- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv Holdings Co (VRT) Announces US$0.04 Quarterly Dividend for Class A Shareholders

Reviewed by Simply Wall St

Vertiv Holdings Co (VRT) recently affirmed its quarterly cash dividend, maintaining shareholder returns as a priority. In the last quarter, Vertiv saw a 10% rise in its stock price, aligning with its strong Q2 financial performance, which included a significant jump in revenue and net income. The introduction of Vertiv™ OneCore and a revised upward guidance for sales may have bolstered investor confidence. Despite no recent earnings updates, these developments added positive weight to sector trends within a broadly rising market that saw the S&P 500 and Nasdaq indexes generally increasing, supported by robust technology stock performances.

Find companies with promising cash flow potential yet trading below their fair value.

The recent affirmation of Vertiv Holdings Co's quarterly cash dividend underscores the company's commitment to maintaining shareholder returns. Over the past three years, Vertiv's total returns, including share price gains and dividends, have increased by a very large margin, highlighting its strong longer-term performance. Comparatively, in the past year, Vertiv has outperformed the US Electrical industry, which achieved returns below 50%.

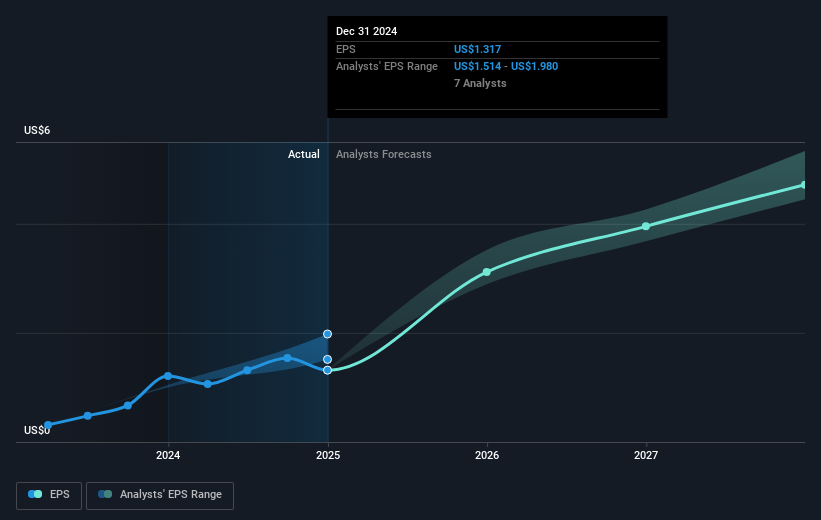

This positive performance aligns with the company's efforts to capitalize on the global demand for AI-driven data centers, as mentioned in the narrative. The introduction of Vertiv™ OneCore and an upward revision in sales guidance could further enhance these growth prospects. Recent news may bolster revenue and earnings forecasts, potentially influencing analysts’ expectations for annual revenue growth of 15.2% and margin improvements to 16.5% over the next three years.

Despite the current share price of US$124.01, analysts set a consensus price target of US$157.42, indicating a potential upside of approximately 27%. The reaffirmed dividend could provide additional investor confidence, but ongoing supply chain challenges and regional execution issues remain potential risks to these forecasts. Investors should consider these dynamics while evaluating Vertiv's future performance relative to its market and industry peers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives