Dividend paying stocks like ASR Nederland N.V. (AMS:ASRNL) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

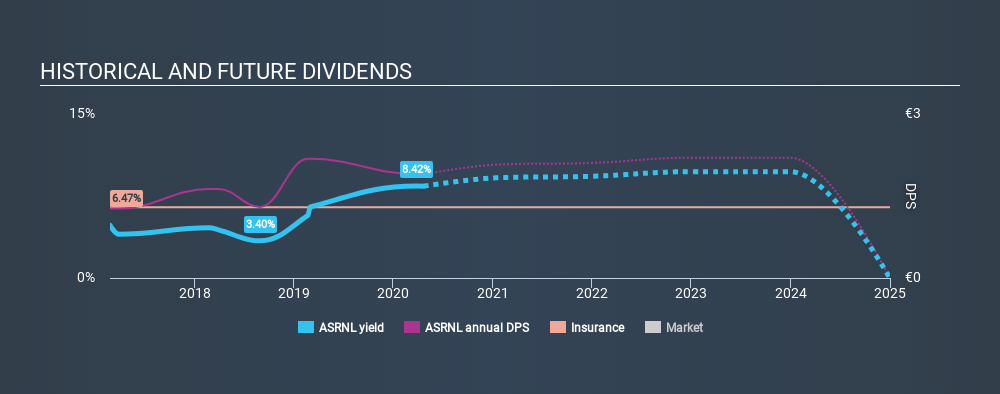

ASR Nederland pays a 8.4% dividend yield, and has been paying dividends for the past three years. A 8.4% yield does look good. Could the short payment history hint at future dividend growth? Remember though, given the recent drop in its share price, ASR Nederland's yield will look higher, even though the market may now be expecting a decline in its long-term prospects. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on ASR Nederland!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, ASR Nederland paid out 29% of its profit as dividends. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

We update our data on ASR Nederland every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. It has only been paying dividends for a few short years, and the dividend has already been cut at least once. This is one income stream we're not ready to live on. During the past three-year period, the first annual payment was €1.27 in 2017, compared to €1.90 last year. Dividends per share have grown at approximately 14% per year over this time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

It's not great to see that the payment has been cut in the past. We're generally more wary of companies that have cut their dividend before, as they tend to perform worse in an economic downturn.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. It's good to see ASR Nederland has been growing its earnings per share at 23% a year over the past five years. With high earnings per share growth in recent times and a modest payout ratio, we think this is an attractive combination if earnings can be reinvested to generate further growth.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're glad to see ASR Nederland has a low payout ratio, as this suggests earnings are being reinvested in the business. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. Overall we think ASR Nederland is an interesting dividend stock, although it could be better.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come accross 5 warning signs for ASR Nederland you should be aware of, and 3 of them are a bit concerning.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTAM:ASRNL

ASR Nederland

Provides insurance, pensions, and mortgages products for consumers, self-employed persons, and companies.

Fair value second-rate dividend payer.