WSP Global Inc. (TSE:WSP) stock is about to trade ex-dividend in 4 days time. Ex-dividend means that investors that purchase the stock on or after the 30th of March will not receive this dividend, which will be paid on the 15th of April.

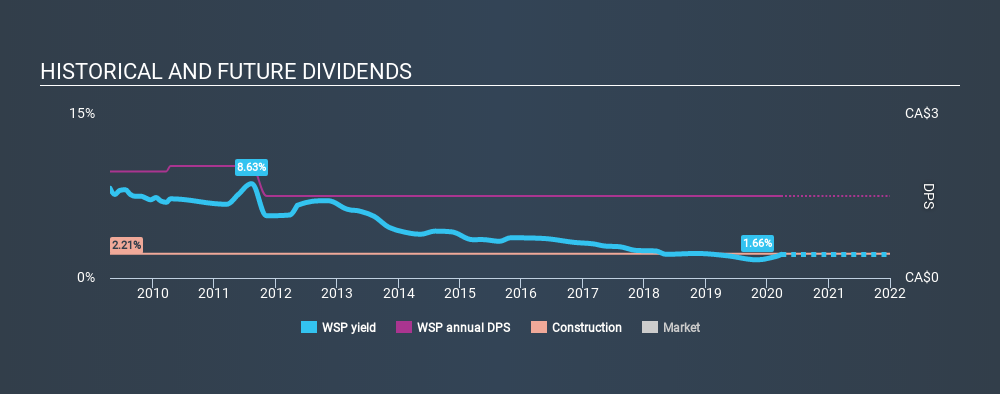

WSP Global's upcoming dividend is CA$0.38 a share, following on from the last 12 months, when the company distributed a total of CA$1.50 per share to shareholders. Last year's total dividend payments show that WSP Global has a trailing yield of 2.2% on the current share price of CA$69.52. If you buy this business for its dividend, you should have an idea of whether WSP Global's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for WSP Global

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. WSP Global is paying out an acceptable 55% of its profit, a common payout level among most companies. A useful secondary check can be to evaluate whether WSP Global generated enough free cash flow to afford its dividend. Luckily it paid out just 12% of its free cash flow last year.

It's positive to see that WSP Global's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That's why it's comforting to see WSP Global's earnings have been skyrocketing, up 23% per annum for the past five years. Management appears to be striking a nice balance between reinvesting for growth and paying dividends to shareholders. Earnings per share have been growing quickly and in combination with some reinvestment and a middling payout ratio, the stock may have decent dividend prospects going forwards.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. WSP Global's dividend payments per share have declined at 2.6% per year on average over the past ten years, which is uninspiring. It's unusual to see earnings per share increasing at the same time as dividends per share have been in decline. We'd hope it's because the company is reinvesting heavily in its business, but it could also suggest business is lumpy.

To Sum It Up

Is WSP Global an attractive dividend stock, or better left on the shelf? WSP Global's growing earnings per share and conservative payout ratios make for a decent combination. We also like that it paid out a lower percentage of its cash flow. It's a promising combination that should mark this company worthy of closer attention.

While it's tempting to invest in WSP Global for the dividends alone, you should always be mindful of the risks involved. For example - WSP Global has 2 warning signs we think you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:WSP

WSP Global

Operates as a professional services consulting firm in the United States, Canada, the United Kingdom, Sweden, Australia, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026