- United States

- /

- Insurance

- /

- NasdaqCM:ACIC

What Did United Insurance Holdings Corp.'s (NASDAQ:UIHC) CEO Take Home Last Year?

John Forney became the CEO of United Insurance Holdings Corp. (NASDAQ:UIHC) in 2012. First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for United Insurance Holdings

How Does John Forney's Compensation Compare With Similar Sized Companies?

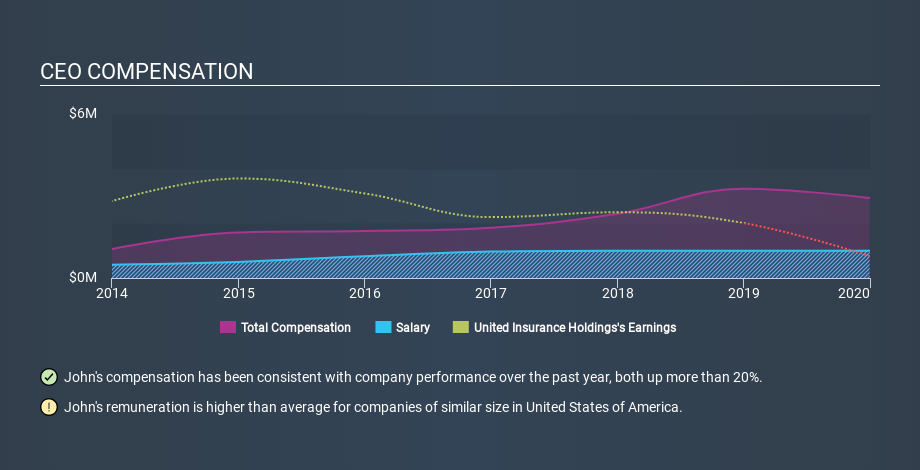

At the time of writing, our data says that United Insurance Holdings Corp. has a market cap of US$372m, and reported total annual CEO compensation of US$2.9m for the year to December 2019. That's less than last year. We think total compensation is more important but we note that the CEO salary is lower, at US$1.0m. Importantly, there may be performance hurdles relating to the non-salary component of the total compensation. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of US$200m to US$800m. The median total CEO compensation was US$2.1m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where United Insurance Holdings stands. On a sector level, around 19% of total compensation represents salary and 81% is other remuneration. According to our research, United Insurance Holdings has allocated a higher percentage of pay to salary in comparison to the broader sector.

As you can see, John Forney is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean United Insurance Holdings Corp. is paying too much. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous. You can see a visual representation of the CEO compensation at United Insurance Holdings, below.

Is United Insurance Holdings Corp. Growing?

On average over the last three years, United Insurance Holdings Corp. has shrunk earnings per share by 71% each year (measured with a line of best fit). Its revenue is up 5.9% over last year.

Few shareholders would be pleased to read that earnings per share are lower over three years. The modest increase in revenue in the last year isn't enough to make me overlook the disappointing change in earnings per share. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Shareholders might be interested in this free visualization of analyst forecasts.

Has United Insurance Holdings Corp. Been A Good Investment?

Given the total loss of 47% over three years, many shareholders in United Insurance Holdings Corp. are probably rather dissatisfied, to say the least. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

We compared the total CEO remuneration paid by United Insurance Holdings Corp., and compared it to remuneration at a group of similar sized companies. We found that it pays well over the median amount paid in the benchmark group.

Neither earnings per share nor revenue have been growing sufficiently to impress us, over the last three years. Arguably worse, investors are without a positive return for the last three years. In our opinion the CEO might be paid too generously! On another note, we've spotted 1 warning sign for United Insurance Holdings that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqCM:ACIC

American Coastal Insurance

Through its subsidiaries, primarily engages in the commercial and personal property and casualty insurance business in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026