- United States

- /

- Banks

- /

- NYSE:WFC

Wells Fargo (NYSE:WFC) Announces 4.75% Senior Unsecured Notes Offering

Reviewed by Simply Wall St

Wells Fargo (NYSE:WFC) recently introduced a new fixed-income offering of 4.75% Senior Unsecured Notes due 2030, which could have supported the company's notable share price increase of 23% over the last quarter. The introduction of callable notes offers a fixed coupon rate, providing an attractive option for fixed-income investors. This move, alongside a 12.5% increase in its dividend and implementing a significant share repurchase program, adds significant weight to the company's performance amid a relatively flat market. The offering aligns well with current market trends, indicating positive investor sentiment toward equity and bond markets.

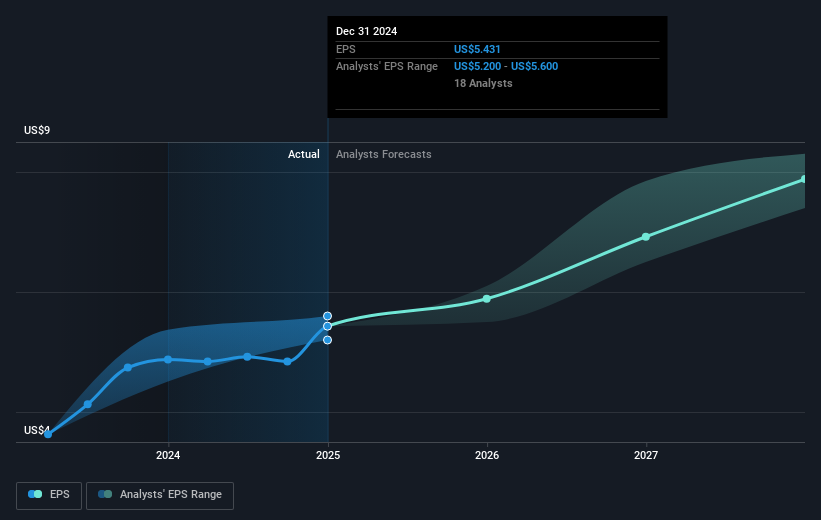

Wells Fargo's recent initiatives, including the introduction of 4.75% Senior Unsecured Notes and the enhancement of dividend payouts, are likely to bolster its narrative of improving operational efficiency and revenue stability. These developments align with the company's efforts to close consent orders and strengthen regulatory controls. They could potentially support diversifying into fee-based revenues, assisting in mitigating risks related to net interest income fluctuations. In the context of revenue and earnings forecasts, these actions may provide incremental growth, as stability in fixed-income offerings could complement the expected revenue rise of 5.0% annually over the next three years.

Examining Wells Fargo's longer-term performance provides additional insight. Over the past five years, the company has delivered a robust on-market total return of approximately 276.60%. This reflects a substantial growth trajectory, influenced largely by strategic initiatives and perhaps broader market dynamics. Over the past year, Wells Fargo's stock exceeded the US Banks industry, which yielded a 27.3% return, reinforcing its competitive positioning within a challenging sector.

In terms of current valuation, Wells Fargo's share price hovers around US$81.49, slightly below the consensus price target of US$82.72. This marginal difference of approximately 1.5% indicates that analysts view the stock as near fair value at present. While the near-term price movement reflects a 23% increase over the last quarter, longer-term potential depends on execution against growth strategies and shifting economic conditions that could impact revenue and earnings continuity. Investors should weigh these elements when considering Wells Fargo's recent strategic maneuvers.

Take a closer look at Wells Fargo's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives