- India

- /

- Entertainment

- /

- NSEI:BALAJITELE

What Type Of Returns Would Balaji Telefilms'(NSE:BALAJITELE) Shareholders Have Earned If They Purchased Their SharesThree Years Ago?

If you love investing in stocks you're bound to buy some losers. Long term Balaji Telefilms Limited (NSE:BALAJITELE) shareholders know that all too well, since the share price is down considerably over three years. Unfortunately, they have held through a 58% decline in the share price in that time. The falls have accelerated recently, with the share price down 33% in the last three months.

Check out our latest analysis for Balaji Telefilms

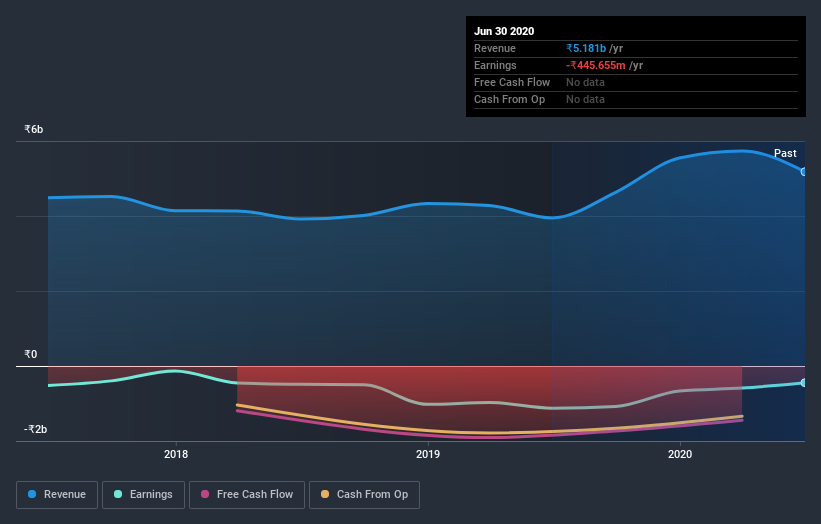

Given that Balaji Telefilms didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Balaji Telefilms grew revenue at 8.6% per year. That's a fairly respectable growth rate. That contrasts with the weak share price, which has fallen 17% compounded, over three years. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. So this is one stock that might be worth investigating further, or even adding to your watchlist.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Balaji Telefilms shareholders have received a total shareholder return of 11% over the last year. That's including the dividend. That certainly beats the loss of about 8% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Balaji Telefilms better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Balaji Telefilms (of which 2 can't be ignored!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade Balaji Telefilms, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Balaji Telefilms might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:BALAJITELE

Balaji Telefilms

Engages in the television content business in India and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives