- United Arab Emirates

- /

- Diversified Financial

- /

- DFM:AMANAT

3 Middle Eastern Penny Stocks With At Least US$100M Market Cap

Reviewed by Simply Wall St

As global trade tensions continue to impact markets, many Gulf indices have seen declines, reflecting broader economic uncertainties. Despite these challenges, the Middle Eastern market remains a fertile ground for investment opportunities, particularly in the realm of penny stocks. While often overlooked and considered outdated by some, penny stocks represent smaller or newer companies that can offer substantial growth potential when backed by strong financials. In this article, we explore three such stocks that stand out for their promising prospects and robust balance sheets.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.85 | SAR1.54B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR3.85 | SAR462M | ✅ 2 ⚠️ 3 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.243 | ₪155.53M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.90 | ₪2.8B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.183 | ₪162.29M | ✅ 1 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.519 | AED2.23B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.738 | AED431.86M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Ansari Financial Services PJSC (DFM:ALANSARI) | AED0.973 | AED7.27B | ✅ 2 ⚠️ 0 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.36 | AED9.99B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 98 stocks from our Middle Eastern Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bank Of Sharjah P.J.S.C. operates as a provider of commercial and investment banking products and services in the United Arab Emirates, with a market capitalization of AED2.82 billion.

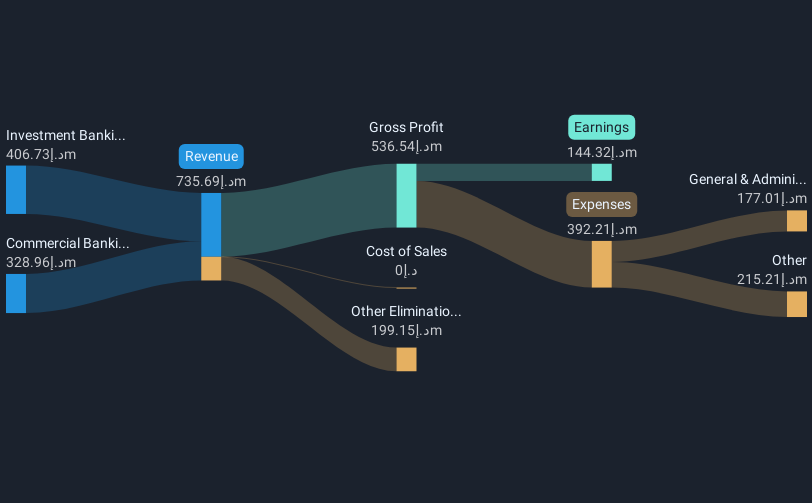

Operations: The company's revenue is derived from two primary segments: Commercial Banking, contributing AED315.01 million, and Investment Banking, generating AED262.69 million.

Market Cap: AED2.82B

Bank Of Sharjah P.J.S.C. has recently turned profitable, reporting a net income of AED 385 million for 2024 compared to a loss the previous year. The bank's price-to-earnings ratio of 7.3x suggests it is valued below the broader AE market average, potentially appealing to value investors. Despite having an appropriate Loans to Deposits ratio (75%) and primarily low-risk funding sources, the bank faces challenges with high bad loans at 8.1%. The management team is relatively new with an average tenure of just 0.3 years, which may impact strategic continuity and execution moving forward.

- Click here to discover the nuances of Bank Of Sharjah P.J.S.C with our detailed analytical financial health report.

- Evaluate Bank Of Sharjah P.J.S.C's historical performance by accessing our past performance report.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amanat Holdings PJSC, with a market cap of AED2.67 billion, invests in companies and enterprises within the education and healthcare sectors both in the United Arab Emirates and internationally.

Operations: The company's revenue is derived from AED432.26 million in the education sector and AED363.84 million in healthcare.

Market Cap: AED2.67B

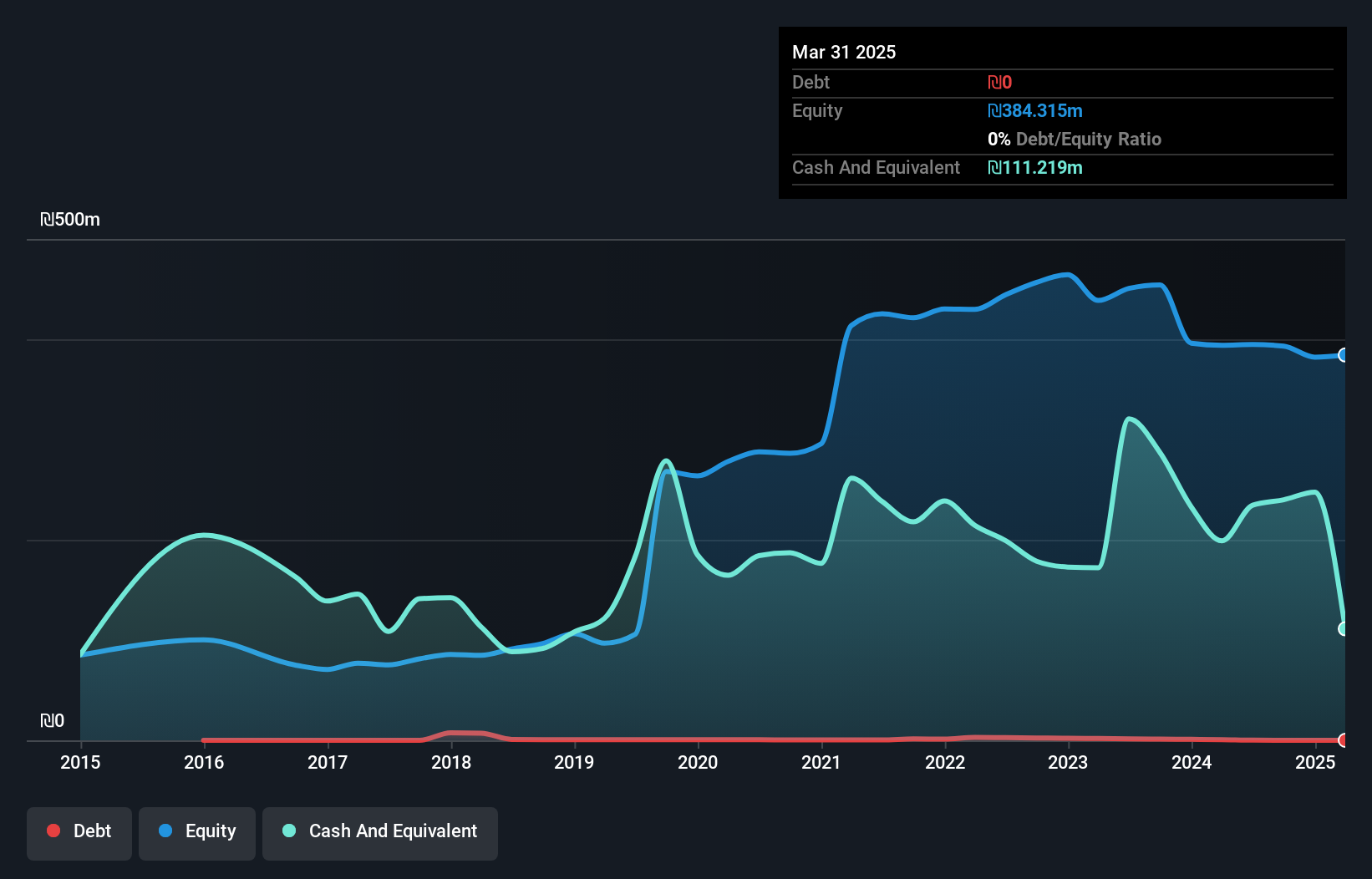

Amanat Holdings PJSC, with a market cap of AED2.67 billion, has shown significant improvement in financial performance, reporting AED 796.1 million in sales and a net income of AED 115.84 million for 2024 compared to a loss the previous year. The company's earnings growth of 191.4% over the past year outpaced industry averages despite a historical decline over five years. Although its Return on Equity is low at 6.2%, Amanat maintains strong short-term asset coverage and interest payment capabilities while managing debt effectively with more cash than total debt, though dividend sustainability remains an area for concern given free cash flow constraints.

- Take a closer look at Amanat Holdings PJSC's potential here in our financial health report.

- Examine Amanat Holdings PJSC's past performance report to understand how it has performed in prior years.

Novolog (Pharm-Up 1966) (TASE:NVLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Novolog (Pharm-Up 1966) Ltd is a healthcare services provider in Israel with a market cap of ₪730.50 million.

Operations: No revenue segments have been reported for this healthcare services provider in Israel.

Market Cap: ₪730.5M

Novolog (Pharm-Up 1966) Ltd, with a market cap of ₪730.50 million, has transitioned to profitability this year, reporting sales of ₪2.02 billion for 2024 and a net income of ₪39.54 million compared to a loss the previous year. Despite its low Return on Equity at 10.7%, the company benefits from being debt-free and having experienced management and board members with average tenures of over four years. While short-term liabilities slightly exceed assets by ₪100 million, high-quality earnings and stable weekly volatility underscore its financial resilience amidst challenges in dividend coverage by earnings.

- Navigate through the intricacies of Novolog (Pharm-Up 1966) with our comprehensive balance sheet health report here.

- Assess Novolog (Pharm-Up 1966)'s previous results with our detailed historical performance reports.

Summing It All Up

- Take a closer look at our Middle Eastern Penny Stocks list of 98 companies by clicking here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:AMANAT

Amanat Holdings PJSC

Engages in the investment in companies and enterprises in the fields of education and healthcare in the United Arab Emirates and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives