- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV) Launches Next-Gen MONA M03 Max With Advanced AI Features In China

Reviewed by Simply Wall St

XPeng (NYSE:XPEV) recently launched the MONA M03 Max, an all-electric hatchback sedan, in China, achieving a milestone of 120,000 units delivered. Despite these advancements, the company's share price fell by 3% over the past month. This decline comes amid a mixed market, where major indexes displayed modest gains following the strong Nvidia earnings report and shifts in U.S. trade policy. While the company's product innovations and delivery achievements might have supported its stock, these developments countered broader market dynamics, resulting in a price move that aligns closely with the general market trend.

Buy, Hold or Sell XPeng? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

XPeng's recent launch of the MONA M03 Max, despite an associated short-term share price decline, aligns with the company's strategic focus on innovation and scaling operations. Over the last year, the company achieved a remarkable total return of 135.44%, indicating robust performance compared to broader market trends, where XPeng exceeded the U.S. Auto industry’s return of 82.1% and the U.S. Market's 11.5% return over the same period. This suggests market validation of XPeng's aggressive expansion and R&D commitments, though these have pressured margins in the short term.

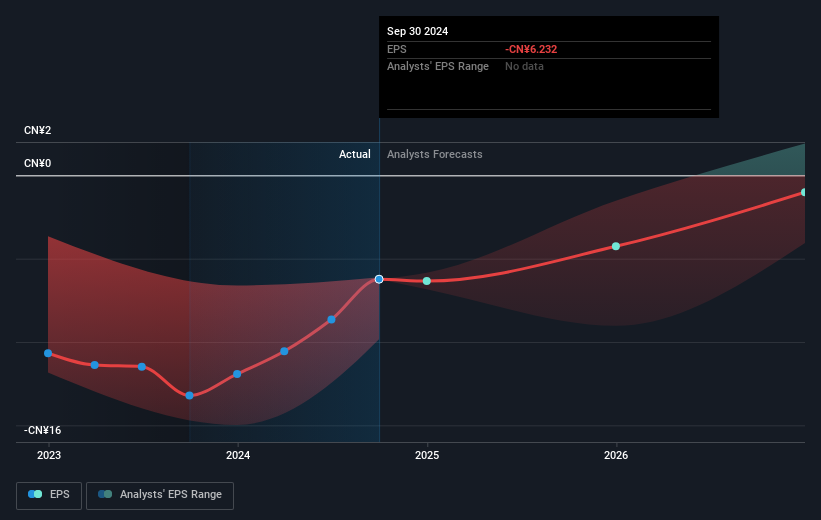

The company's intensifying investments in AI and international expansion suggest potential for future revenue enhancement, although near-term profitability may be impacted by increased expenses. With a current share price of US$22.64, XPeng remains below analysts' consensus price target of US$19.91, reflecting market skepticism about realizing forecasted earnings of CN¥2.7 billion by 2028 despite expected revenue growth. Therefore, although immediate earnings might be constrained, the focus on AI-driven product launches continues to be promising, potentially justifying market optimism as XPeng seeks to boost its global market presence and redefine its valuation trajectory.

Assess XPeng's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives