- United States

- /

- Banks

- /

- NYSE:USB

U.S. Bancorp (USB) Q2 Earnings Rise With Net Income At US$1,815 Million

Reviewed by Simply Wall St

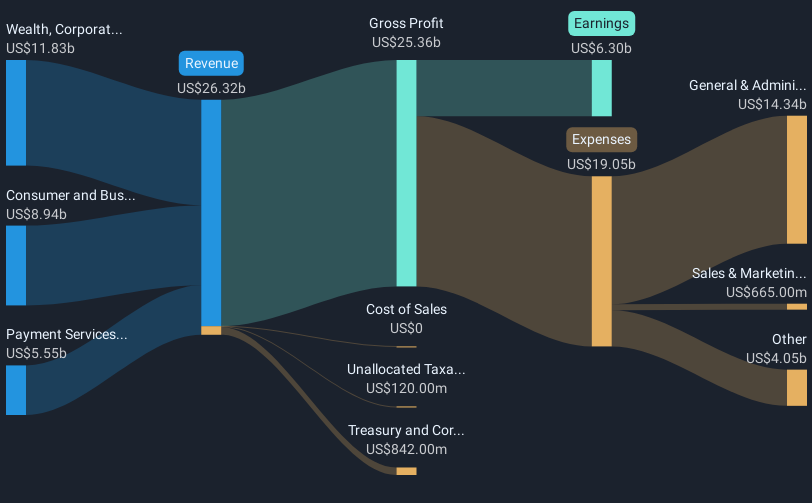

U.S. Bancorp (USB) recently reported a 19.58% increase in share price over the last quarter, a performance that coincides with positive quarterly and half-year financial results. The company's net income and earnings per share saw consistent year-over-year growth, reflecting effective expense management and revenue generation. This financial success aligns with broader market trends, where major indices, including the S&P 500 and Nasdaq, hovered near record highs. The company's addition to the Russell 1000 Value-Defensive Index and affirmation of regular dividends further contributed positively. Overall, U.S. Bancorp's robust results complemented the favorable market environment, supporting its notable price increase.

Buy, Hold or Sell U.S. Bancorp? View our complete analysis and fair value estimate and you decide.

The recent 19.58% quarterly increase in U.S. Bancorp's share price aligns well with its emphasis on digital payments and Merchant Acquiring business transformations. These initiatives are positioned to attract affluent customers and bolster fee income and revenue growth. Over the past five years, the company's total return, including dividends, reached 56.17%. Despite this significant long-term gain, the firm faced a challenging past year, underperforming the broader US Banks industry, which returned 18.4% in comparison.

The company's strategic moves and expense management indicate a positive outlook for revenue and earnings, potentially affecting future forecasts. Analysts' consensus targets price U.S. Bancorp shares at US$49.18, reflecting a 16.7% discount to the current price of US$45.68. As revenue and earnings forecasts remain under scrutiny, aligning with the analysts' price target involves expecting specific growth metrics by 2028, with anticipated shifts in earnings and valuation multiples. These factors present a mixed outlook, with the share price reflecting ongoing adjustments to these expectations.

Click to explore a detailed breakdown of our findings in U.S. Bancorp's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USB

U.S. Bancorp

A financial services holding company, provides various financial services to individuals, businesses, institutional organizations, governmental entities, and other financial institutions in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives