- France

- /

- Aerospace & Defense

- /

- ENXTPA:HO

What Kind Of Shareholder Appears On The Thales S.A.'s (EPA:HO) Shareholder Register?

Every investor in Thales S.A. (EPA:HO) should be aware of the most powerful shareholder groups. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. We also tend to see lower insider ownership in companies that were previously publicly owned.

Thales has a market capitalization of €20b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company. Taking a look at our data on the ownership groups (below), it's seems that institutions own shares in the company. Let's take a closer look to see what the different types of shareholder can tell us about Thales.

View 2 warning signs we detected for Thales

What Does The Institutional Ownership Tell Us About Thales?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

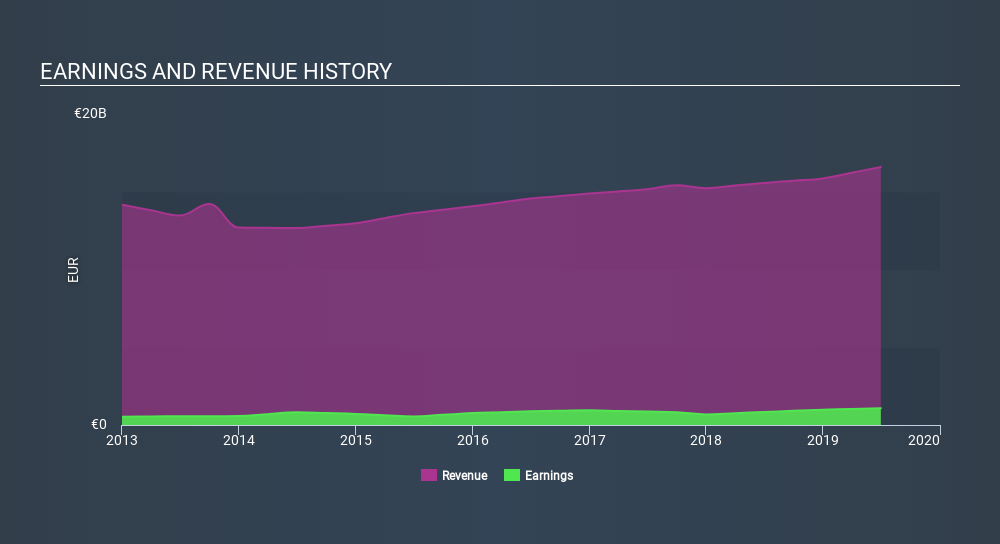

Thales already has institutions on the share registry. Indeed, they own 23% of the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone, since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Thales's earnings history, below. Of course, the future is what really matters.

We note that hedge funds don't have a meaningful investment in Thales. TSA Société Anonyme is currently the largest shareholder, with 26% of shares outstanding. With 25% and 4.7% of the shares outstanding respectively, Groupe Industriel Marcel Dassault S.A. and BlackRock, Inc. are the second and third largest shareholders.

Our analysis suggests that the top 2 shareholders collectively control 50% of the company's shares, implying that they have considerable power to influence the company's decisions.

While it makes sense to study institutional ownership data for a company, It also makes sense to study analyst sentiments to know which way the wind is blowing. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Thales

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our data suggests that insiders own under 1% of Thales S.A. in their own names. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. As it is a large company, we'd only expect insiders to own a small percentage of it. But it's worth noting that they own €1.5m worth of shares. When analysing a company, looking at ownership may seem a logical place to start. But ultimately, many risks exist within the business itself, rather than its shareholders. For example, we've discovered 2 warning signs for Thales (of which 1 is major) which any shareholder or potential investor should be aware of.

General Public Ownership

The general public, with a 23% stake in the company, will not easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

We can see that Private Companies own 50%, of the shares on issue. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Thales better, we need to consider many other factors.

I always like to check for a history of revenue growth. You can too, by accessing this free chart of historic revenue and earnings in this detailed graph.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:HO

Thales

Provides various solutions in the defence and security, aerospace and space, and digital identity and security markets worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)