- New Zealand

- /

- Capital Markets

- /

- NZSE:NZX

With A -2.5% Earnings Drop, Is NZX Limited's (NZSE:NZX) A Concern?

After reading NZX Limited's (NZSE:NZX) most recent earnings announcement (30 June 2019), I found it useful to look back at how the company has performed in the past and compare this against the latest numbers. As a long term investor, I pay close attention to earnings trend, rather than the figures published at one point in time. I also compare against an industry benchmark to check whether NZX's performance has been impacted by industry movements. In this article I briefly touch on my key findings.

See our latest analysis for NZX

Was NZX's recent earnings decline indicative of a tough track record?

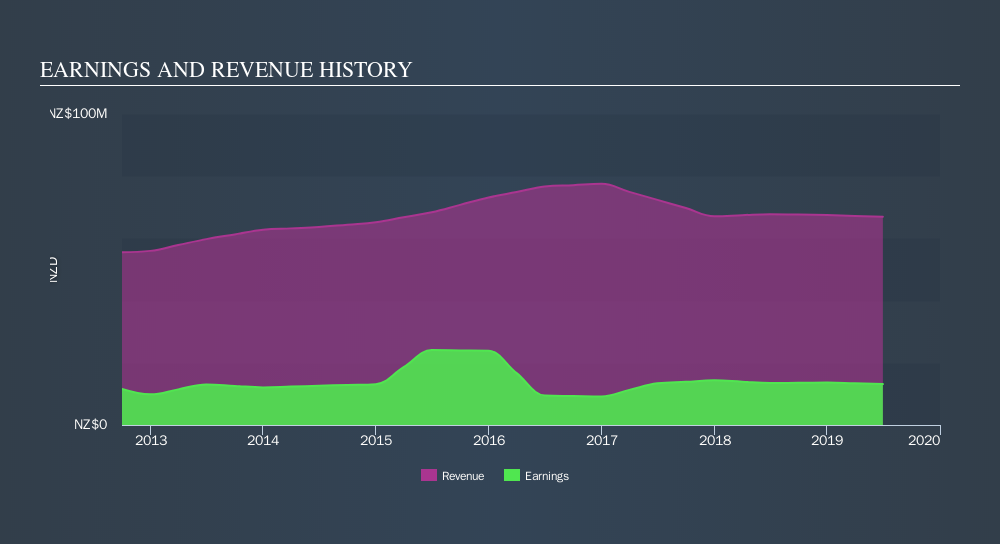

NZX's trailing twelve-month earnings (from 30 June 2019) of NZ$13m has declined by -2.5% compared to the previous year.

Furthermore, this one-year growth rate has been lower than its average earnings growth rate over the past 5 years of -6.1%, indicating the rate at which NZX is growing has slowed down. Why is this? Well, let's look at what's transpiring with margins and whether the rest of the industry is feeling the heat.

In terms of returns from investment, NZX has invested its equity funds well leading to a 21% return on equity (ROE), above the sensible minimum of 20%. Furthermore, its return on assets (ROA) of 7.1% exceeds the NZ Capital Markets industry of 6.1%, indicating NZX has used its assets more efficiently. However, its return on capital (ROC), which also accounts for NZX’s debt level, has declined over the past 3 years from 20% to 18%. This correlates with an increase in debt holding, with debt-to-equity ratio rising from 4.2% to 62% over the past 5 years.

What does this mean?

While past data is useful, it doesn’t tell the whole story. Generally companies that face an extended period of decline in earnings are going through some sort of reinvestment phase However, if the whole industry is struggling to grow over time, it may be a indicator of a structural change, which makes NZX and its peers a riskier investment. You should continue to research NZX to get a better picture of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for NZX’s future growth? Take a look at our free research report of analyst consensus for NZX’s outlook.

- Financial Health: Are NZX’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 30 June 2019. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NZSE:NZX

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)