- United States

- /

- Auto

- /

- NYSE:NIO

Undervalued Opportunities: Penny Stocks Worth Watching In July 2025

Reviewed by Simply Wall St

Over the past year, the United States market has seen a 13% rise, although it remained flat over the last week, with earnings forecasted to grow by 15% annually. In this context of steady growth and future potential, identifying stocks with strong financial health becomes crucial for investors seeking opportunities. Penny stocks, though an older term in today's financial lexicon, still represent smaller or newer companies that might offer significant value when backed by solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.45 | $513.56M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.03 | $157.85M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.21 | $238.33M | ✅ 3 ⚠️ 0 View Analysis > |

| Talkspace (TALK) | $2.75 | $465.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $99.92M | ✅ 3 ⚠️ 2 View Analysis > |

| Safe Bulkers (SB) | $4.05 | $385.71M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.84154 | $6.17M | ✅ 2 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.89 | $45.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.2853 | $27.24M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 419 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

GoodRx Holdings (GDRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoodRx Holdings, Inc. provides tools and information to help consumers compare prices and save on prescription drugs in the United States, with a market cap of approximately $1.87 billion.

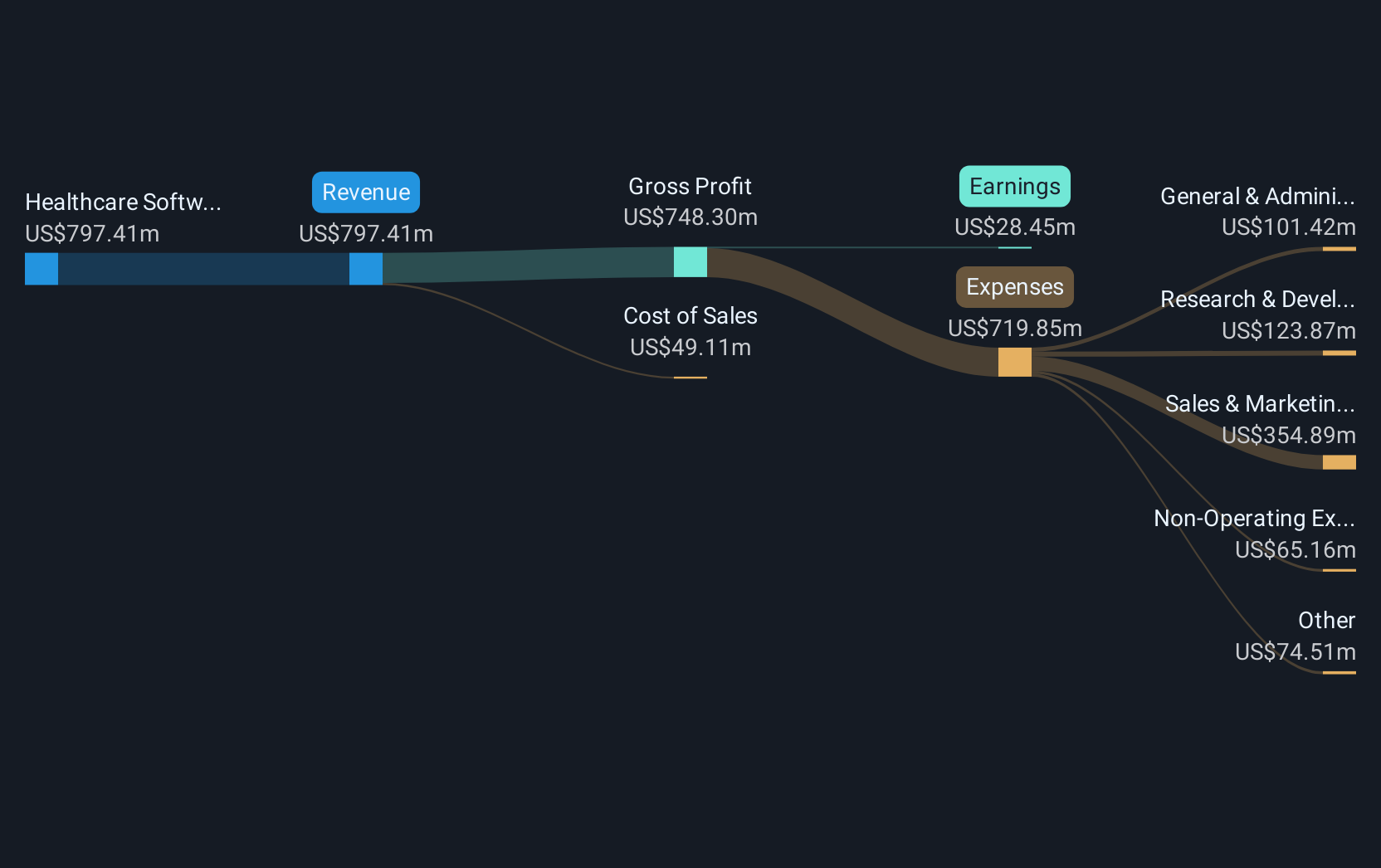

Operations: The company's revenue is primarily generated from its Healthcare Software segment, which accounted for $797.41 million.

Market Cap: $1.87B

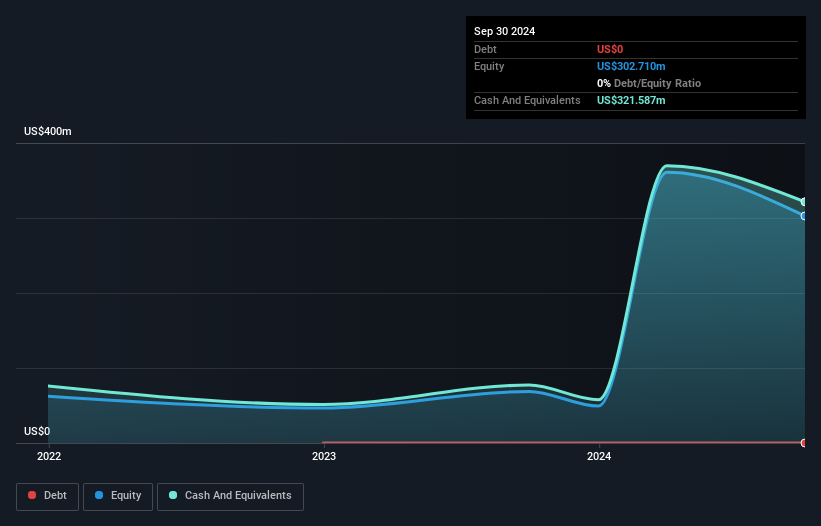

GoodRx Holdings, Inc., with a market cap of approximately US$1.87 billion, has recently turned profitable, marking significant growth in its financial performance. The company's short-term assets exceed both its short and long-term liabilities, indicating strong liquidity. GoodRx's debt is well covered by operating cash flow, and it has not significantly diluted shareholders over the past year. Recent initiatives include launching a subscription service for erectile dysfunction treatment and GoodRx Community Link to support independent pharmacies with cost-plus pricing models. These efforts aim to enhance consumer access to affordable healthcare solutions while strengthening partnerships with pharmacies.

- Unlock comprehensive insights into our analysis of GoodRx Holdings stock in this financial health report.

- Evaluate GoodRx Holdings' prospects by accessing our earnings growth report.

Kyverna Therapeutics (KYTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kyverna Therapeutics, Inc. is a clinical-stage biopharmaceutical company that develops cell therapies for autoimmune diseases, with a market cap of $154.29 million.

Operations: Kyverna Therapeutics, Inc. currently does not report any revenue segments.

Market Cap: $154.29M

Kyverna Therapeutics, Inc., with a market cap of US$154.29 million, is currently pre-revenue and unprofitable, facing challenges typical of clinical-stage biotech firms. Despite having no debt and short-term assets of US$247.7 million that comfortably cover its liabilities, the company has been dropped from several Russell indices recently, reflecting potential investor concerns about its financial trajectory. The appointment of Marc Grasso as CFO brings extensive capital markets expertise which may aid in strategic financial management. However, Kyverna's cash runway is limited to 1.2 years if current cash flow reduction trends persist, highlighting the necessity for prudent fiscal strategies moving forward.

- Click here to discover the nuances of Kyverna Therapeutics with our detailed analytical financial health report.

- Understand Kyverna Therapeutics' earnings outlook by examining our growth report.

NIO (NIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NIO Inc. designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally with a market cap of approximately $7.80 billion.

Operations: The company's revenue is primarily generated from its smart electric vehicles related business, amounting to CN¥67.86 billion.

Market Cap: $7.8B

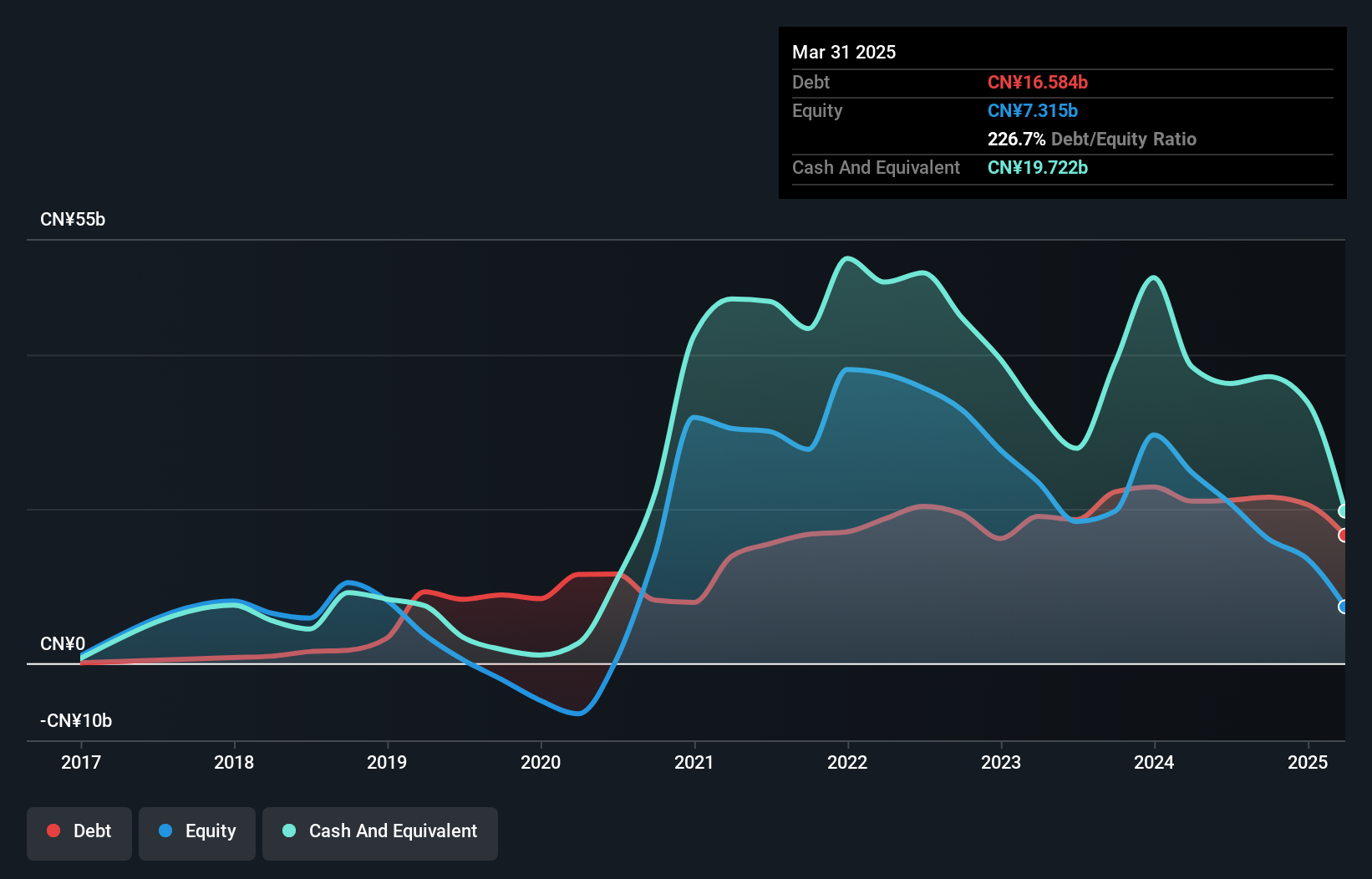

NIO Inc., with a market cap of $7.80 billion, remains unprofitable, with losses widening at 26.2% annually over the past five years. Despite this, NIO's revenue is projected to grow by 18.33% per year, supported by robust vehicle deliveries that increased significantly in recent months. The company delivered 24,925 vehicles in June alone and projects second-quarter revenues between RMB19.51 billion ($2.69 billion) and RMB20.07 billion ($2.77 billion). While NIO has more cash than total debt and a seasoned management team, its short-term liabilities exceed short-term assets by CN¥9.7 billion, posing financial challenges ahead.

- Jump into the full analysis health report here for a deeper understanding of NIO.

- Gain insights into NIO's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Access the full spectrum of 419 US Penny Stocks by clicking on this link.

- Seeking Other Investments? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives