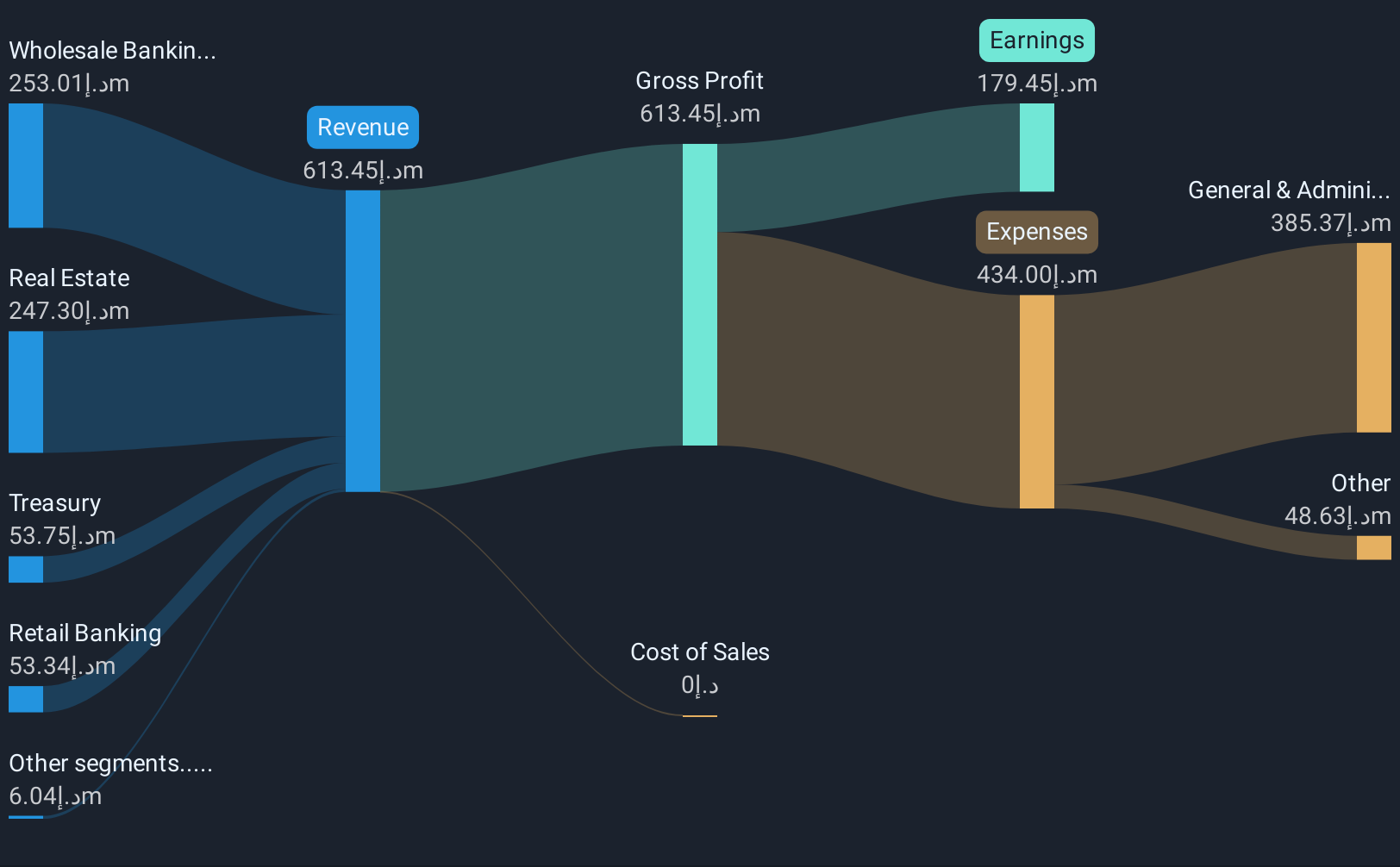

Operations: The company's revenue is primarily derived from three segments: Retail Banking, which contributes AED68.24 million; Wholesale Banking, generating AED391.12 million; and Treasury and Capital Markets, accounting for AED189.27 million.

Market Cap: AED2.89B

United Arab Bank P.J.S.C., with a market capitalization of AED2.89 billion, reported robust earnings growth, with net income rising to AED101.56 million in Q1 2025 from AED68.25 million a year prior. The bank's funding is primarily low-risk through customer deposits, and it maintains an appropriate Loans to Deposits ratio of 72%. Despite high-quality earnings and experienced board members, challenges include a declining forecasted earnings trajectory and a Return on Equity at 11.8%, which is considered low compared to industry benchmarks. Additionally, the bank faces elevated non-performing loans at 3.9%, indicating potential credit risk concerns.

- Click here to discover the nuances of United Arab Bank P.J.S.C with our detailed analytical financial health report.

- Understand United Arab Bank P.J.S.C's earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 93 Middle Eastern Penny Stocks now.

- Want To Explore Some Alternatives? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:UAB

United Arab Bank P.J.S.C

Together with its subsidiary, provides commercial banking products and services for institutional and corporate customers in the United Arab Emirates.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives