The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). We'll show how you can use Auto Partner SA's (WSE:APR) P/E ratio to inform your assessment of the investment opportunity. Looking at earnings over the last twelve months, Auto Partner has a P/E ratio of 10.14. That corresponds to an earnings yield of approximately 9.9%.

View our latest analysis for Auto Partner

How Do I Calculate A Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Auto Partner:

P/E of 10.14 = PLN4.48 ÷ PLN0.44 (Based on the trailing twelve months to June 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each PLN1 the company has earned over the last year. That isn't a good or a bad thing on its own, but a high P/E means that buyers have a higher opinion of the business's prospects, relative to stocks with a lower P/E.

Does Auto Partner Have A Relatively High Or Low P/E For Its Industry?

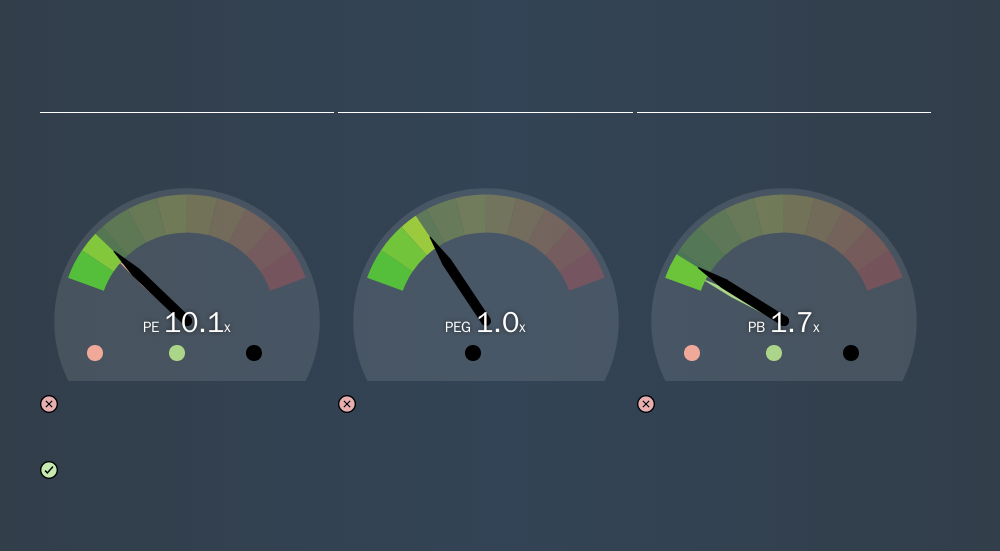

We can get an indication of market expectations by looking at the P/E ratio. You can see in the image below that the average P/E (8.7) for companies in the specialty retail industry is lower than Auto Partner's P/E.

Auto Partner's P/E tells us that market participants think the company will perform better than its industry peers, going forward.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. That means even if the current P/E is high, it will reduce over time if the share price stays flat. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Notably, Auto Partner grew EPS by a whopping 32% in the last year. And it has improved its earnings per share by 21% per year over the last three years. So we'd generally expect it to have a relatively high P/E ratio. In contrast, EPS has decreased by 25%, annually, over 5 years. If the company can grow EPS strongly, the market may improve its opinion of it. Further research into factors such as insider buying and selling, could help you form your own view on whether that is likely.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. That means it doesn't take debt or cash into account. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

How Does Auto Partner's Debt Impact Its P/E Ratio?

Auto Partner has net debt equal to 26% of its market cap. You'd want to be aware of this fact, but it doesn't bother us.

The Verdict On Auto Partner's P/E Ratio

Auto Partner trades on a P/E ratio of 10.1, which is fairly close to the PL market average of 10.2. With only modest debt levels, and strong earnings growth, the market seems to doubt that the growth can be maintained.

Investors have an opportunity when market expectations about a stock are wrong. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

But note: Auto Partner may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WSE:APR

Auto Partner

Imports and distributes parts for passenger cars, delivery vans, and motorcycles in Poland.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

SIrios Resources (SOI) is significantly undervalued on a risk-adjusted basis.

BSX after Penumbra ?

Procter & Gamble - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!