Jim Park has been the CEO of GeoPark Limited (NYSE:GPRK) since 2002. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for GeoPark

How Does Jim Park's Compensation Compare With Similar Sized Companies?

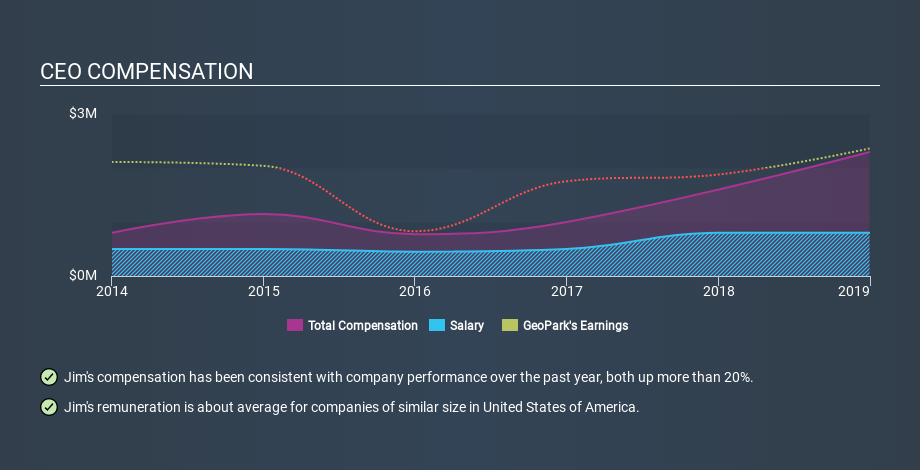

According to our data, GeoPark Limited has a market capitalization of US$1.1b, and paid its CEO total annual compensation worth US$2.3m over the year to December 2018. We think total compensation is more important but we note that the CEO salary is lower, at US$800k. We note that more than half of the total compensation is not the salary; and performance requirements may apply to this non-salary portion. We examined companies with market caps from US$400m to US$1.6b, and discovered that the median CEO total compensation of that group was US$2.5m.

So Jim Park receives a similar amount to the median CEO pay, amongst the companies we looked at. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance.

You can see a visual representation of the CEO compensation at GeoPark, below.

Is GeoPark Limited Growing?

On average over the last three years, GeoPark Limited has grown earnings per share (EPS) by 126% each year (using a line of best fit). In the last year, its revenue is up 12%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. You might want to check this free visual report on analyst forecasts for future earnings.

Has GeoPark Limited Been A Good Investment?

I think that the total shareholder return of 246%, over three years, would leave most GeoPark Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Jim Park is paid around what is normal the leaders of comparable size companies.

Shareholders would surely be happy to see that shareholder returns have been great, and the earnings per share are up. Although the pay is a normal amount, some shareholders probably consider it fair or modest, given the good performance of the stock. Shareholders may want to check for free if GeoPark insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:GPRK

GeoPark

Operates as an oil and natural gas exploration and production company in Chile, Colombia, Brazil, Argentina, Ecuador, and other Latin American countries.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)