- India

- /

- Consumer Services

- /

- NSEI:CLEDUCATE

Vice Chairman & MD Gautam Puri Just Bought A Handful Of Shares In CL Educate Limited (NSE:CLEDUCATE)

Even if it's not a huge purchase, we think it was good to see that Gautam Puri, the Vice Chairman & MD of CL Educate Limited (NSE:CLEDUCATE) recently shelled out ₹119k to buy stock, at ₹47.65 per share. Nevertheless, it only increased their shareholding by a minuscule percentage, and it wasn't a massive purchase by absolute value, either.

Check out our latest analysis for CL Educate

The Last 12 Months Of Insider Transactions At CL Educate

Vice Chairman & MD Gautam Puri previously made an even bigger purchase of ₹499k worth of shares at a price of ₹78.00 per share. That means that an insider was happy to buy shares at above the current price of ₹46.75. Their view may have changed since then, but at least it shows they felt optimistic at the time. In our view, the price an insider pays for shares is very important. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

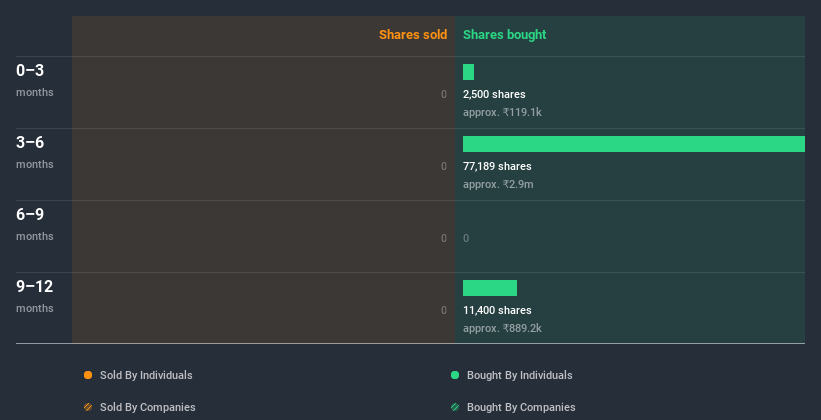

In the last twelve months CL Educate insiders were buying shares, but not selling. They paid about ₹39.69 on average. Although they bought at below the recent price of ₹46.75 per share, it is good to see that insiders are willing to invest in the company. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. CL Educate insiders own about ₹304m worth of shares (which is 46% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The CL Educate Insider Transactions Indicate?

It is good to see the recent insider purchase. We also take confidence from the longer term picture of insider transactions. But we don't feel the same about the fact the company is making losses. Along with the high insider ownership, this analysis suggests that insiders are quite bullish about CL Educate. Looks promising! So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Be aware that CL Educate is showing 3 warning signs in our investment analysis, and 2 of those don't sit too well with us...

Of course CL Educate may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading CL Educate or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:CLEDUCATE

CL Educate

Provides education and test preparation training programmes in India and internationally.

Flawless balance sheet slight.