- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Victory Capital Holdings And 2 Other Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market navigates geopolitical uncertainties and fluctuating oil prices, investors are keenly observing the mixed performance of major indices like the Dow Jones, S&P 500, and Nasdaq Composite. In such a climate, identifying undervalued stocks becomes crucial for those looking to capitalize on potential opportunities; Victory Capital Holdings and two other companies may currently be priced below their estimated value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TransMedics Group (TMDX) | $124.00 | $246.09 | 49.6% |

| StoneCo (STNE) | $14.86 | $29.31 | 49.3% |

| Shoals Technologies Group (SHLS) | $5.225 | $10.38 | 49.7% |

| Roku (ROKU) | $81.43 | $160.64 | 49.3% |

| Peoples Financial Services (PFIS) | $47.14 | $93.66 | 49.7% |

| MAC Copper (MTAL) | $11.94 | $23.54 | 49.3% |

| German American Bancorp (GABC) | $36.80 | $72.97 | 49.6% |

| EQT (EQT) | $59.37 | $117.07 | 49.3% |

| Central Pacific Financial (CPF) | $26.02 | $51.99 | 50% |

| Arrow Financial (AROW) | $24.93 | $49.74 | 49.9% |

Here's a peek at a few of the choices from the screener.

Victory Capital Holdings (VCTR)

Overview: Victory Capital Holdings, Inc. is an asset management company operating in the United States and internationally, with a market cap of approximately $4.21 billion.

Operations: The company generates revenue of $897.22 million from providing investment management services and products in the U.S. and internationally.

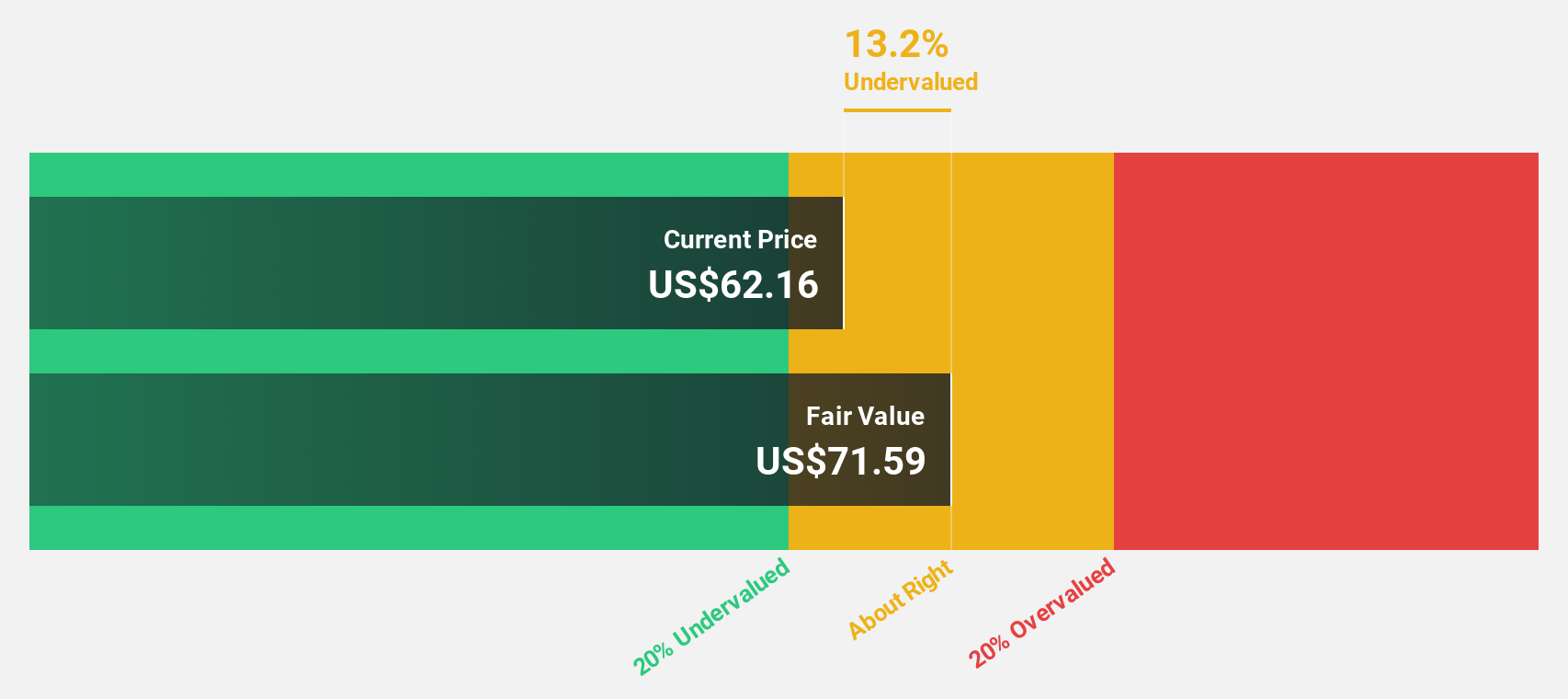

Estimated Discount To Fair Value: 12.7%

Victory Capital Holdings is trading at US$62.67, below its estimated fair value of US$71.81, indicating potential undervaluation based on cash flows. Despite a high debt level, the company shows strong earnings growth forecasts of 34.97% annually and revenue growth outpacing the U.S. market at 19.5%. Recent financial results highlight a modest increase in Q1 revenue to US$219.6 million and net income to US$61.98 million, supporting its valuation appeal amidst industry peers.

- The analysis detailed in our Victory Capital Holdings growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Victory Capital Holdings' balance sheet health report.

Inspire Medical Systems (INSP)

Overview: Inspire Medical Systems, Inc. is a medical technology company specializing in minimally invasive solutions for obstructive sleep apnea, with a market cap of approximately $3.83 billion.

Operations: The company's revenue primarily comes from its Patient Monitoring Equipment segment, generating $840.11 million.

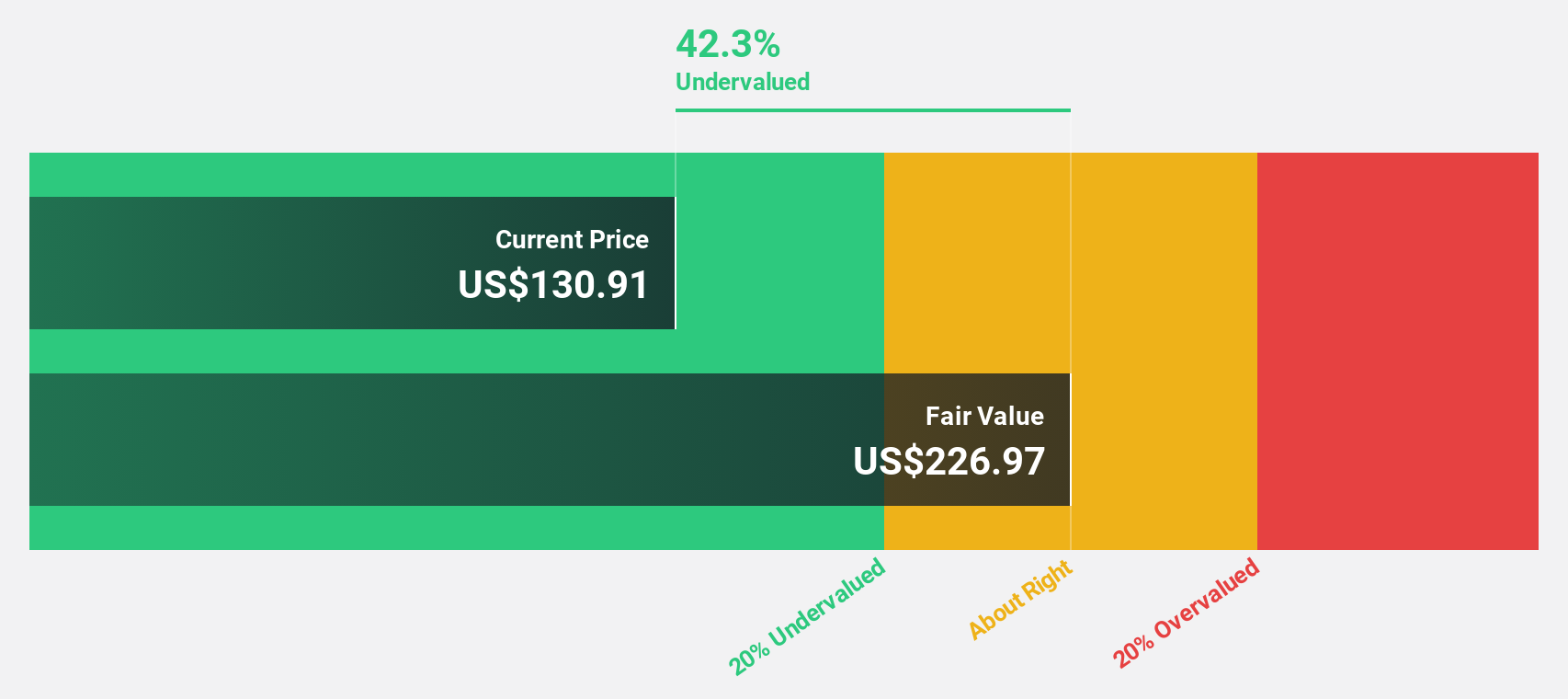

Estimated Discount To Fair Value: 42.9%

Inspire Medical Systems is trading at US$129.7, significantly below its fair value estimate of US$226.95, suggesting undervaluation based on cash flows. The company has recently revised its 2025 revenue guidance to between US$940 million and US$955 million, reflecting growth of 17% to 19%. Analysts forecast substantial earnings growth at 24.9% annually over the next three years, outpacing the broader U.S. market's expected profit increase.

- Insights from our recent growth report point to a promising forecast for Inspire Medical Systems' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Inspire Medical Systems.

V.F (VFC)

Overview: V.F. Corporation, along with its subsidiaries, provides branded apparel, footwear, and accessories for men, women, and children across the Americas, Europe, and the Asia-Pacific regions with a market cap of $4.58 billion.

Operations: The company's revenue segments include Work at $833.10 million, Active at $3.10 billion, and Outdoor at $5.58 billion.

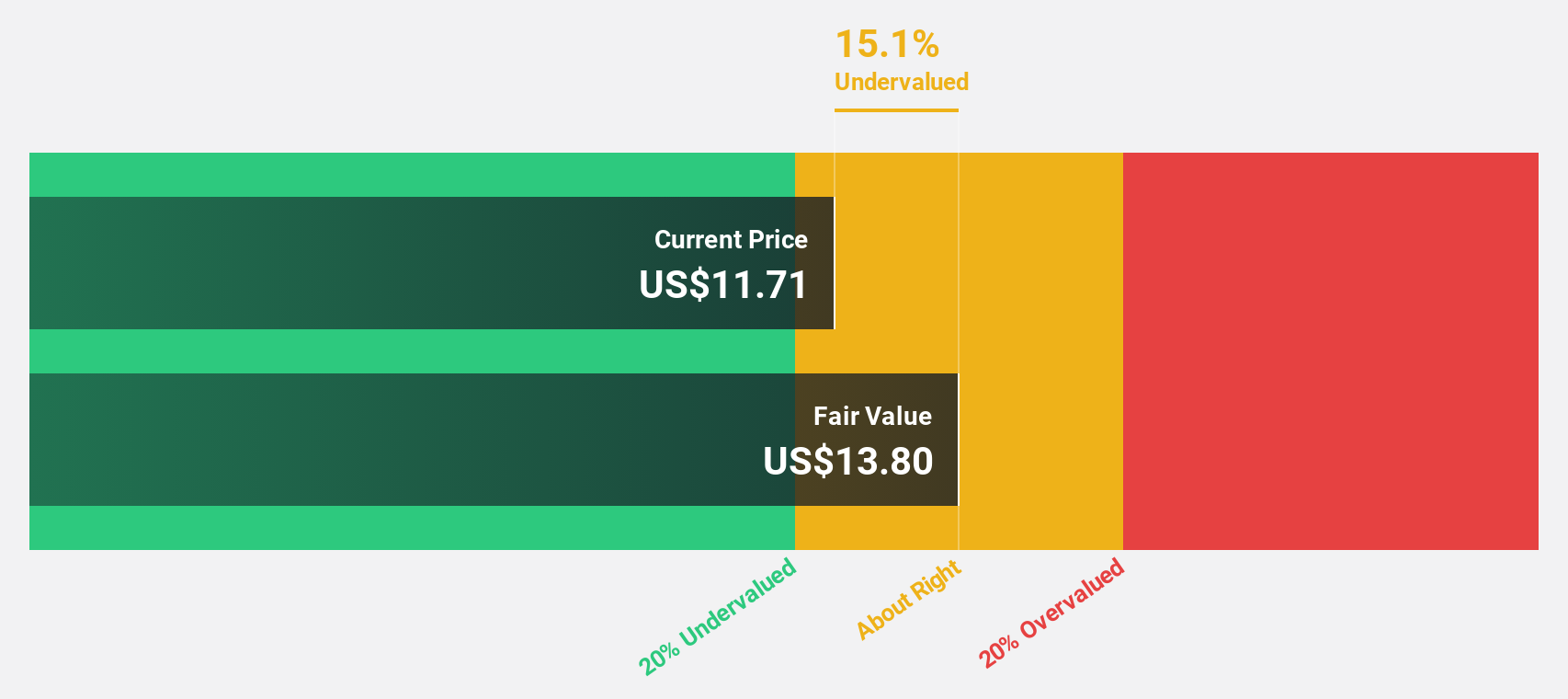

Estimated Discount To Fair Value: 15%

V.F. Corporation's current stock price of US$11.76 is 15% below its estimated fair value of US$13.83, indicating potential undervaluation based on cash flows despite recent financial challenges and a high debt load not fully covered by operating cash flow. While earnings are expected to grow significantly at 32.2% annually over the next three years, revenue growth remains modest at 2.7%. Recent executive changes may impact strategic direction and financial performance stability.

- According our earnings growth report, there's an indication that V.F might be ready to expand.

- Unlock comprehensive insights into our analysis of V.F stock in this financial health report.

Make It Happen

- Explore the 167 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives