- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TBLA

Undervalued Opportunities: Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

As U.S. stock indexes remain relatively stable following revised jobs data, investors are keeping a close watch on major tech announcements and economic indicators. For those willing to explore beyond the well-known names, penny stocks—often representing smaller or newer companies—can still offer intriguing possibilities. Despite being an older term, these stocks present opportunities for growth at accessible price points, with some demonstrating strong financial foundations that may provide stability and potential upside.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.24 | $465.04M | ✅ 4 ⚠️ 0 View Analysis > |

| ATRenew (RERE) | $4.29 | $973.64M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.90 | $654.61M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.22 | $200.09M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.56 | $253.36M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.97 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (TBTC) | $4.85 | $21.34M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.9154 | $7.04M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.12 | $97.2M | ✅ 3 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $4.75 | $625.08M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 376 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Taboola.com (TBLA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across various countries including Israel, the United States, and the United Kingdom, with a market cap of approximately $999.23 million.

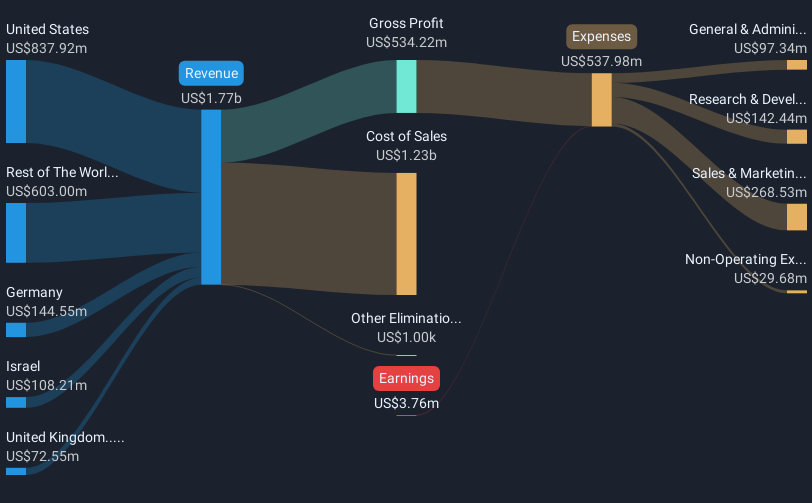

Operations: The company's revenue is primarily generated from its advertising segment, totaling $1.82 billion.

Market Cap: $999.23M

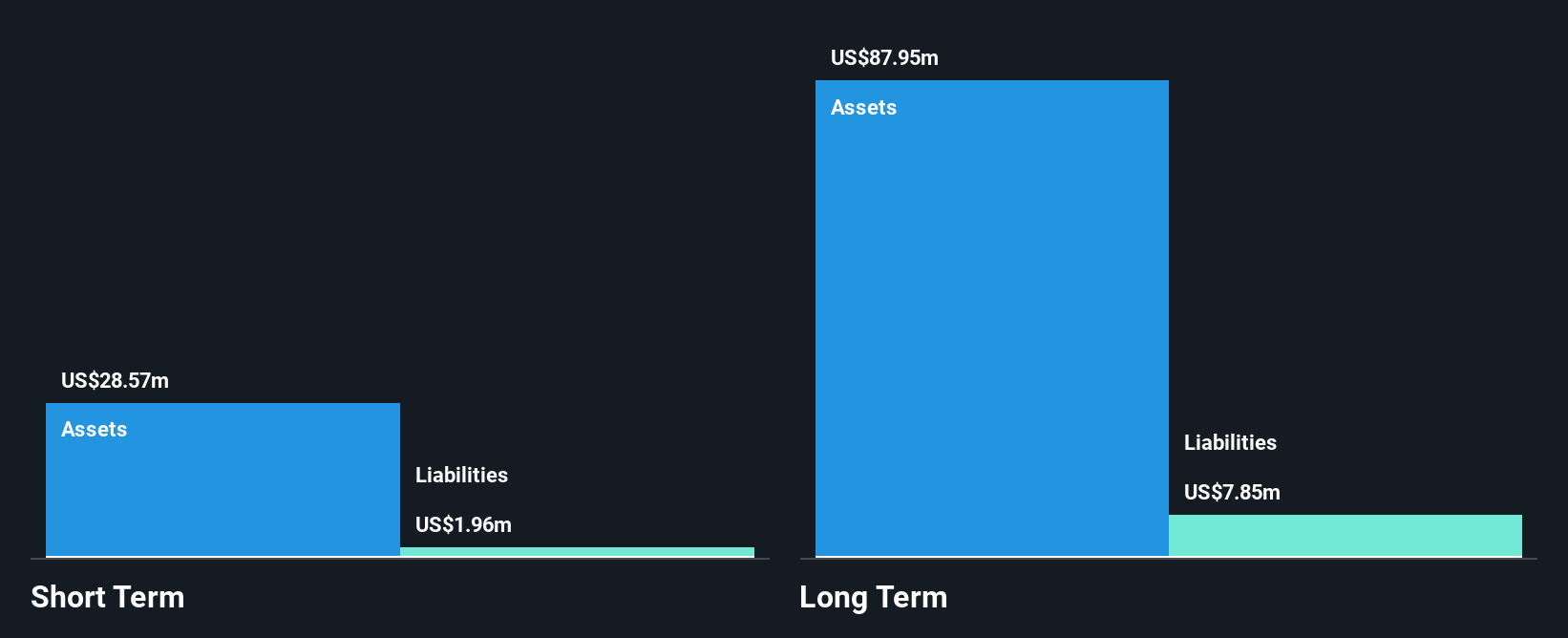

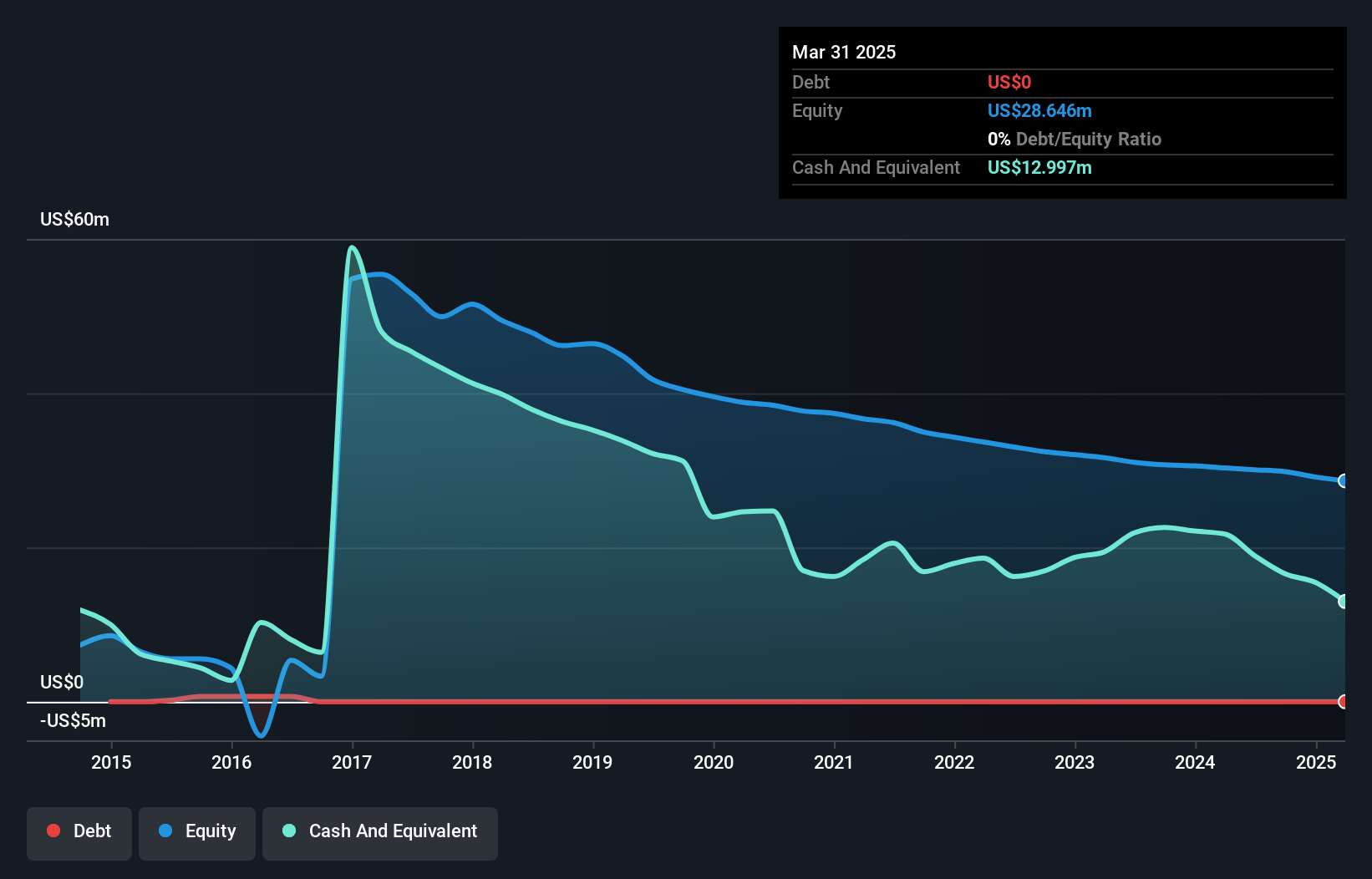

Taboola.com Ltd., with a market cap of approximately US$999.23 million, has demonstrated financial resilience by covering its debt well with operating cash flow and maintaining more cash than total debt. The company reported second-quarter sales of US$465.47 million and a net loss of US$4.35 million, showing improved profitability compared to previous years. Despite low return on equity at 1.5%, Taboola's recent profitability marks a positive shift, supported by stable weekly volatility and an experienced management team with an average tenure of five years. Recent initiatives like the DeeperDive AI engine could enhance engagement and monetization for publishers.

- Dive into the specifics of Taboola.com here with our thorough balance sheet health report.

- Explore Taboola.com's analyst forecasts in our growth report.

Fortitude Gold (FTCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fortitude Gold Corporation, along with its subsidiaries, operates as a mining company focusing on gold and silver exploration projects in the United States, with a market cap of $96.28 million.

Operations: The company generates revenue of $31.02 million from its Metals & Mining segment, specifically focusing on gold and other precious metals.

Market Cap: $96.28M

Fortitude Gold Corporation, with a market cap of US$96.28 million, has shown mixed financial performance recently. The company reported second-quarter sales of US$4.88 million, down from US$9.55 million the previous year, yet managed to achieve net income of US$0.849 million compared to a net loss previously. Despite being debt-free and having strong asset coverage over liabilities, its earnings growth has been negative recently and profit margins have declined significantly from 13.8% to 0.6%. The dividend yield is high but not well supported by earnings or cash flow, indicating potential sustainability concerns for investors focused on income stability in penny stocks.

- Click to explore a detailed breakdown of our findings in Fortitude Gold's financial health report.

- Review our historical performance report to gain insights into Fortitude Gold's track record.

Liquidmetal Technologies (LQMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liquidmetal Technologies, Inc. is a materials technology company that designs, develops, and sells custom products and parts made from bulk amorphous alloys to various industries worldwide, with a market cap of $132.22 million.

Operations: The company's revenue is generated entirely from developing and manufacturing products and applications using amorphous alloys, amounting to $1.02 million.

Market Cap: $132.22M

Liquidmetal Technologies, Inc., with a market cap of US$132.22 million, remains pre-revenue with its revenue at US$1.02 million from amorphous alloy products. The company is debt-free and has a cash runway exceeding three years if free cash flow grows consistently. Recent earnings showed increased losses despite slightly higher revenues compared to the previous year. A strategic move includes forming Hangzhou Feifeng Liquidmetal Co., Ltd., a joint venture for manufacturing in China, which may enhance production capabilities by mid-2026. While unprofitable, the company has reduced losses over five years and benefits from experienced board oversight without shareholder dilution recently.

- Take a closer look at Liquidmetal Technologies' potential here in our financial health report.

- Gain insights into Liquidmetal Technologies' historical outcomes by reviewing our past performance report.

Key Takeaways

- Get an in-depth perspective on all 376 US Penny Stocks by using our screener here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taboola.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBLA

Taboola.com

Operates an artificial intelligence-based algorithmic engine platform in Israel, the United States, the United Kingdom, Germany, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives