Why Investors Shouldn't Be Surprised By R Systems International Limited's (NSE:RSYSTEMS) P/E

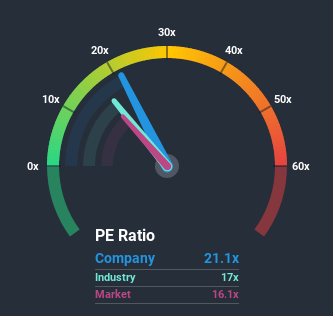

With a price-to-earnings (or "P/E") ratio of 21.1x R Systems International Limited (NSE:RSYSTEMS) may be sending bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 16x and even P/E's lower than 8x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's lofty.

For instance, R Systems International's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for R Systems International

Is There Enough Growth For R Systems International?

In order to justify its P/E ratio, R Systems International would need to produce impressive growth in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.6%. Even so, admirably EPS has lifted 60% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 12% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that R Systems International's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that R Systems International maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for R Systems International (1 is concerning) you should be aware of.

Of course, you might also be able to find a better stock than R Systems International. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you decide to trade R Systems International, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:RSYSTEMS

R Systems International

A digital product engineering company, designs and builds chip-to-cloud software products and platforms.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives